Decoding Vulcan Materials Co (VMC): A Strategic SWOT Insight

VMC's dominant market position as the largest U.S. producer of construction aggregates.

Strategic reserves location and innovative operational practices bolstering profitability.

Dependence on the cyclical construction industry and regulatory challenges as potential risks.

Opportunities for growth in high-demand metropolitan areas and through strategic acquisitions.

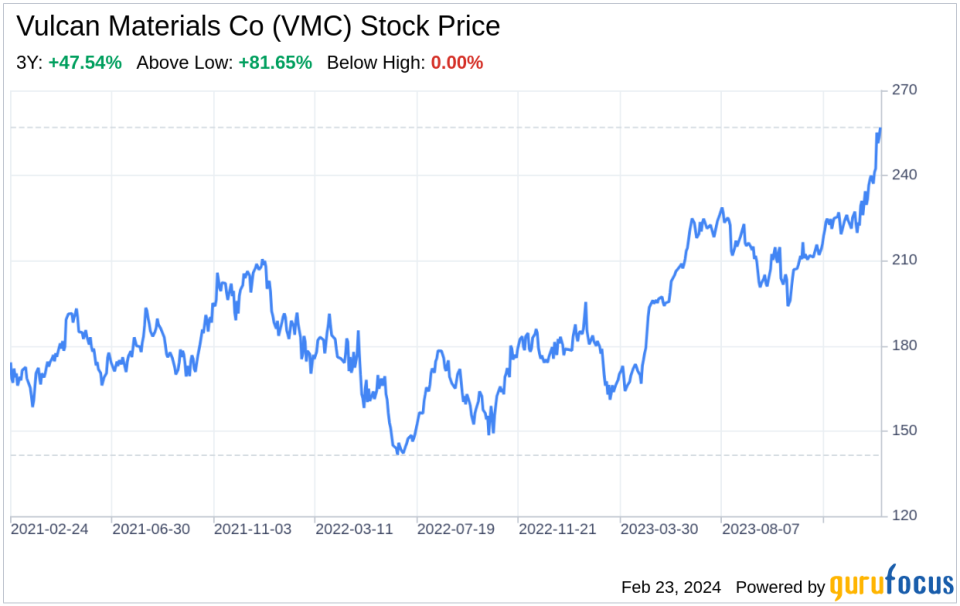

On February 22, 2024, Vulcan Materials Co (NYSE:VMC), the United States' premier producer of construction aggregates, released its annual 10-K filing, revealing a year of robust performance and strategic positioning. With 234.3 million tons of aggregates sold and a substantial 16 billion tons of aggregates reserves, VMC's financial health is reflected in its increased aggregates gross profit per ton from $5.81 to $7.40 over two years. The company's focus on high-growth metropolitan areas and its strategic approach to operations have contributed to its strong financial standing and market leadership.

Strengths

Market Leadership and Scale: Vulcan Materials Co (NYSE:VMC) stands as the largest producer of construction aggregates in the U.S., a position that affords it significant competitive advantages. With 397 active aggregates facilities and a presence in key growth states, VMC's scale allows for operational efficiencies and cost-effective procurement. The company's strategic reserve locations, catering to high-growth metropolitan areas, ensure a steady demand for its products. This scale and market presence have enabled VMC to achieve a 27% increase in aggregates gross profit per ton from 2021 to 2023, showcasing the strength of its business model.

Innovative Operational Practices: VMC's operational excellence is a cornerstone of its success. The company's Vulcan Way of Operating, which emphasizes continuous improvement and safety, coupled with its Commercial Excellence & Logistics Innovation, has driven profitability. These practices have not only improved customer service and asset utilization but have also led to a significant increase in aggregates cash gross profit per ton, demonstrating the effectiveness of VMC's strategic disciplines.

Weaknesses

Dependence on Cyclical Construction Industry: VMC's reliance on the construction industry, which is inherently cyclical, poses a risk to its financial stability. Economic downturns or reductions in infrastructure spending can lead to decreased demand for aggregates, impacting VMC's revenue. This dependence is evident in the company's top ten revenue-producing states, which accounted for 88% of its 2023 revenues, indicating a potential vulnerability to regional economic fluctuations.

Regulatory and Environmental Challenges: The aggregates industry is heavily regulated, with stringent zoning and permitting regulations. VMC's operations are subject to environmental laws and regulations that can impose significant costs and constraints. For instance, the company's Calica operations in Mexico are currently halted, highlighting the impact that regulatory challenges can have on its international business endeavors.

Opportunities

Demographic and Economic Growth in Served States: VMC is well-positioned to capitalize on projected demographic and economic growth in the states it serves. With 76% of the U.S. population growth and 75% of household formations expected to occur in Vulcan-served states over the next decade, the company has significant opportunities to invest in high-return projects. This growth potential is supported by VMC's strategic reserve locations and its focus on metropolitan areas with high demand for construction materials.

Strategic Acquisitions and Market Expansion: VMC has a history of growth through strategic acquisitions, such as the purchase of U.S. Concrete, which expanded its aggregates-led business in growing metropolitan areas. The fragmented nature of the aggregates industry presents ongoing opportunities for consolidation and market expansion. VMC's disciplined approach to mergers and acquisitions positions it to continue enhancing its core business and expanding its reach.

Threats

Economic and Political Uncertainties: VMC's business could be adversely affected by economic and political uncertainties, including changes in federal, state, and local funding for infrastructure. The company's reliance on public infrastructure projects, which are often subject to political decision-making and budgetary constraints, could lead to fluctuations in demand for its products. Additionally, global economic developments and domestic policy changes, such as those related to climate change and tax policy, could pose threats to VMC's operations.

Competition and Technological Disruption: The construction industry is highly competitive, and VMC must continuously innovate to maintain its market position. Technological advancements could disrupt traditional business models and distribution methods. VMC must stay ahead of such changes to remain competitive and avoid losing market share to emerging competitors or alternative materials.

In conclusion, Vulcan Materials Co (NYSE:VMC) exhibits a robust SWOT profile with its strong market leadership, operational excellence, and strategic positioning poised to leverage growth opportunities in high-demand areas. However, the company must navigate the cyclical nature of the construction industry, regulatory challenges, and potential economic and political uncertainties. By continuing to focus on innovation and strategic acquisitions, VMC is well-equipped to address these challenges and maintain its industry-leading status.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.