Delta Air Lines: From Turbulent Times to Financial Resurgence

Over the past 12 months, the share price of Delta Air Lines Inc. (NYSE:DAL) has experienced quite some volatility. It started at approximately $39.60 per share, rose to $48.55, then dropped to $30.65 in October 2023 before rebounding to nearly $40 per share currently. With the recent rebound, I believe the stock is only modestly undervalued currently.

Business overview

Delta is one of the world's largest airlines with a global network offering more than 4,000 daily flights to more than 275 destinations worldwide, serving around 177 million passengers. In 2023, most of the company's revenue was generated from passenger ticket sales. The sales from main cabin tickets amounted to nearly $24.50 billion, comprising about 43% of total revenue. Sales of premium products were the second-largest contributor, bringing in $19.12 billion and accounting for over 33.30% of the year's total revenue.

Beyond ticket sales, Delta, like many airlines, significantly benefits from its loyalty program and co-branding with credit card issuers, which are key sources of sustainable revenue. In 2022, its partnership with American Express (NYSE:AXP) yielded a total remuneration of $5.5. billion. This figure is expected to grow to as much as $7 billion by 2024. The increase in Delta's loyalty program members fosters customer retention and enhances revenue per passenger. These loyal customers are more likely to book their travels directly through the airline's website, reducing distribution expenses associated with third-party travel agencies.

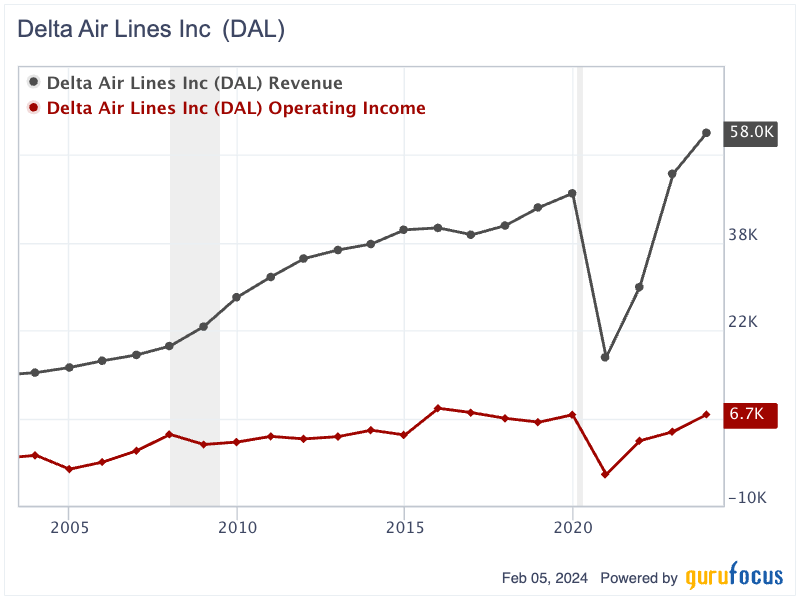

Revenue and profitability rollercoaster

Between 2003 and 2019, Delta Airlines experienced consistent revenue growth, escalating from $14.3 billion to $47 billion. However, the Covid-19 pandemic in 2020 led to its revenue plummeting $17 billion. Despite this setback, the company made a strong recovery, reaching all-time high revenue of $58 billion at the time of writing.

Simultaneously, the airline's operating income displayed a fluctuating yet upward trend. It recovered from losses of $785 million to achieve a profit of $6.60 billion in 2019. The pandemic-induced financial strain in 2020 has made the airline produce losses of $4.25 billion. Nevertheless, Delta bounced back impressively, posting an operating profit of $6.66 billion in 2023.

Remarkable resurgence

2023 was a growth year for Delta. While its revenue increased by 15% from the previous year, its operating income also enjoyed a year-over-year growth of 51%. The increase in operating income can be attributed to higher revenue coupled with reduced expenses in ancillary businesses and refinery operations. Its adjusted operating income came in at $6.30 billion, resulting in an operating margin of 11.60%. The return on invested capital also increased by five percentage points, reaching 13.40%. In terms of cash flow, Delta generated $7.20 billion in operating cash flow and $2 billion in free cash flow in 2023.

Prior to the pandemic, Delta had a history of consistently generating strong free cash flow. However, the onset of the pandemic significantly impacted its operations, adversely affecting its cash flow generation. Despite these challenges, the company has made a remarkable recovery in 2023, with improving cash flow generating capabilities. The return to positive profitability and strong cash flow generation indicates the airline's resilience and strategic adaptability in the face of global economic disruptions.

