Delving into Dole PLC's Dividend Dynamics: A Comprehensive Analysis

Unpacking the Fruit Giant's Dividend Performance and Sustainability

Dole PLC (NYSE:DOLE) recently announced a dividend of $0.08 per share, payable on October 5, 2023, with the ex-dividend date set for September 13, 2023. As investors anticipate this upcoming payout, it's crucial to examine the company's dividend history, yield, and growth rates. Using GuruFocus data, we will delve into Dole PLC's dividend performance and assess its sustainability.

Introduction to Dole PLC

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

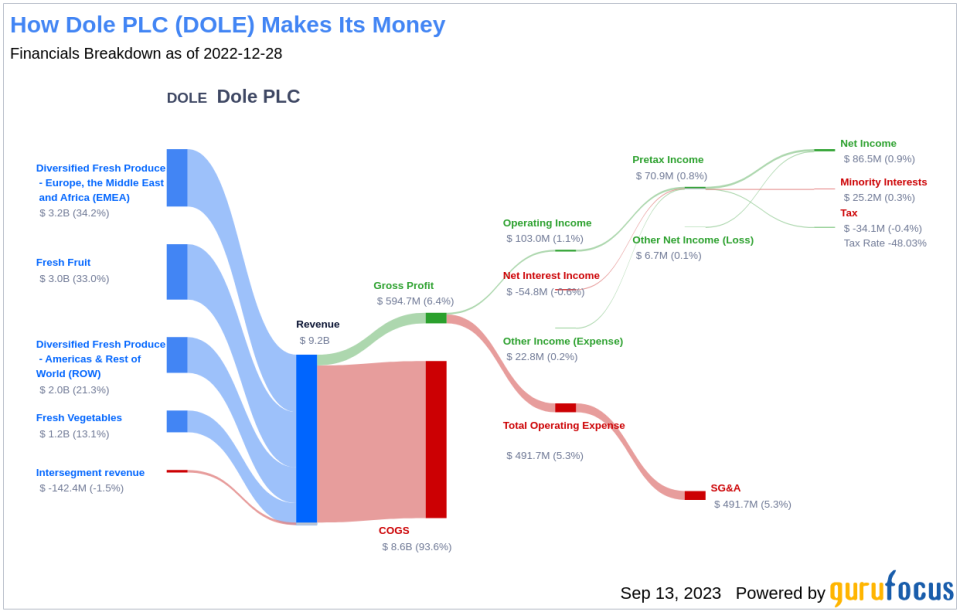

Dole PLC, through its subsidiaries, operates in the North American and European markets for fresh fruits and vegetables. The company's segment includes Fresh Fruit; Diversified Fresh Produce - EMEA; Diversified Fresh Produce - Americas and ROW and Fresh Vegetables. It generates maximum revenue from the Diversified Fresh Produce - EMEA segment, which includes Dole's various businesses across the European marketplace.

