Definitive Healthcare Corp.'s (NASDAQ:DH) Share Price Not Quite Adding Up

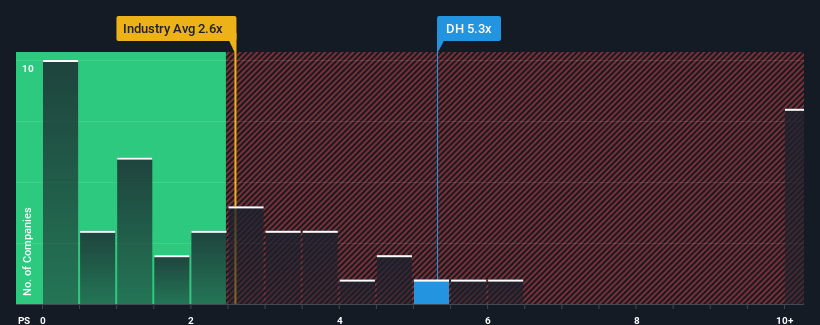

When close to half the companies in the Healthcare Services industry in the United States have price-to-sales ratios (or "P/S") below 2.6x, you may consider Definitive Healthcare Corp. (NASDAQ:DH) as a stock to avoid entirely with its 5.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Definitive Healthcare

What Does Definitive Healthcare's Recent Performance Look Like?

Recent times have been advantageous for Definitive Healthcare as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Definitive Healthcare's future stacks up against the industry? In that case, our free report is a great place to start.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Definitive Healthcare would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. The latest three year period has also seen an excellent 160% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 18% per year during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 18% per annum, which is not materially different.

With this in consideration, we find it intriguing that Definitive Healthcare's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Definitive Healthcare's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Definitive Healthcare's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Definitive Healthcare (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here