Dell Technologies Inc (DELL) Announces Fiscal 2024 Earnings with Increased Dividend Despite ...

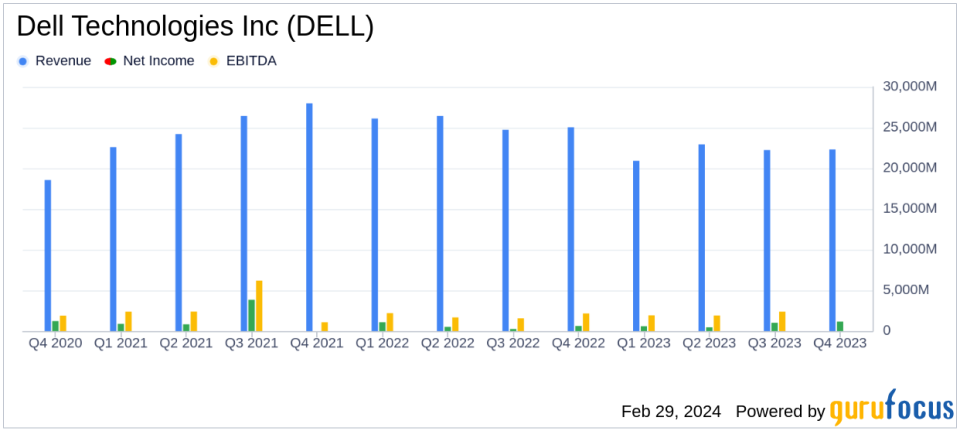

Revenue: Full-year revenue fell to $88.4 billion, a 14% decrease from the previous fiscal year.

Operating Income: Operating income for the year declined by 10% to $5.2 billion.

Net Income: Net income increased by 32% YOY to $3.195 billion.

Earnings Per Share: Diluted EPS rose by 35% to $4.36, while non-GAAP diluted EPS decreased by 6% to $7.13.

Cash Flow: Cash flow from operations for the year was strong at $8.7 billion.

Dividend: Announced a 20% increase in annual cash dividend to $1.78 per common share.

Leverage: Achieved core leverage target of 1.5x exiting the fiscal year.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 29, 2024, Dell Technologies Inc (NYSE:DELL) released its 8-K filing, detailing the financial results for its fourth quarter and the full fiscal year of 2024. The company, a leading information technology vendor known for its premium personal computers and enterprise data center hardware, reported a year-over-year decline in revenue but increased its net income and diluted earnings per share (EPS).

Fiscal Year 2024 Performance Highlights

For the fiscal year 2024, Dell Technologies reported a total revenue of $88.4 billion, marking a 14% decrease from the previous fiscal year. The company's operating income stood at $5.2 billion, a 10% decrease year over year. Despite the revenue and operating income decline, Dell Technologies managed to increase its net income by 32% to $3.195 billion. The diluted EPS saw a significant rise of 35% to $4.36, while non-GAAP diluted EPS experienced a 6% decrease to $7.13.

The company's cash flow from operations remained robust at $8.7 billion for the year. Dell Technologies ended the fiscal year with $9.0 billion in cash and investments and achieved its core leverage target of 1.5x. In a move reflecting confidence in its business and cash flow generation capabilities, Dell announced a 20% increase in its annual cash dividend to $1.78 per common share.

Segment Performance and Strategic Developments

The Infrastructure Solutions Group (ISG) reported a fourth-quarter revenue of $9.3 billion, a 6% decrease year over year, with full-year revenue down 12% to $33.9 billion. The Client Solutions Group (CSG) saw a 12% year-over-year decline in fourth-quarter revenue to $11.7 billion and a 16% decrease in full-year revenue to $48.9 billion.

Dell Technologies highlighted its strong AI-optimized server momentum, with orders increasing nearly 40% sequentially and backlog nearly doubling. The company is expanding its portfolio to address performance, cost, and security requirements across various platforms, including cloud, on-premises, and edge computing.

Financial Statements and Key Metrics

The company's balance sheet shows a decrease in total assets from $89.6 billion in the previous fiscal year to $82.1 billion. Total liabilities decreased from $92.6 billion to $84.4 billion, while stockholders' equity improved from a deficit of $3.0 billion to a deficit of $2.3 billion.

Key financial metrics from the income statement include a net revenue decrease of 11% for the fourth quarter and 14% for the full year. Gross margin as a percentage of total net revenue decreased slightly from 23.0% to 23.8% for the fourth quarter, while operating income as a percentage of total net revenue increased from 4.7% to 6.7%.

Outlook and Commentary

Chief Financial Officer Yvonne McGill commented on the results, stating, "We generated $8.7 billion in cash flow from operations this fiscal year, returning $7 billion to shareholders since Q1 FY23. Were optimistic about FY25 and are increasing our annual dividend by 20% a testament to our confidence in the business and ability to generate strong cash flow."

"Our strong AI-optimized server momentum continues, with orders increasing nearly 40% sequentially and backlog nearly doubling, exiting our fiscal year at $2.9 billion," said Jeff Clarke, vice chairman and chief operating officer, Dell Technologies. "Weve just started to touch the AI opportunities ahead of us, and we believe Dell is uniquely positioned with our broad portfolio to help customers build GenAI solutions that meet performance, cost and security requirements."

Dell Technologies' earnings report reflects a challenging fiscal year with revenue declines, but also demonstrates the company's resilience through increased net income and a strong cash flow. The strategic focus on AI-optimized servers and expansion into new technology areas, coupled with a confident dividend increase, suggests a positive outlook for the future.

Explore the complete 8-K earnings release (here) from Dell Technologies Inc for further details.

This article first appeared on GuruFocus.