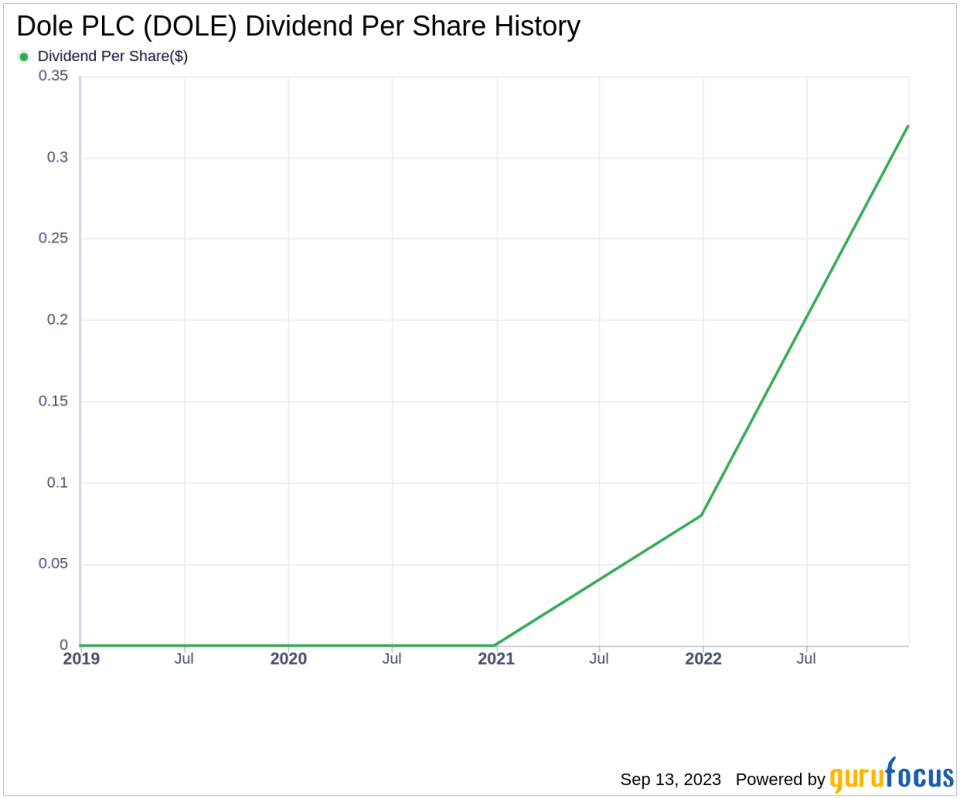

Exploring Dole PLC's Dividend History

Since 2021, Dole PLC has maintained a consistent dividend payment record, with dividends currently distributed on a quarterly basis. The chart below shows the annual Dividends Per Share for tracking historical trends.

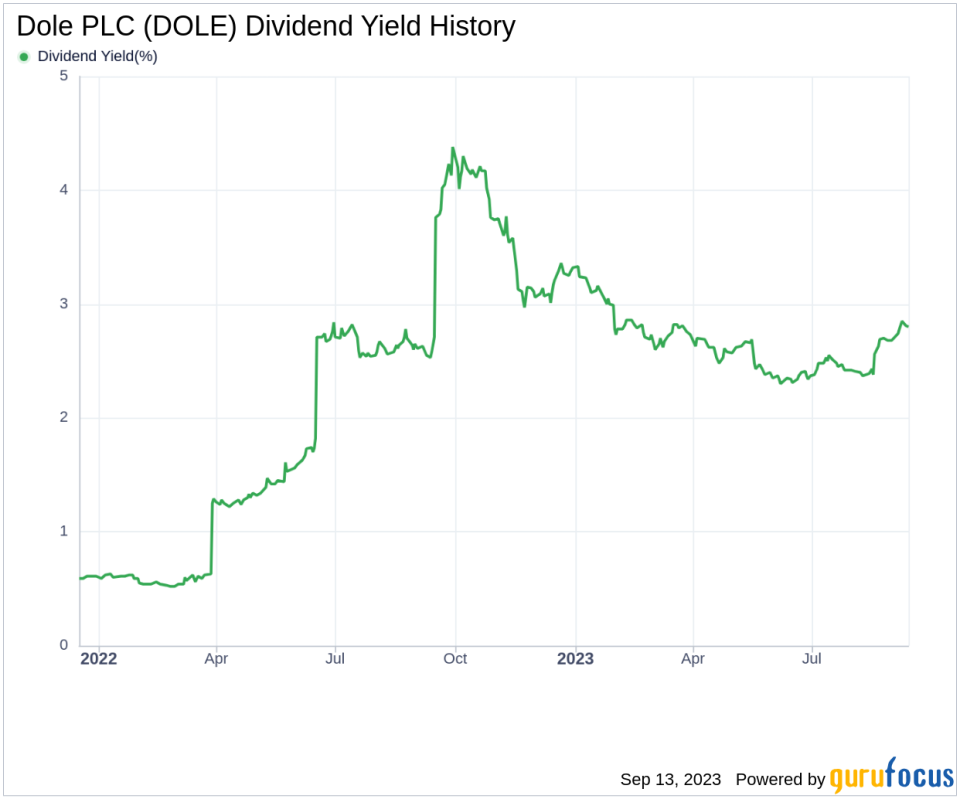

Understanding Dole PLC's Dividend Yield and Growth

As of today, Dole PLC has a 12-month trailing dividend yield and a 12-month forward dividend yield of 2.79%. This suggests an expectation of consistent dividend payments over the next 12 months. The 5-year yield on cost of Dole PLC stock is also approximately 2.79%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The dividend payout ratio of Dole PLC, as of June 30, 2023, is 0.33, providing insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. However, Dole PLC's profitability rank of 4 out of 10 suggests potential challenges in sustaining the dividend. The company has reported net profit in 4 years out of the past 10 years.

Growth Metrics: A Glimpse into the Future

Dole PLC's growth rank of 4 out of 10 suggests limited growth prospects, potentially impacting dividend sustainability. However, Dole PLC's strong revenue per share and 3-year revenue growth rate of approximately 29.50% per year on average indicate a robust revenue model. Furthermore, the company's 3-year EPS growth rate of approximately 15.50% per year on average showcases its capability to grow its earnings, a critical factor for sustaining dividends in the long run.

Conclusion

While Dole PLC's consistent dividend history and strong revenue growth are encouraging, the company's low profitability and growth ranks suggest potential challenges in maintaining its dividends. Investors should continue monitoring these factors to make informed decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.