Deerfield Management Company, L.P. (Series C) Boosts Holding in DA32 Life Science Tech ...

Deerfield Management Company, L.P. (Series C), a renowned investment firm, recently made a significant addition to its portfolio. The firm acquired a substantial stake in DA32 Life Science Tech Acquisition Corp (NASDAQ:DALS), a blank check company. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential implications of this acquisition.

Details of the Transaction

On July 28, 2023, Deerfield Management Company, L.P. (Series C) added 3,545,000 shares of DA32 Life Science Tech Acquisition Corp to its portfolio. The shares were acquired at a price of $10.32 each, bringing the firm's total holdings in the company to 5,145,000 shares. This transaction had a 1.27% impact on the firm's portfolio and increased the firm's holdings in the traded stock to 91.06%. The traded stock now represents 1.84% of the firm's total holdings.

Firm Profile

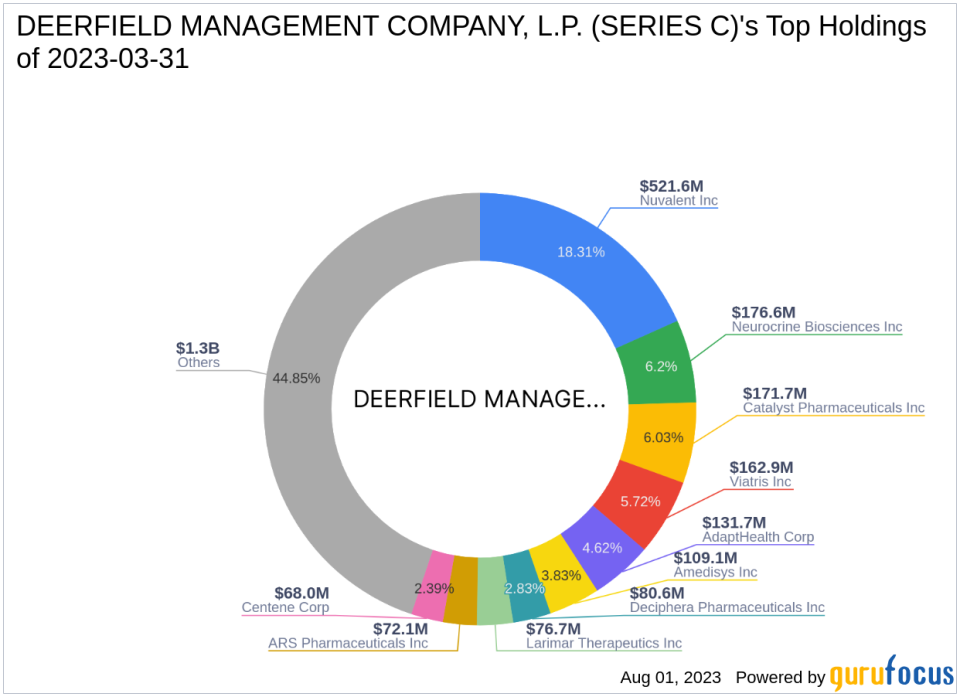

Deerfield Management Company, L.P. (Series C) is a well-established investment firm based in New York. The firm's investment philosophy is centered around a long-term perspective and a focus on healthcare and financial services sectors. As of the date of the transaction, the firm held 86 stocks in its portfolio, with a total equity of $2.85 billion. The firm's top holdings include Catalyst Pharmaceuticals Inc, Viatris Inc, Neurocrine Biosciences Inc, AdaptHealth Corp, and Nuvalent Inc.

Overview of the Traded Stock

DA32 Life Science Tech Acquisition Corp is a US-based blank check company. The company, which went public on July 28, 2021, is primarily involved in mergers, capital stock exchanges, asset acquisitions, stock purchases, reorganizations, or similar business combinations with one or more businesses. As of the transaction date, the company had a market capitalization of $264.708 million and a stock price of $10.32. The company's price-earnings ratio stood at 147.43. However, due to insufficient data, the GF valuation of the stock could not be evaluated.

