Deep Dive into J&J Snack Foods Corp's Dividend Performance and Sustainability

Assessing the company's dividend history, yield, growth rates, and payout ratio

J&J Snack Foods Corp (NASDAQ:JJSF) recently announced a dividend of $0.74 per share, payable on 2023-10-10, with the ex-dividend date set for 2023-09-15. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into J&J Snack Foods Corps dividend performance and assess its sustainability.

What Does J&J Snack Foods Corp Do?

Warning! GuruFocus has detected 8 Warning Signs with JJSF. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

J&J Snack Foods Corp manufactures, markets, and distributes snack foods and beverages to foodservice and retail supermarket outlets. The company's products include frozen beverages, juice, fruit bars, sorbet, cakes, and cookies that are distributed to various consumers, including restaurants, supermarkets, convenience stores, universities, theaters, and theme parks. The company operates in three business segments: food service, retail supermarkets, and frozen beverages.

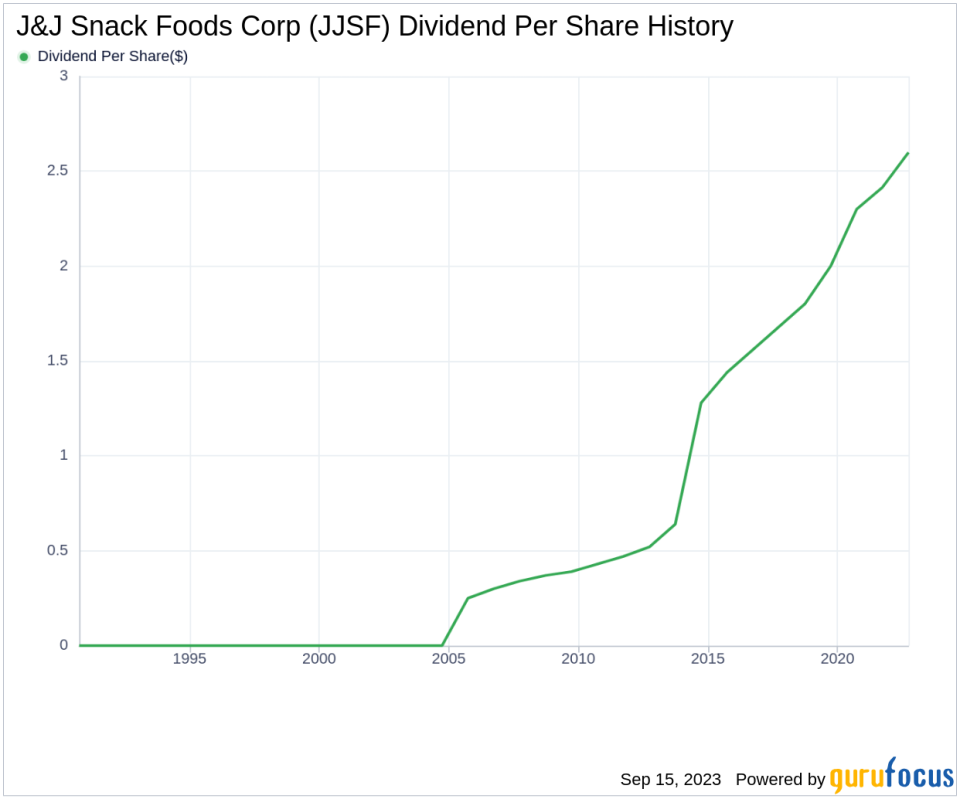

A Glimpse at J&J Snack Foods Corp's Dividend History

J&J Snack Foods Corp has maintained a consistent dividend payment record since 2004. Dividends are currently distributed on a quarterly basis. Since 2005, J&J Snack Foods Corp has increased its dividend each year, earning the status of a dividend achiever.

