Delving into Graphic Packaging Holding Co's Dividend Landscape

An in-depth analysis of Graphic Packaging Holding Co's dividend performance and prospects

Graphic Packaging Holding Co(NYSE:GPK) recently announced a dividend of $0.1 per share, payable on 2023-10-05, with the ex-dividend date set for 2023-09-14. As investors anticipate this forthcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Using GuruFocus data, let's delve into Graphic Packaging Holding Co's dividend performance and evaluate its sustainability.

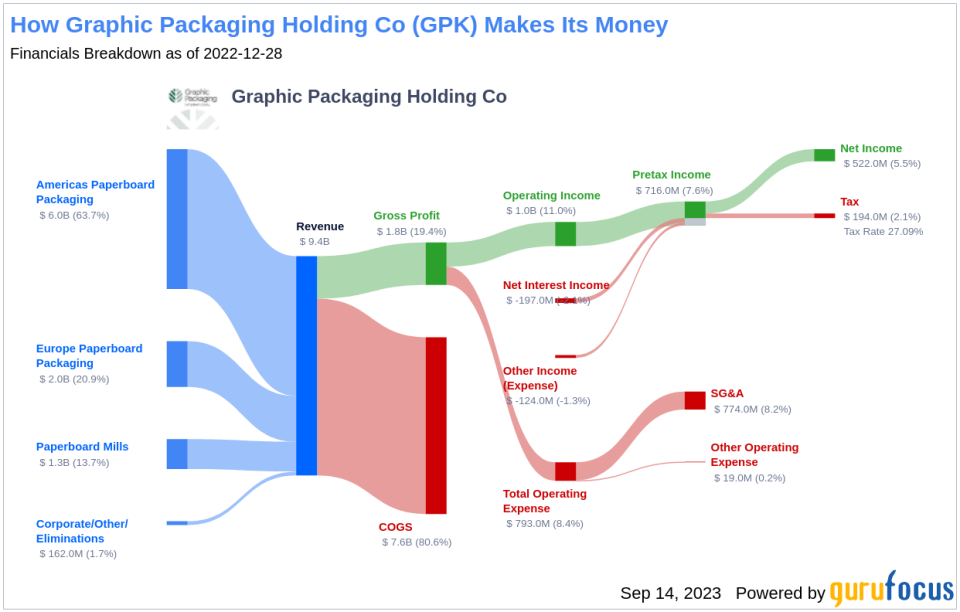

Understanding Graphic Packaging Holding Co's Business Model

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Graphic Packaging Holding Co is a holding company that offers a wide range of paper-based consumer packaging products through its subsidiaries. The company primarily focuses on selling paperboard packaging and operating paperboard mills. Its packaging solutions cater to a variety of industries, including beverages, food, and household products. Graphic Packaging also operates paper mills that sell laminated and coated packaging products to third parties, with the majority of revenue derived from the Americas.

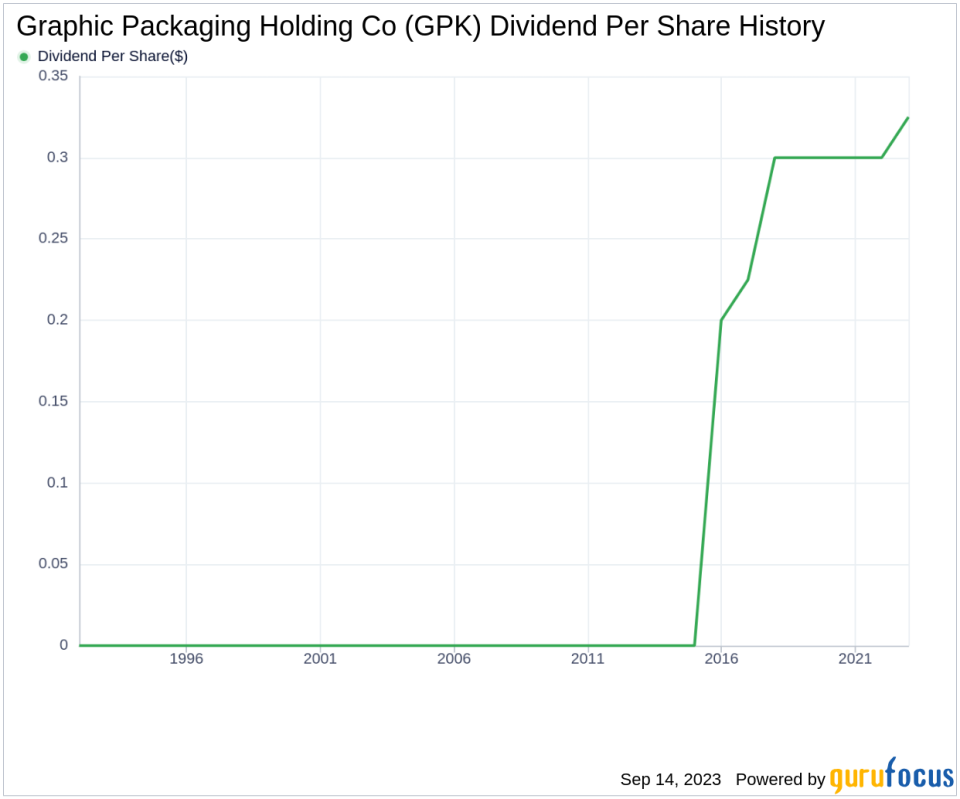

Tracing Graphic Packaging Holding Co's Dividend History

Graphic Packaging Holding Co has sustained a steady dividend payment record since 2015, with dividends currently distributed on a quarterly basis. The following chart depicts the annual Dividends Per Share for tracking historical trends.

