Delek US Holdings Inc's Meteoric Rise: Unpacking the 27% Surge in Just 3 Months

Delek US Holdings Inc (NYSE:DK), a prominent player in the Oil & Gas industry, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $1.75 billion, with its stock price currently at $26.97. Over the past week, the stock price has seen a gain of 0.52%, and over the past three months, it has skyrocketed by 26.92%. This impressive performance has caught the attention of investors and market analysts alike.

GF Value and Valuation

The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, Delek's GF Value stands at $34.86, down from $39.14 three months ago. Despite this decrease, the company's stock is still considered modestly undervalued, compared to being significantly undervalued three months ago. This suggests that the stock still has room for growth.

Company Overview

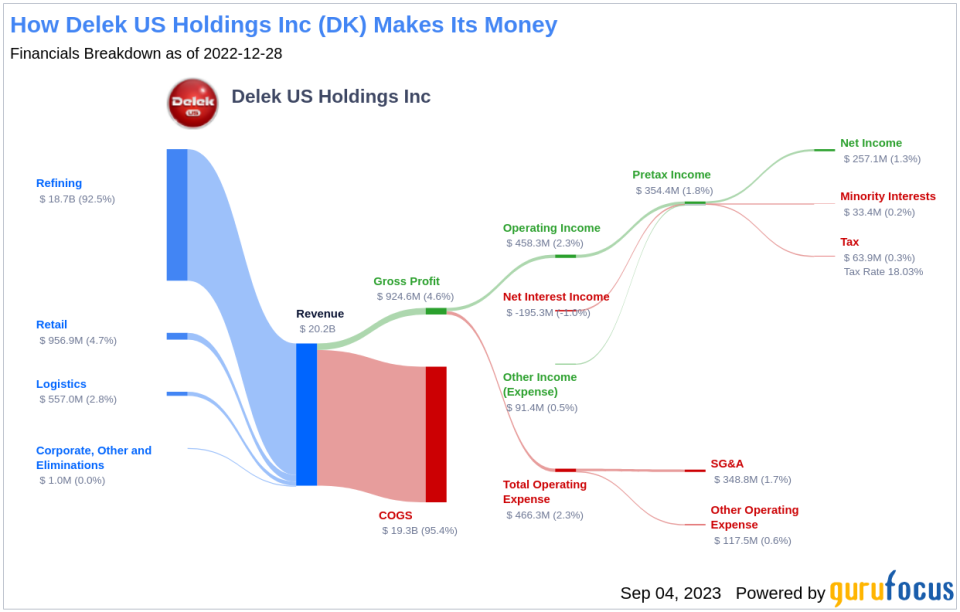

Delek US Holdings Inc is an integrated energy business focused on petroleum refining, transportation, and storage; wholesale crude oil, intermediate, and refined products, and convenience store retailing. The company owns and operates independent refineries that produce a variety of petroleum products for transportation and industrial markets in the United States. Delek's logistics segment sells portions of the petroleum products its refineries produce. The logistics segment generates revenue through gathering, transporting, and storing crude oil and intermediate products, as well as by marketing, storing, and distributing refined products. The company also offers a collection of retail fuel and convenience stores operating in the Southeast region of the United States.

