Deep Track Capital, LP Enters Position in Terns Pharmaceuticals Inc

Deep Track Capital, LP (Trades, Portfolio), a prominent investment firm, recently made a significant move in the stock market by acquiring a new stake in Terns Pharmaceuticals Inc. (TERN, Financial) This article will delve into the details of this transaction, provide an overview of both the guru and the traded company, and analyze the potential implications of this move for value investors.

Details of the Transaction

The transaction took place on July 20, 2023, with Deep Track Capital, LP (Trades, Portfolio) purchasing 3,560,000 shares of Terns Pharmaceuticals Inc at a price of $8.03 per share. This acquisition had a 1.16% impact on the firm's portfolio, making Terns Pharmaceuticals Inc account for 1.16% of the firm's holdings. The firm now holds a 6.28% stake in Terns Pharmaceuticals Inc.

Profile of the Guru: Deep Track Capital, LP (Trades, Portfolio)

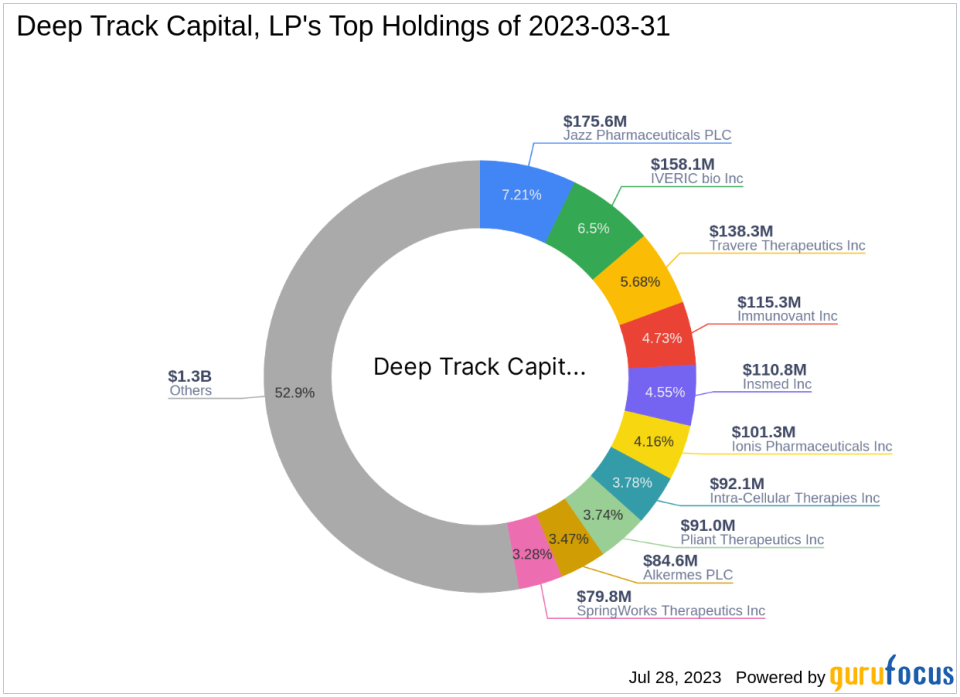

Deep Track Capital, LP (Trades, Portfolio) is a well-established investment firm based in Greenwich, Connecticut. The firm manages a diverse portfolio of 59 stocks, with a total equity of $2.44 billion. Its top holdings include Insmed Inc, Jazz Pharmaceuticals PLC, IVERIC bio Inc, Travere Therapeutics Inc, and Immunovant Inc.

Overview of Terns Pharmaceuticals Inc

Terns Pharmaceuticals Inc, a clinical-stage biopharmaceutical company based in the USA, specializes in developing small-molecule single-agent and combination therapy candidates for the treatment of non-alcoholic steatohepatitis (NASH) and other chronic liver diseases. The company, which went public on February 5, 2021, has a market capitalization of $394.495 million and a current stock price of $6.96. Since its IPO, the company's stock price has decreased by 58.94%.

Analysis of Terns Pharmaceuticals Inc's Stock

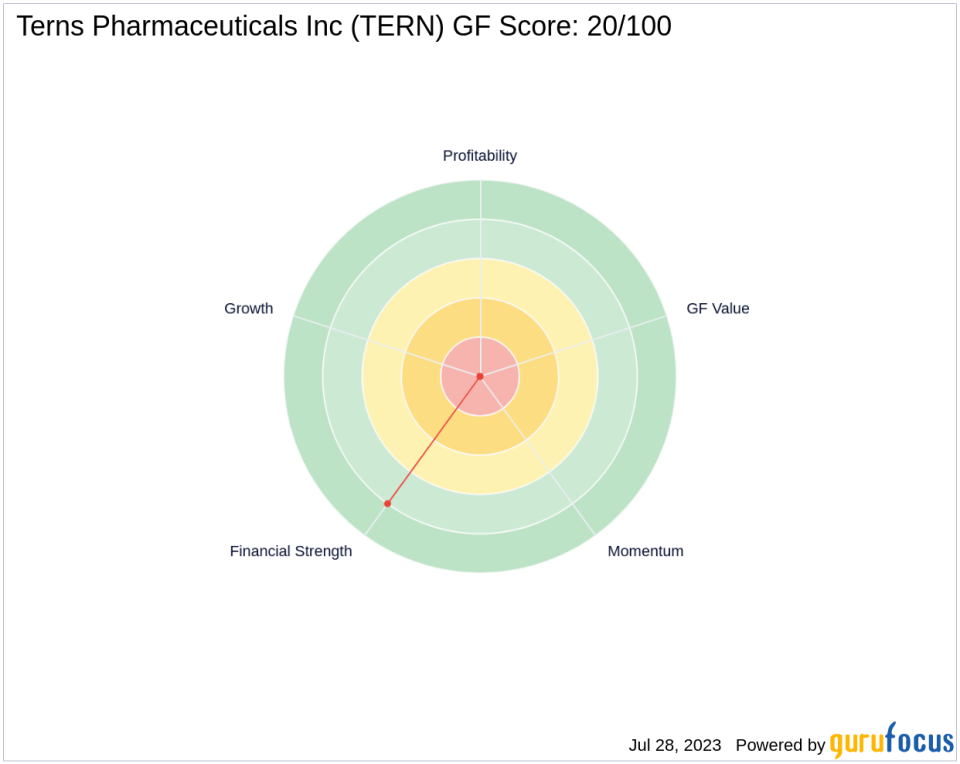

As of July 28, 2023, Terns Pharmaceuticals Inc's stock has a GF Score of 20/100, indicating low future performance potential due to insufficient data. While the company's financial strength ranks 8 out of 10, the company does not have enough data to compute the profitability, growth, and momentum ranks. The company's cash to debt ratio is 285.53, ranking 285th in the industry. The company's ROE and ROA are -32.92 and -31.46 respectively, ranking 558th and 706th in the industry.

Terns Pharmaceuticals Inc's Performance Indicators

The company's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 21.96, 27.14, and 31.15 respectively. The company's Momentum Index 6 - 1 Month and Momentum Index 12 - 1 Month are -7.08 and 245.07 respectively. The company's RSI 14 Day Rank and Momentum Index 6 - 1 Month Rank are 170 and 576 respectively.

Conclusion

In conclusion, Deep Track Capital, LP (Trades, Portfolio)'s recent acquisition of a new stake in Terns Pharmaceuticals Inc is a significant move that could potentially influence the firm's portfolio. However, given Terns Pharmaceuticals Inc's poor future performance potential and low rankings in profitability, growth, and momentum, it remains to be seen how this transaction will impact the firm's portfolio in the long run. As always, value investors should conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.