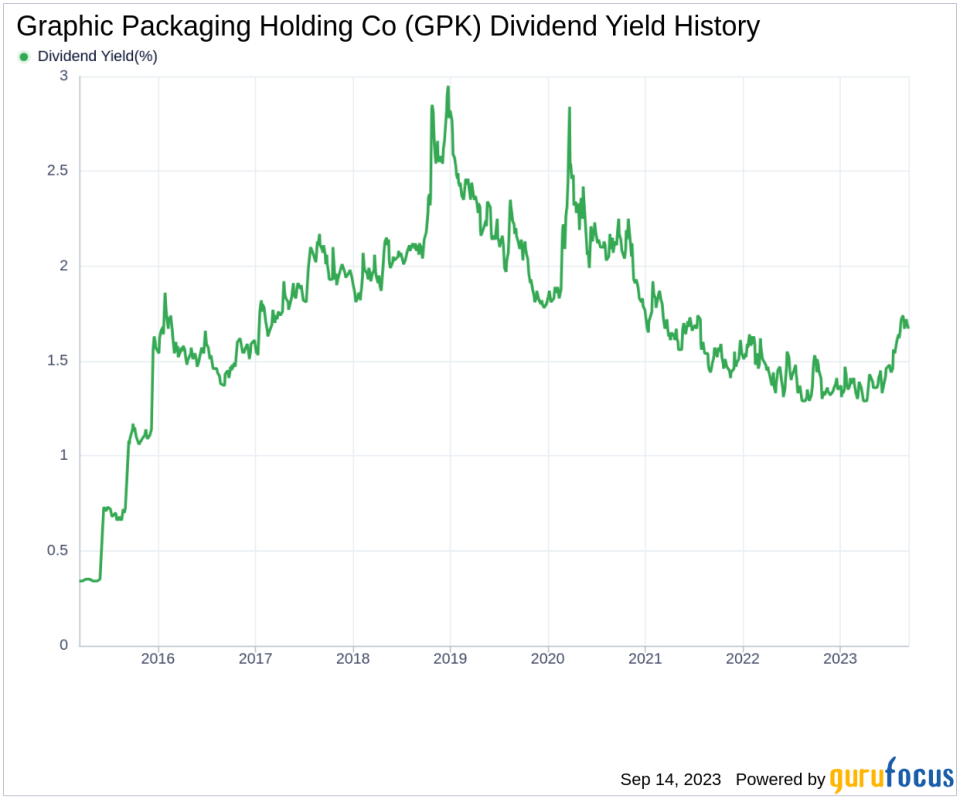

Dissecting Graphic Packaging Holding Co's Dividend Yield and Growth

As of today, Graphic Packaging Holding Co boasts a 12-month trailing dividend yield of 1.68% and a 12-month forward dividend yield of 1.80%. This indicates an anticipated increase in dividend payments over the next 12 months.

Over the past three years, Graphic Packaging Holding Co's annual dividend growth rate was 2.70%. This rate decreased to 1.20% per year when extended to a five-year horizon. Based on these figures, the 5-year yield on cost of Graphic Packaging Holding Co stock as of today is approximately 1.78%.

Examining Dividend Sustainability: Payout Ratio and Profitability

The dividend payout ratio offers insights into the percentage of earnings Graphic Packaging Holding Co distributes as dividends. As of 2023-06-30, the company's dividend payout ratio is 0.16, suggesting that a substantial portion of its earnings is retained for future growth and unexpected downturns.

The company's profitability rank of 9 out of 10, as of 2023-06-30, indicates robust profitability prospects. Graphic Packaging Holding Co has reported positive net income each year over the past decade, further reinforcing its high profitability.

Assessing Future Prospects: Growth Metrics

Graphic Packaging Holding Co's growth rank of 9 out of 10 indicates a promising growth trajectory relative to its competitors. The company's revenue per share and 3-year revenue growth rate suggest a robust revenue model, with an average annual increase of approximately 13.40%.

The company's 3-year EPS growth rate showcases its ability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Graphic Packaging Holding Co's earnings increased by approximately 34.20% per year on average.

The company's 5-year EBITDA growth rate of 7.50% further underscores its growth potential.

Concluding Remarks

Based on the analysis of Graphic Packaging Holding Co's dividend payments, growth rate, payout ratio, profitability, and growth metrics, it is evident that the company has a strong dividend performance and sustainability. Its robust growth metrics and profitability rank suggest promising future prospects. As such, Graphic Packaging Holding Co presents an attractive proposition for value investors seeking steady dividend income.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.