Deluxe Corp (DLX) Reports Mixed Results for Q4 and Full Year 2023, Maintains 2024 Outlook

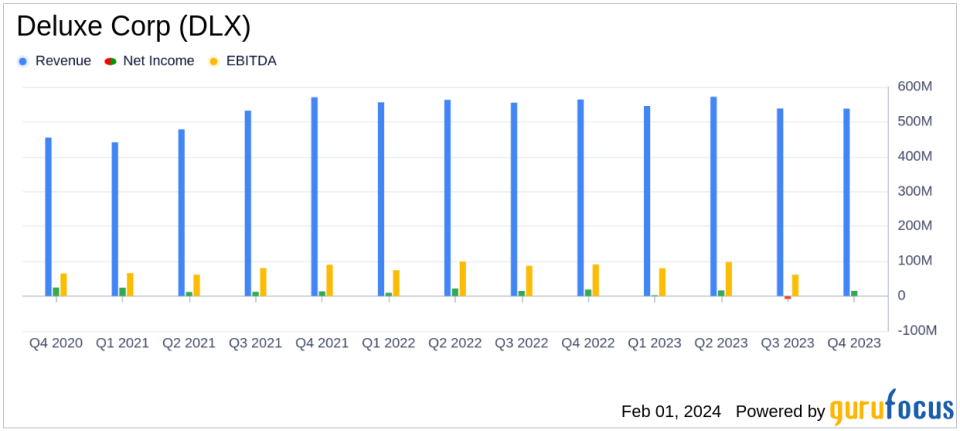

Revenue: Full year 2023 revenue decreased by 2.0% to $2.19 billion; however, comparable adjusted revenue saw a slight increase of 0.3%.

Net Income: Net income for the year dropped significantly to $26.2 million, a 60.0% decrease from the previous year.

Adjusted EBITDA: Comparable adjusted EBITDA rose by 3.2% to $417.1 million for the full year.

Earnings Per Share: GAAP diluted EPS was $0.59, while adjusted diluted EPS was $3.32, marking an 18.6% decrease from 2022.

Free Cash Flow: Deluxe Corp reported improved free cash flows during both the fourth quarter and the full year.

Dividend: A regular quarterly dividend of $0.30 per share was announced, payable on March 4, 2024.

On February 1, 2024, Deluxe Corp (NYSE:DLX), a leading provider of payment solutions and data-driven marketing services, released its 8-K filing, disclosing its financial results for the fourth quarter and the full year of 2023. The company operates across four segments, offering a range of services from merchant payment solutions to promotional products and printed checks.

Financial Performance and Challenges

Deluxe Corp's full-year revenue experienced a slight decline due to divestitures, but comparable adjusted revenuewhich excludes these impactsshowed a modest increase. This marks the third consecutive year of revenue growth on a comparable adjusted basis. However, net income saw a significant decrease, primarily due to increased interest expenses and restructuring activities.

The company's adjusted EBITDA margin improved slightly, indicating better operational efficiency. Despite the challenges, Deluxe Corp's management remains confident in the company's earnings trajectory and its ability to execute its strategic initiatives, referred to as "North Star" initiatives.

Financial Achievements and Importance

Deluxe Corp's financial achievements, particularly the increase in comparable adjusted EBITDA, are important as they reflect the company's ability to grow its core operations despite external pressures. The improved free cash flow is also a critical indicator of the company's financial health, providing more flexibility for investments, debt reduction, and shareholder returns.

The company's guidance for 2024 reiterates expectations for continued revenue and EBITDA growth, as well as an increase in EPS. This outlook is significant for investors as it suggests confidence in Deluxe Corp's strategic direction and resilience in the face of economic headwinds.

Key Financial Metrics

Deluxe Corp's financial statements reveal important metrics that are vital for assessing the company's performance:

"The increasing scale of our combined Payments and Data platform is driving improved operating leverage and expansion of our comparable adjusted EBITDA margins," said Barry McCarthy, President and CEO of Deluxe.

This commentary underscores the importance of the company's scale in achieving operational efficiencies and margin improvements. Additionally, the focus on operational execution and capital allocation priorities by CFO Chip Zint highlights the company's strategic financial management.

In summary, Deluxe Corp's financial results for 2023 reflect a mixed performance with challenges in net income but strengths in adjusted EBITDA and free cash flow. The company's affirmation of its 2024 outlook provides a positive signal to the market about its future performance.

For detailed financial figures and further information, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Deluxe Corp for further details.

This article first appeared on GuruFocus.