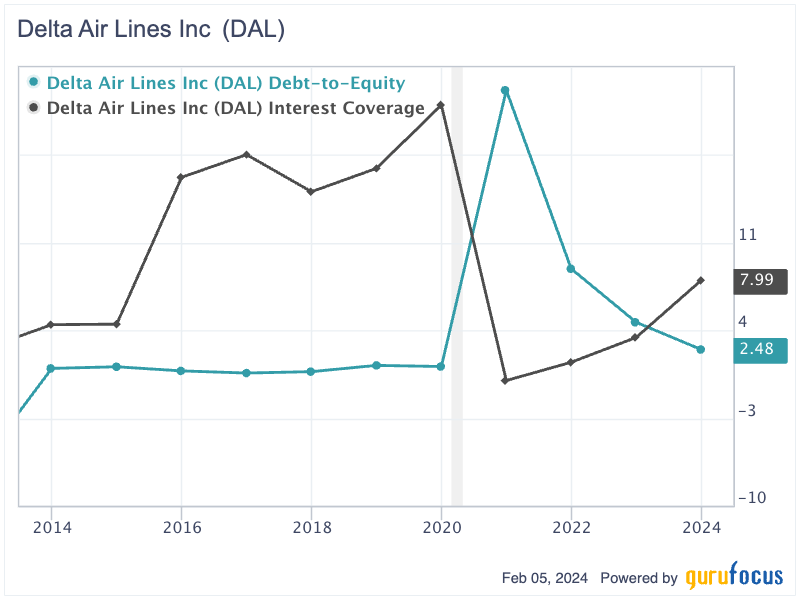

Reasonable amount of leverage

Delta Air Lines has maintained a consistently manageable level of debt. Between 2013 and 2019, its debt-to-equity ratio remained fairly stable, ranging from 0.6 to 1.21, while its interest coverage ratio increased from 4.46 to 23. However, the pandemic marked a challenging period. The debt-to-equity ratio surged to approximately 23.20 in 2020, which was due to substantial borrowing from the government to sustain operations.

On the other hand, the airline swung to significant losses as nobody flew during that time. Despite these challenges, Delta made a remarkable recovery by reducing its debt aggressively and enhancing its balance sheet. By 2023, the airline had successfully lowered its debt-to-equity ratio to just 2.48, with a comfortably high interest coverage ratio of 8, demonstrating its resilience and financial prudence.

As of December 2023, the company's shareholders' equity stood at nearly $11 billion. The cash and short-term investments were around $3.70 billion and the debt was around $20 billion.

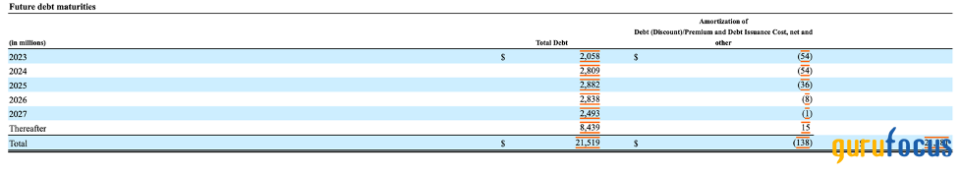

Looking forward, Delta's leverage level is expected to continue to decrease. This decline is anticipated due to the airline's robust cash flow generation, which is poised to facilitate further deleveraging in the near future. With average annual debt maturities ranging from $2.50 billion to $2.90 billion each year from 2024 to 2027 less than half of its operating cash flow of $7 billion the company is comfortable meeting its interest obligations and debt principal repayments. This financial stability places it in a solid position to manage its debts effectively in the coming years.

Source: Delta's 10-K filing

Modestly undervalued

For 2024, Delta anticipates earnings per share in the range of $6 to $7, accompanied by an increase in free cash flow estimated between $3 billion and $4 billion. This growth in free cash flow is expected to stem from enhanced profitability and growth, reduced capital expenditures and an improved mix of cash sales.

Assuming Delta generates free cash flow of $3.50 billion in 2024, applying a free cash flow multiple of 12, the airline's enterprise value is estimated to be around $42 billion. As the company aims to reduce its debt to approximately $17 billion, if the cash balance remains constant at about $4 billion, the net debt is projected to be $13 billion. Thus, the equity value should be $29 billion.

Given Delta's 643 million shares outstanding, its valuation is approximately $45 per share, which is nearly 13% higher than the current share price. It can be concluded that the stock is modestly undervalued at the moment.

The bottom line

Delta Air Lines emerges from a tumultuous period marked by volatility and the impacts of the Covid-19 pandemic as a financially resilient player in the airline industry. The company's robust recovery, characterized by significant revenue growth, strong cash flow generation and a manageable leverage level, underscores its operational and financial prudence.

Despite these achievements, Delta's current valuation is only slightly below the current trading price, not offering enough margin of safety for investors. I would rather wait for a better price before initiating a long position.

This article first appeared on GuruFocus.