Deere & Co (DE) Reports Q1 Net Income Dip Amid Sales Challenges

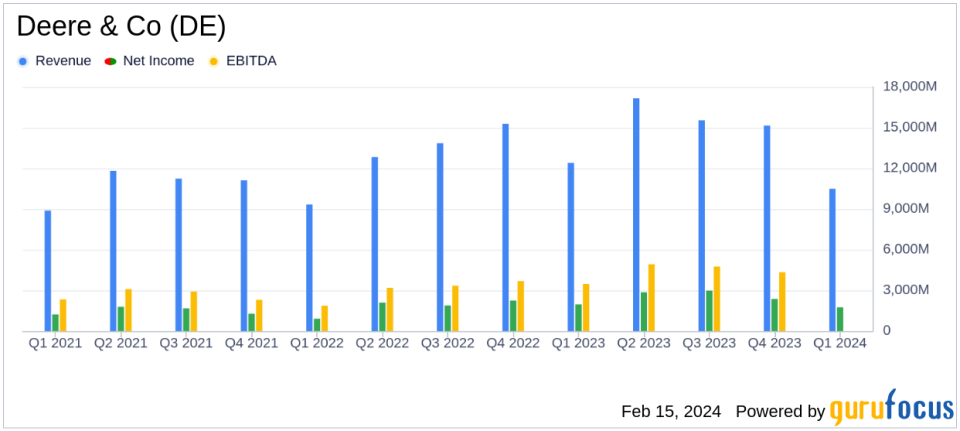

Net Income: $1.751 billion, a decrease of 11% year-over-year.

Revenue: Worldwide net sales and revenues down 4% to $12.185 billion.

Earnings Per Share (EPS): $6.23, compared to $6.55 in the previous year.

Segment Performance: Production & Precision Agriculture net sales down 7%, Small Agriculture & Turf net sales down 19%, Construction & Forestry sales remained flat.

Financial Services: Net income increased by 12% to $207 million.

Fiscal 2024 Outlook: Net income forecasted to be between $7.50 billion and $7.75 billion.

On February 15, 2024, Deere & Co (NYSE:DE) released its 8-K filing, detailing its financial performance for the first quarter ended January 28, 2024. The company, a global leader in the production of agricultural equipment, reported a net income of $1.751 billion, or $6.23 per share, a decrease from the $1.959 billion, or $6.55 per share reported in the same quarter of the previous year. The decrease in net income comes amidst a 4% decline in worldwide net sales and revenues, which totaled $12.185 billion for the quarter.

Deere & Co operates through four segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and John Deere Capital. The company's extensive dealer network and financial services arm support its core equipment manufacturing business. Despite the downturn in net income and sales, Deere's CEO, John C. May, emphasized the company's commitment to customer productivity and sustainability, highlighting a new partnership aimed at expanding rural connectivity.

Segment Analysis and Challenges

The Production and Precision Agriculture segment saw a 7% decrease in net sales, with operating profit falling by 13% due to lower shipment volumes and increased expenses. The Small Agriculture and Turf segment experienced a more significant sales decline of 19%, with operating profit down by 27%. The Construction and Forestry segment maintained flat sales, but operating profit decreased by 9%.

These declines reflect the broader challenges faced by Deere & Co, including moderating agricultural fundamentals and increased competition. The company's outlook suggests a cautious approach, with fleet replenishment expected to moderate after record levels in the previous years.

Financial Services and Outlook

Deere's Financial Services segment provided a bright spot, with net income increasing by 12% to $207 million, attributed to higher average portfolio balances. For fiscal 2024, the net income attributable to Deere & Co from financial services operations is forecasted to be approximately $770 million, an improvement over the previous fiscal year.

The company's forecast for net income in fiscal 2024 is set between $7.50 billion and $7.75 billion, indicating confidence in its ability to navigate the current economic environment and deliver value to customers through innovative products and solutions.

Comprehensive Financial Review

Deere & Co's financial statements reveal the intricate details of its operations. The Income Statement, Balance Sheet, and Cash Flow Statement provide insights into the company's profitability, financial health, and cash management. Key metrics such as net income, total revenues, operating margins, and net sales are crucial for investors to understand the company's performance and potential for growth.

For instance, the operating margin in the Production and Precision Agriculture segment decreased to 21.6% from 23.2%, indicating pressure on profitability. These financial metrics are vital for assessing Deere & Co's standing in the Farm & Heavy Construction Machinery industry, where efficiency, scale, and innovation play significant roles in success.

Deere & Co's earnings report is a testament to the company's resilience in the face of market headwinds. While the decrease in net income and sales presents challenges, the company's strategic focus on customer productivity and sustainability, along with its positive financial services performance, positions it to navigate the current economic landscape effectively. Investors and stakeholders will be watching closely as Deere & Co continues to adapt and innovate in its quest to deliver value and drive growth.

Explore the complete 8-K earnings release (here) from Deere & Co for further details.

This article first appeared on GuruFocus.