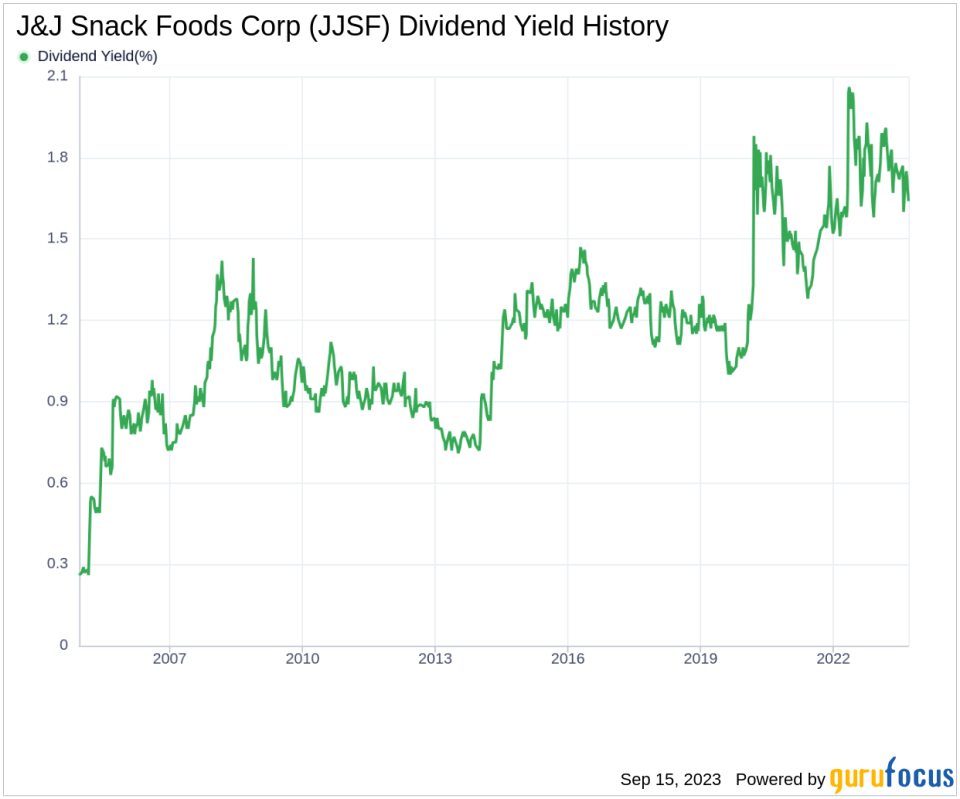

Breaking Down J&J Snack Foods Corp's Dividend Yield and Growth

J&J Snack Foods Corp currently has a 12-month trailing dividend yield of 1.63% and a 12-month forward dividend yield of 1.70%, indicating an expectation of increasing dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was 9.10%, which increased to 9.60% per year over a five-year horizon. Over the past decade, the annual dividends per share growth rate stands at an impressive 15.60%.

The Sustainability Question: Payout Ratio and Profitability

Assessing the sustainability of the dividend requires an evaluation of the company's payout ratio. J&J Snack Foods Corp's dividend payout ratio as of 2023-06-30 is 0.82, which may suggest that the company's dividend may not be sustainable. However, the company's profitability rank is 7 out of 10, indicating good profitability prospects. The company has reported positive net income for each of the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

J&J Snack Foods Corp's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors. The company's revenue has increased by approximately 4.70% per year on average, a rate that underperforms approximately 56.14% of global competitors. Meanwhile, its 3-year EPS growth rate and 5-year EBITDA growth rate underperform approximately 80.49% and 89.55% of global competitors, respectively.

Next Steps

Considering J&J Snack Foods Corp's consistent dividend payments, impressive growth rate, and high profitability, the company appears to be a promising choice for dividend investors. However, its high payout ratio and underperforming growth metrics compared to global competitors warrant caution. Therefore, potential investors should conduct thorough research and consider other factors before making an investment decision. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.