Denali Therapeutics Inc (DNLI) Reports Full Year and Q4 2023 Financial Results

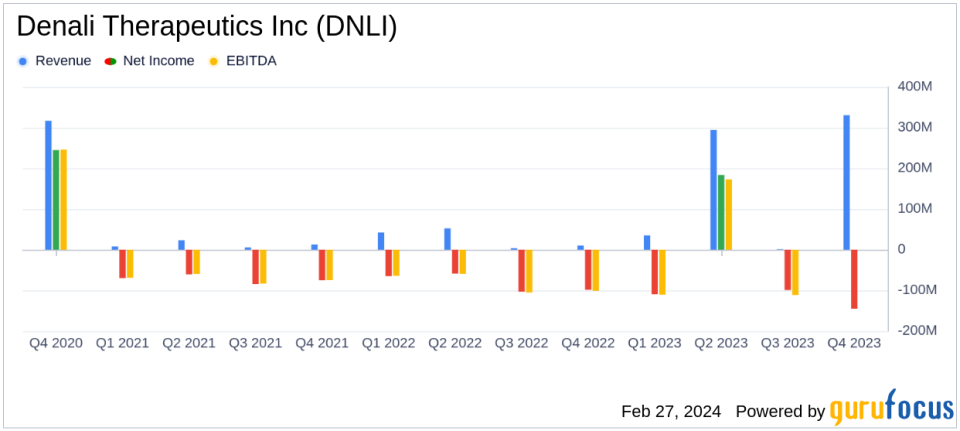

Net Loss: Reported a net loss of $119.5 million for Q4 and $145.2 million for the full year 2023.

Collaboration Revenue: No collaboration revenue for Q4 2023, but a significant increase to $330.5 million for the full year.

Research and Development Expenses: R&D expenses rose to $107.8 million for Q4 and $423.9 million for the full year.

General and Administrative Expenses: G&A expenses increased to $24.8 million for Q4 and $103.4 million for the full year.

Cash Position: Cash, cash equivalents, and marketable securities were approximately $1.03 billion as of December 31, 2023.

2024 Guidance: Operating expenses for 2024 anticipated to be less than or equal to those in 2023, with cash runway extending into 2028.

Denali Therapeutics Inc (NASDAQ:DNLI) released its 8-K filing on February 27, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative approach to treating neurodegenerative and lysosomal storage diseases, has made significant strides in its therapeutic portfolio and the clinical validation of its blood-brain barrier (BBB) Transport Vehicle (TV) platform.

Denali Therapeutics Inc (NASDAQ:DNLI) is a biotechnology company focused on defeating neurodegeneration through the development of therapeutics that cross the BBB. Its development programs, such as the LRRK2 Inhibitor Program for Parkinson's disease, are critical to addressing the unmet needs of patients with neurodegenerative conditions.

Financial Performance and Challenges

Despite the absence of collaboration revenue in Q4 2023, the company reported a substantial increase in full-year collaboration revenue to $330.5 million, primarily due to revenue recognized under the Biogen Collaboration Agreement. However, the company faced a net loss of $119.5 million for Q4 and $145.2 million for the full year, which was an improvement from the previous year's net loss of $326.0 million. The financial health of Denali is crucial as it supports the continued research and development of its product candidates, which are in various stages of clinical trials.

Research and development expenses increased due to the progression of clinical trials and increased personnel costs associated with higher headcount. General and administrative expenses also rose, reflecting the company's growth and investment in infrastructure, including a new manufacturing facility in Salt Lake City. These financial metrics are important as they reflect the company's commitment to advancing its therapeutic candidates and scaling operations in anticipation of commercial readiness.

Key Financial Details

The balance sheet shows a strong cash position with approximately $1.03 billion in cash, cash equivalents, and marketable securities, providing a solid runway for the company's operations. This is a critical metric for Denali, as it ensures the company can sustain its research and development efforts without the immediate need for additional financing.

"2023 was a year of significant progress across our broad therapeutic portfolio and further clinical validation of our BBB-crossing Transport Vehicle (TV) platform," said Ryan Watts, Ph.D., Chief Executive Officer of Denali. "We are well positioned to expand our TV-enabled portfolio to address large neurodegenerative diseases with TV-enabled enzymes, antibodies, and oligonucleotides."

Denali's financial achievements, particularly the increase in collaboration revenue, are significant for a biotechnology company as they reflect the industry's recognition of the potential of Denali's platform and product candidates. The company's strategic partnerships and collaborations are essential for advancing its pipeline and bringing new treatments to market.

Analysis of Company's Performance

Denali's strategic focus on its TV-enabled platforms and the prioritization of its portfolio are reflected in its financial guidance for 2024, with operating expenses expected to be less than or equal to those in 2023. This disciplined approach to spending, combined with the anticipated proceeds from the PIPE financing, positions the company for sustained operations into 2028. Denali's commitment to advancing its clinical programs while maintaining financial stability is a positive sign for investors and stakeholders in the biotechnology sector.

For a more detailed analysis of Denali Therapeutics Inc (NASDAQ:DNLI)'s financial results and strategic initiatives, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Denali Therapeutics Inc for further details.

This article first appeared on GuruFocus.