Profitability Analysis

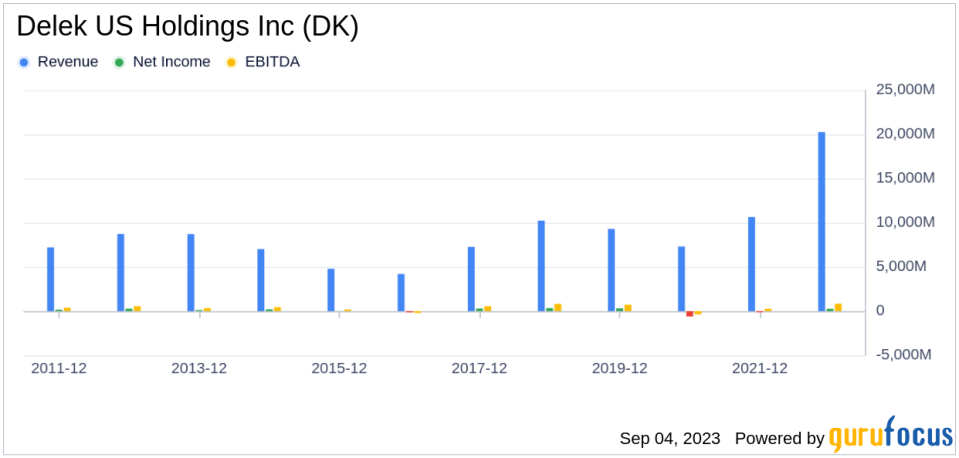

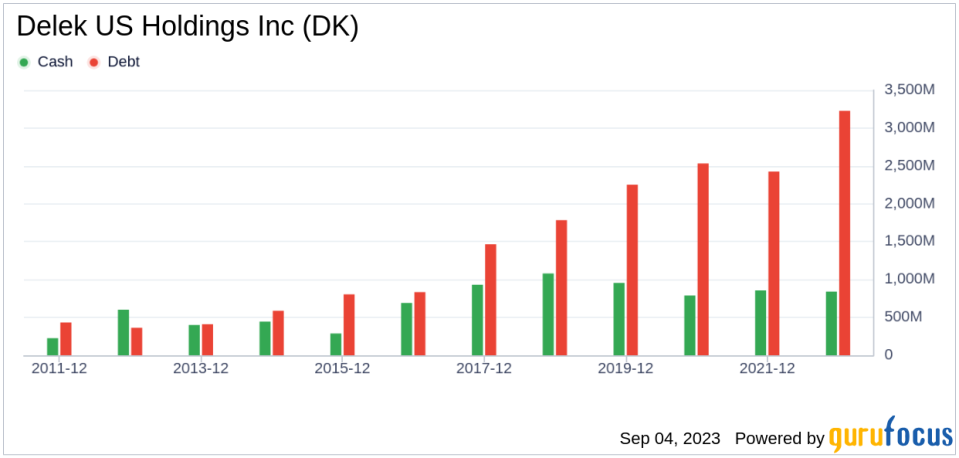

Delek's Profitability Rank stands at 7/10, indicating a strong profitability compared to its industry peers. The company's Operating Margin is 0.62%, better than 26.81% of the companies in the industry. However, the company's ROE and ROA are -5.26% and -0.67% respectively, indicating a need for improvement. The ROIC of 0.93% is better than 38.02% of the companies in the industry. Over the past decade, Delek has had 7 years of profitability, better than 68.95% of the companies in the industry.

Growth Prospects

Delek's Growth Rank is 6/10, indicating a solid growth potential. The company's 3-Year Revenue Growth Rate per Share is 32.60%, better than 85.19% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 17.30%, better than 80.57% of the companies in the industry. However, the company's future total revenue growth rate estimate is -11.90%, which is better than only 7.69% of the companies in the industry. The 3-Year EPS without NRI Growth Rate is -3.50%, better than 26.93% of the companies in the industry.

Top Holders

Ken Fisher (Trades, Portfolio) is the top holder of Delek's stock, holding 1,306,751 shares, which accounts for 1.99% of the company's shares. Paul Tudor Jones (Trades, Portfolio) holds the second-largest number of shares, with 176,865 shares, accounting for 0.27% of the company's shares. Prem Watsa (Trades, Portfolio) holds 32,000 shares, accounting for 0.05% of the company's shares.

Competitors

Delek's top three competitors in the industry are Delek Logistics Partners LP(NYSE:DKL) with a stock market cap of $1.9 billion, World Kinect Corp(NYSE:WKC) with a stock market cap of $1.35 billion, and Par Pacific Holdings Inc(NYSE:PARR) with a stock market cap of $2.18 billion.

Conclusion

In conclusion, Delek US Holdings Inc has shown impressive stock performance over the past three months, with a significant surge in its stock price. The company's profitability and growth prospects are solid, and it has a strong presence in the Oil & Gas industry. However, the company needs to improve its ROE and ROA to enhance its profitability. Despite facing stiff competition, Delek has managed to hold its ground and continues to show promise for future growth.

This article first appeared on GuruFocus.