Decoding WEC Energy Group Inc (WEC): A Strategic SWOT Insight

Comprehensive SWOT analysis based on WEC Energy Group Inc's latest SEC 10-K filing.

Strategic evaluation of WEC's financial health and market position.

Expert breakdown of the company's potential growth opportunities and industry challenges.

Forward-looking perspective on WEC's plans to leverage its strengths and mitigate risks.

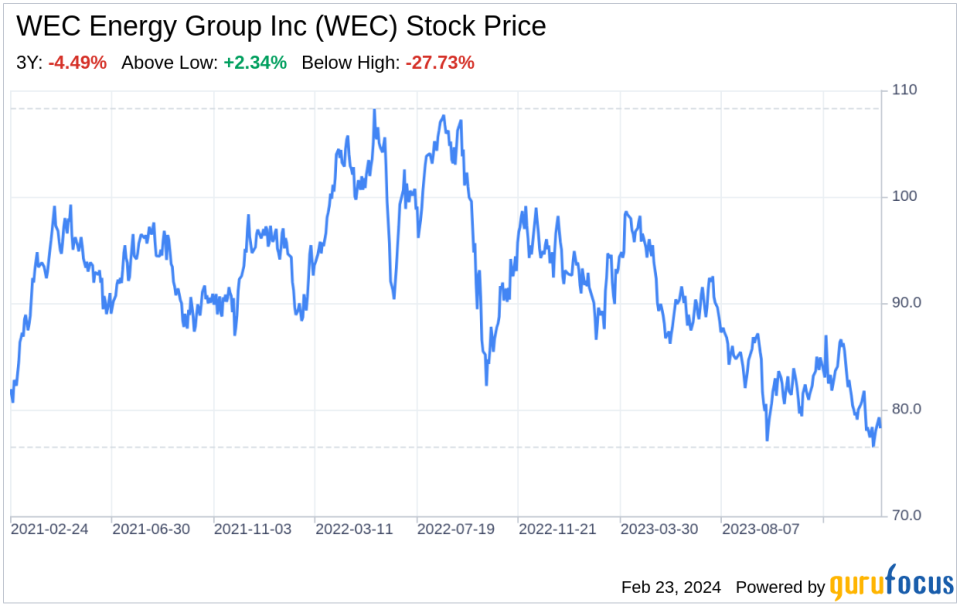

On February 22, 2024, WEC Energy Group Inc (NYSE:WEC) filed its annual 10-K report with the SEC, providing a detailed account of its financial performance and strategic positioning. As a diversified holding company with a significant presence in the electric and gas utility sector, WEC serves a broad customer base across Illinois, Michigan, Minnesota, and Wisconsin. The company's asset mix, comprising electric generation and distribution, gas distribution, electric transmission, and unregulated renewable energy, reflects a balanced portfolio designed to navigate the complexities of the energy market. With an aggregate market value of $27.8 billion as of June 30, 2023, and a strong commitment to environmental stewardship and operational efficiency, WEC is poised to maintain its competitive edge in the industry.

Strengths

Diversified Energy Portfolio: WEC Energy Group Inc's diverse energy portfolio is a cornerstone of its strength. Approximately 49% of its assets are in electric generation and distribution, 36% in gas distribution, 10% in electric transmission, and 5% in unregulated renewable energy. This diversification allows WEC to mitigate risks associated with market fluctuations in any single energy sector and provides a stable revenue stream. The company's significant equity interest in American Transmission Co. further bolsters its position in the electric transmission space, enhancing its ability to deliver reliable energy solutions to its customers.

Robust Financial Performance: WEC's financial health is a testament to its operational success. The company's 10-K filing reveals a solid financial foundation, with a market capitalization of $27.8 billion, reflecting investor confidence and market strength. WEC's strategic investments in infrastructure and renewable energy projects underscore its commitment to long-term growth and sustainability, which is likely to appeal to environmentally conscious investors and customers alike. The company's ability to generate consistent revenues from its utility operations provides a stable cash flow, essential for funding future capital projects and maintaining dividend payments to shareholders.

Weaknesses

Regulatory Challenges: As a utility provider, WEC Energy Group Inc is subject to extensive regulation at the federal, state, and local levels. The company's operations can be significantly impacted by legislative and regulatory changes, such as rate-setting policies and environmental regulations. These external factors can introduce uncertainty and may affect WEC's ability to recover costs and earn a reasonable return on investment. The company's recent filings highlight the impact of rate orders and the potential for increased scrutiny over utility rates and practices, which could pose financial and operational challenges.

Dependence on Economic Conditions: The demand for electricity and natural gas is closely tied to economic conditions. Adverse weather conditions, changes in commodity prices, and shifts in customer growth can influence WEC's operational performance. While the company has taken steps to mitigate these risks through its diversified energy mix, it remains vulnerable to economic downturns and shifts in consumer behavior, such as increased energy conservation efforts and the adoption of distributed generation technologies.

Opportunities

Investment in Renewable Energy: WEC Energy Group Inc's strategic focus on renewable energy presents significant growth opportunities. The company's ESG Progress Plan outlines ambitious goals to reduce carbon emissions and invest in zero-carbon-emitting renewables and clean natural gas-fired generation. By retiring older, less efficient fossil-fueled generation and embracing new technologies, WEC is positioning itself as a leader in the transition to a sustainable energy future. This proactive approach not only aligns with global environmental trends but also opens up new revenue streams and enhances the company's appeal to eco-conscious consumers and investors.

Technological Advancements: The energy sector is undergoing rapid technological transformation, and WEC Energy Group Inc is well-placed to capitalize on these changes. Advances in smart grid technology, energy storage, and distributed generation offer opportunities for WEC to improve operational efficiency, enhance customer service, and develop new business models. By staying at the forefront of technological innovation, WEC can strengthen its market position and drive future growth.

Threats

Market Competition: The energy market is highly competitive, with numerous players vying for market share. WEC Energy Group Inc faces competition from other utility providers, as well as from alternative energy sources such as solar and wind power. The company must continuously innovate and improve its service offerings to retain existing customers and attract new ones. Additionally, technological advancements could lower barriers to entry, allowing new competitors to emerge and challenge WEC's market dominance.

Cybersecurity Risks: As a utility company, WEC Energy Group Inc is increasingly reliant on digital technologies to manage its operations. This dependence makes the company vulnerable to cybersecurity threats, which could disrupt service delivery, compromise customer data, and result in significant financial and reputational damage. WEC's recent filings acknowledge the importance of robust cybersecurity measures and the ongoing investment required to safeguard its systems against potential attacks.

In conclusion, WEC Energy Group Inc's SWOT analysis reveals a company with a strong market position, bolstered by a diversified energy portfolio and solid financial performance. However, regulatory challenges and economic dependencies present ongoing risks that require careful management. Opportunities for growth in renewable energy and technological innovation offer promising avenues for expansion, while competitive pressures and cybersecurity threats necessitate vigilance and strategic planning. Overall, WEC's proactive approach to leveraging its strengths and addressing its weaknesses positions it

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.