Deere Continues to Power On

- By Steve Gray Booyens

Deere & Co. (NYSE:DE) has been on a solid run over the past year, and by beating earnings expectations once again, we think the stock will have another successful 12 months.

Performance

Deere has beaten the S&P 500 by nearly 3.6 times over the past year.

The stock's performance is driven by the company's transformational period. Deere's investing heavily in precision farming, which has gotten investors excited. Investors have also bought into the fact that farmers will have benefited from high commodity prices and stimulus checks, which assumably will be spent on equipment upgrades.

Earnings and estimates

Deere posted an earnings per share beat of $1.16 and a revenue beat of $439.83 million in its latest earnings report. Following on from the stimulus and commodity prices contributing to performance, a few matters need to be considered when looking at earnings.

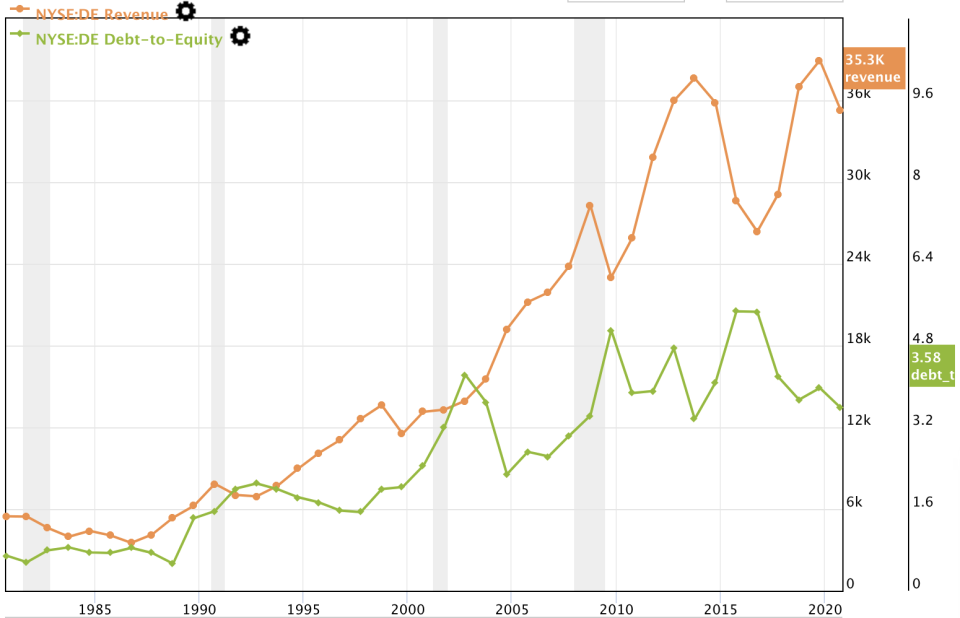

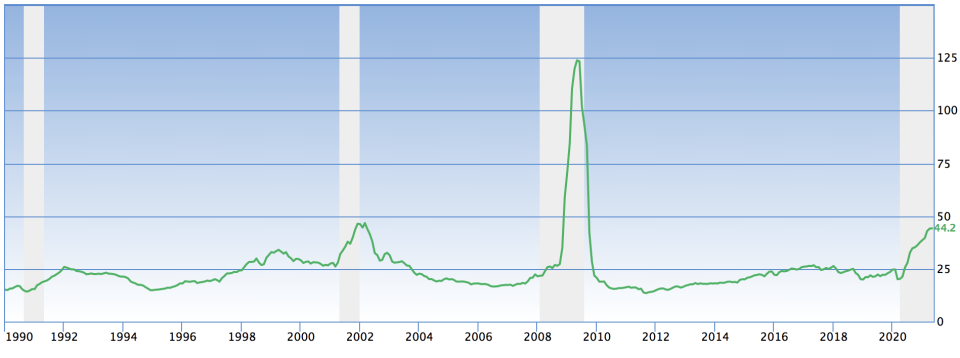

Although the company beat revenue estimates, is has yet to return to pre-Covid levels. As the reopening accelerates, the company will probably re-lever on debt. The chart shows the correlation between the company's top-line earnings and the amount of leverage. Should Deere re-lever, the company will experience stronger top-line growth.

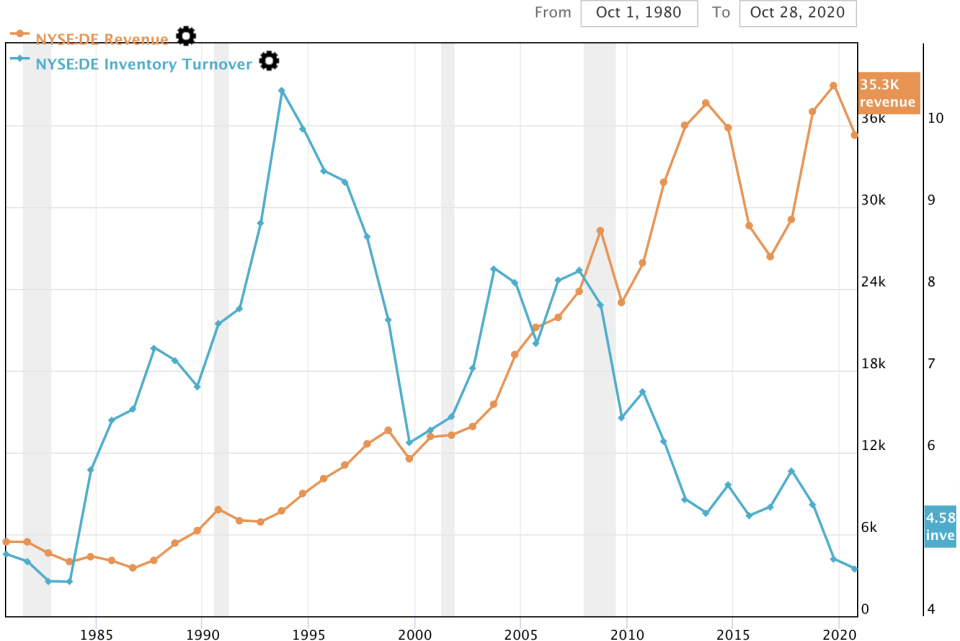

Deere has managed to decrease its inventory turnover drastically since 1994, whilst increasing its revenue. As this divergence continues, the company will experience better and better gross profit margins.