Performance of the Traded Stock

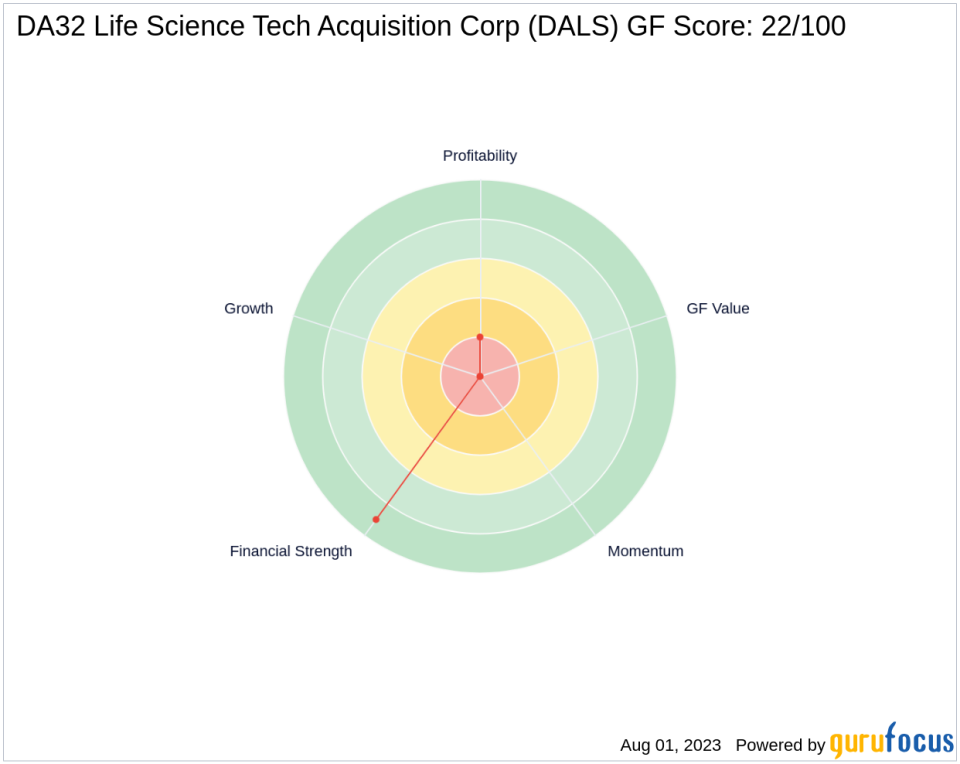

Since its IPO, DA32 Life Science Tech Acquisition Corp has seen a price change of 4.77%. The year-to-date price change ratio stands at 3.61%. The stock has a GF score of 22/100, indicating poor future performance potential due to lack of data. The stock's balance sheet and profitability ranks are 9/10 and 2/10 respectively.

Financial Health of the Traded Stock

DA32 Life Science Tech Acquisition Corp operates in the diversified financial services industry. The company's Z score and cash to debt ratio are not available due to insufficient data. The company's ROE and ROA stand at 0.88 and 0.85, respectively, with respective ranks of 379 and 355.

Growth Metrics of the Traded Stock

Due to insufficient data, the gross margin growth, operating margin growth, and 3-year revenue, EBITDA, and earning growth of DA32 Life Science Tech Acquisition Corp could not be evaluated.

Momentum and Predictability of the Traded Stock

The stock's RSI 5 day, 9 day, and 14 day stand at 74.97, 68.08, and 64.13, respectively. The stock's momentum index 6 - 1 month and 12 - 1 month are 1.89 and 5.66, respectively. However, the stock's predictability rank could not be evaluated due to insufficient data.

Transaction Analysis

The acquisition of a significant stake in DA32 Life Science Tech Acquisition Corp by Deerfield Management Company, L.P. (Series C) is a strategic move that could potentially yield substantial returns for the firm. However, given the traded stock's poor GF score and the lack of sufficient data to evaluate its financial health and growth metrics, the transaction's impact on the stock and the guru's portfolio remains to be seen.

All data and rankings are accurate as of August 2, 2023, and are based on the provided relative data.

This article first appeared on GuruFocus.