Definitive Healthcare Corp Reports Mixed Results Amidst Growth and Challenges

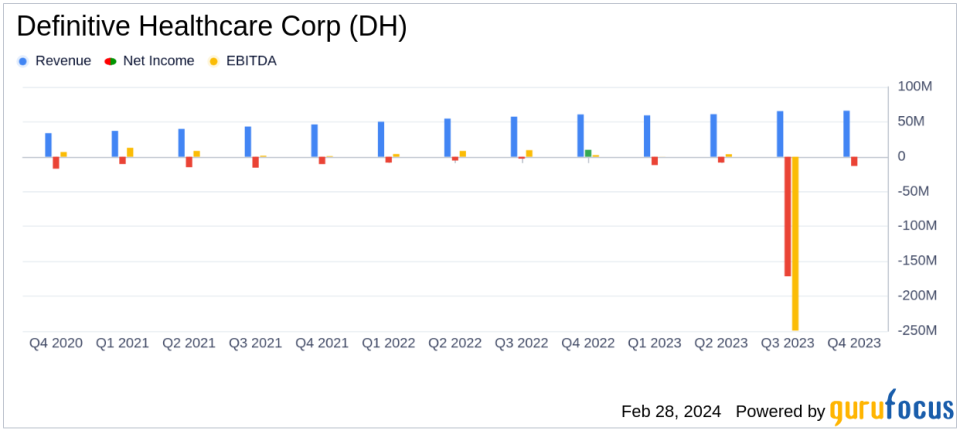

Revenue Growth: Q4 revenue increased by 9% year-over-year to $65.9 million, and full-year revenue grew by 13% to $251.4 million.

Net Loss: Q4 saw a net loss of $13.4 million, contrasting with a net income of $5.9 million in Q4 2022. Full-year net loss deepened to $289.6 million from $24.2 million in 2022.

Adjusted EBITDA: Q4 Adjusted EBITDA improved to $19.8 million, while full-year Adjusted EBITDA rose to $74.5 million, maintaining a 30% margin.

Customer Growth: Enterprise customer base grew by 28, ending the quarter with 565 enterprise customers.

Guidance: Revenue for Q1 2024 is expected to be between $63.0 $65.0 million, with full-year 2024 projected to be $263.0 $269.0 million.

On February 28, 2024, Definitive Healthcare Corp (NASDAQ:DH), a leader in healthcare commercial intelligence, released its 8-K filing, detailing its financial results for the fourth quarter and full fiscal year 2023. The company, which primarily operates in the United States, provides comprehensive information on healthcare providers to optimize customer operations across product development, market planning, and sales execution.

Financial Performance and Challenges

Definitive Healthcare Corp (NASDAQ:DH) reported a revenue increase in both the fourth quarter and full year, indicating continued demand for its healthcare intelligence solutions. However, the company faced significant challenges, as evidenced by a substantial net loss for the year. The net loss was primarily due to a non-cash goodwill impairment charge, reflecting a decline in stock price and market capitalization.

Despite these challenges, the company's Adjusted EBITDA and Adjusted Net Income remained positive, showcasing the underlying strength of its core operations. The growth in enterprise customers by 5% year-over-year also underscores the company's ability to expand its client base in a competitive market.

Financial Achievements and Industry Importance

The company's ability to maintain a 30% Adjusted EBITDA margin is a testament to its operational efficiency and the importance of its services in the healthcare industry. The healthcare providers and services industry is data-driven, and Definitive Healthcare's intelligence solutions are crucial for clients navigating this complex landscape.

Key Financial Metrics

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight the company's financial position and operational efficiency. Unlevered Free Cash Flow for the full year stood at $68.6 million, indicating the company's ability to generate cash after accounting for capital expenditures and interest expenses. The balance sheet shows a healthy cash and cash equivalents position of $130.9 million as of December 31, 2023.

"We are pleased with our performance in 2023. We delivered double-digit revenue growth year-over-year in a difficult macro environment, along with 30% full-year adjusted EBITDA margin, for Rule of Forty performance," said Jason Krantz, Founder, Executive Chairman, and Interim CEO of Definitive Healthcare.

Analysis of Company's Performance

Definitive Healthcare Corp (NASDAQ:DH) has demonstrated resilience in revenue growth amidst a challenging economic environment. The company's strategic customer wins and product investments indicate a forward-looking approach to sustaining growth. However, the net loss for the year, driven by a goodwill impairment, raises concerns about market valuation and future profitability.

For the upcoming year, the company's guidance suggests cautious optimism, with a projected increase in revenue. Investors and stakeholders will be watching closely to see if the company can translate its strategic initiatives into improved bottom-line performance and market confidence.

For more detailed information and analysis, investors are encouraged to review the full earnings report and listen to the earnings call. Definitive Healthcare's commitment to integrating its solutions into clients' workflows and its innovative product development are key factors that will continue to shape its trajectory in the healthcare intelligence market.

For further inquiries and a deeper dive into Definitive Healthcare Corp's financials, please contact Investor Relations or visit the Investor Relations website.

Explore the complete 8-K earnings release (here) from Definitive Healthcare Corp for further details.

This article first appeared on GuruFocus.