Delving into Korn Ferry's Dividend Dynamics: A Comprehensive Analysis

Unpacking Korn Ferry's Dividend History, Yield, Growth, and Sustainability

Renowned organizational consulting and management recruitment firm, Korn Ferry (NYSE:KFY), recently announced a dividend of $0.18 per share, set to be payable on October 13, 2023. The ex-dividend date is marked for September 21, 2023. With investors eagerly anticipating this forthcoming payment, it's a fitting time to examine Korn Ferry's dividend history, yield, and growth rates. Using the data collated by GuruFocus, we delve into the company's dividend performance and evaluate its sustainability.

A Brief Introduction to Korn Ferry

Warning! GuruFocus has detected 4 Warning Signs with IGGRF. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Headquartered in the United States, Korn Ferry is a leading firm in organizational consulting and management recruitment. The company assists clients in filling mid- to high-level management positions across various sectors. Korn Ferry's operations are segmented into Consulting, Digital, Executive Search, and RPO and Professional Search.

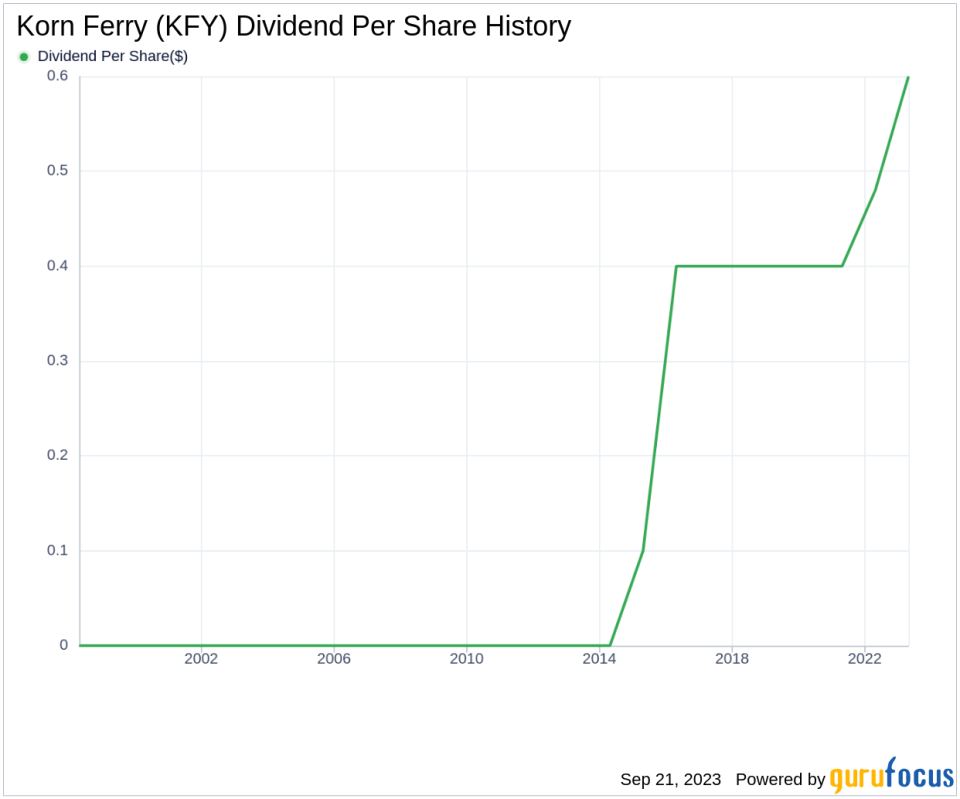

Reflecting on Korn Ferry's Dividend History

Since 2015, Korn Ferry has consistently distributed dividends on a quarterly basis. This track record provides a sense of reliability for investors seeking regular income from their investment. The chart below provides a historical perspective on the company's annual Dividends Per Share.

Understanding Korn Ferry's Dividend Yield and Growth

As of the present day, Korn Ferry boasts a trailing dividend yield of 1.28% over the past 12 months, and a forward dividend yield of 1.34% for the upcoming 12 months. This indicates an anticipated increase in dividend payments in the next year.

Over the past three years, Korn Ferry's annual dividend growth rate has been 14.50%. However, when extended to a five-year horizon, this rate decreases to 7.60% per year. With these figures in mind, the 5-year yield on cost of Korn Ferry stock is approximately 1.85% as of today.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a company's dividends can be gauged by its payout ratio. The dividend payout ratio reveals the proportion of earnings that a company allocates to dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring funds for future growth and unforeseen downturns. As of July 31, 2023, Korn Ferry's dividend payout ratio is 0.19.

Additionally, Korn Ferry's profitability rank provides insight into the company's earnings prowess relative to its peers. As of July 31, 2023, GuruFocus ranks Korn Ferry's profitability at 9 out of 10, indicating strong profitability prospects. The company has reported positive net income each year over the past decade, further solidifying its high profitability.

Assessing Future Prospects: Growth Metrics

For dividends to be sustainable, a company must showcase robust growth metrics. Korn Ferry's growth rank of 9 out of 10 indicates a promising growth trajectory relative to its competitors.

Revenue is the lifeblood of any company, and Korn Ferry's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Korn Ferry's revenue has increased by approximately 15.20% per year on average, outperforming approximately 78.27% of global competitors.

The company's 3-year EPS growth rate showcases its ability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Korn Ferry's earnings increased by approximately 27.60% per year on average, outperforming approximately 70.45% of global competitors.

Lastly, the company's 5-year EBITDA growth rate stands at 19.60%, outperforming approximately 74.19% of global competitors.

Concluding Thoughts

Considering Korn Ferry's consistent dividend payments, impressive growth rate, reasonable payout ratio, and strong profitability and growth metrics, the company presents a compelling case for dividend-focused investors. However, as with any investment, it's crucial to conduct thorough research and consider the company's overall financial health and market position.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.