Source: Seeking Alpha

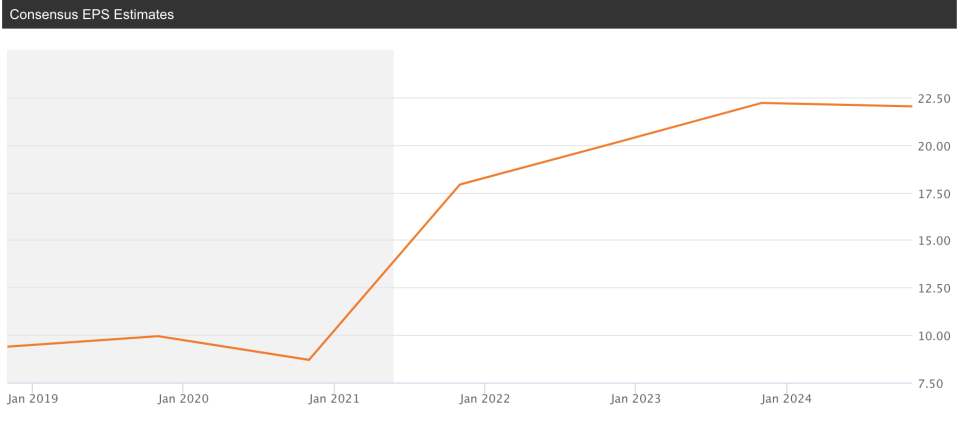

Analysts expect earnings per share to take off for the rest of 2021, due to estimated increases in net income and the anti-dilutive nature of the stock's earnings.

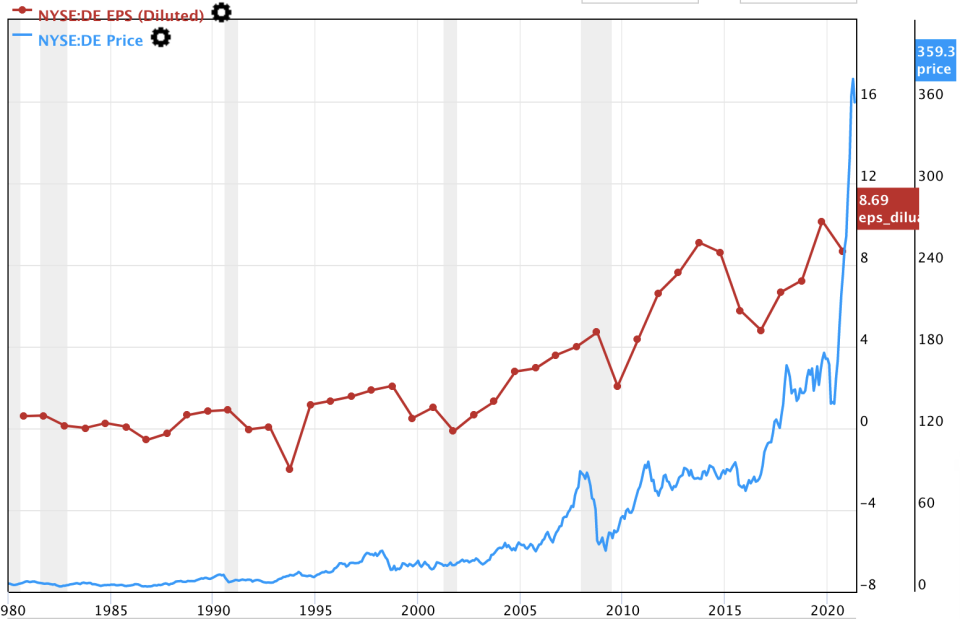

Historically speaking, the diluted earnings per share have been trending higher, which has added more value for shareholders. Although sporadic selloffs after dilutions, the stock's price has correlated closely with improved diluted earnings in the long run.

In addition to the charts above, Deere is sitting on a deferred tax asset of $1,191 million, which will boost earnings if exercised and provide stimulus to the stock price.

Peer analysis

Source: Seeking Alpha

By looking at the peer analysis, it should be noted that Deere's trading below most of its peers with value multiples such as price-earnings and price-book. The stock's earnings multiple of 24.80 trades well below the current S&P 500 average, which is around 44 times. Should there be a market correction, Deere will be on the right side of it.

Source: MarketWatch

Valuation

The justified price-earnings ratio indicates that investors could be provided with a potential 38% 12-month upside.

GAAP justified forward price-earnings: 24.80 x 20.04 = $497 (rounded)

The valuation can be justified considering the size of the company as well as the strength of its earnings. Even with market factors considered, we think that investors could experience a 38% return over the next 12 months.

Final word

Metrics show that Deere is a valuable investment. The recent earnings beat should ensure momentum. The stock's plateaued over the past week due to insider stock sales, but since 1994 the company's policy has always been to limit insider selling whilst maximizing shareholder value. Deere is a good buy at the moment!

Disclosure: I am long Deere & Co.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.