Denison Mine (DNN) to Report Q3 Earnings: What's in Store?

Denison Mine Corp DNN is expected to register a loss of 1 cent per share when it reports third-quarter 2023 results on Nov 8.

The estimate has been unchanged over the past 30 days. The company had reported a loss per share of 1 cent in the third quarter of 2022.

Q2 Results

In the last reported quarter, Denison Mine reported a year-over-year decline in revenues. The company reported break-even earnings per share in the second quarter of 2023 against the loss per share of 2 cents in the second quarter of 2022. The Zacks Consensus Estimate for the second quarter was a loss of 1 cent per share.

Denison Mine’s earnings have outpaced the consensus estimate in three of the trailing four quarters while coming in line in one quarter, the average surprise being 75%.

Denison Mine Corp Price and EPS Surprise

Denison Mine Corp price-eps-surprise | Denison Mine Corp Quote

Factors to Note

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. It has a 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure-rich eastern portion of the Athabasca Basin region of northern Saskatchewan.

Denison holds a 22.5% ownership interest in the MLJV (a joint venture with Orano Canada) and the McClean Lake uranium mill, one of the world’s largest uranium processing facilities, which is contracted to process ore from the Cigar Lake mine under a toll milling agreement.

In the second quarter of 2023, the McClean Lake mill processed 3.8 million pounds of uranium, down compared with 5.4 million in the second quarter of 2022. Denison recorded toll milling revenues of $0.97 million in the second quarter of 2023 compared with $1.5 million in the year-ago quarter. The decrease in toll milling in the current quarter is due to the mill processing fewer pounds of uranium for the Cigar Lake Joint Venture. Notably, the company’s toll milling revenues fluctuate due to the timing of uranium processing at the McClean Lake mill, as well as changes to the estimated mineral resources of the Cigar Lake mine.

Denison’s Closed Mines group has provided long-term care and maintenance for closed mine sites. It manages Denison’s Elliot Lake reclamation projects and provides related services for certain third-party projects. The company’s third-quarter revenues are likely to reflect the recent increase in care and maintenance activities at certain sites. However, the group is also expected to have witnessed an increase in labor and other costs due to this increased activity

The company has been witnessing higher general and administrative expenses, which comprise head office salaries and benefits, office costs in multiple regions, audit and regulatory costs, legal fees, investor relations expenses and project costs. Increases in compliance costs (stock exchange fees, audit fees, etc.), as well as increased travel costs associated with site visits to the Wheeler River FFT site, are also expected to have driven these costs higher. The company’s results in the third quarter are also likely to be impacted by exploration and evaluation costs.

What our Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for Denison Mine this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Denison Mine is 0.00%.

Zacks Rank: DNN currently carries a Zacks Rank of 2.

Price Performance

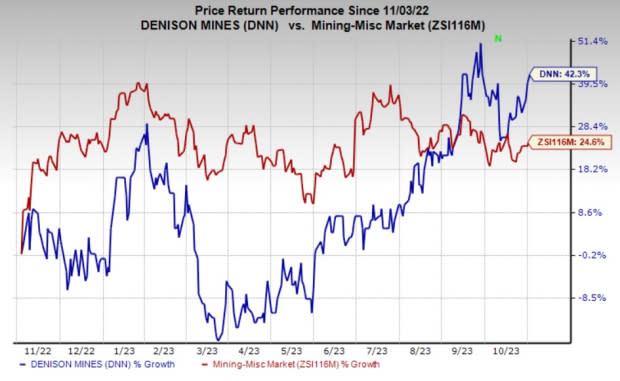

Denison Mine’s shares have gained 42.3% in the past year compared with the industry’s 24.6% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

LegalZoom.com LZ, slated to release earnings on Nov 7, has an Earnings ESP of +17.65% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Legal Zoom’s earnings for the third quarter is pegged at 9 cents per share. LZ has an average trailing four-quarter earnings surprise of 10.4%.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +2.96% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Kinross Gold’s earnings for the third quarter is pegged at 10 cents per share. The company has an average trailing four-quarter earnings surprise of 31.7%.

Innospec IOSP, scheduled to release earnings on Nov 7, currently has an Earnings ESP of +1.73% and a Zacks Rank of 3.

The Zacks Consensus Estimate for IOSP’s earnings for the third quarter is pegged at $1.45 per share. The company has an average trailing four-quarter earnings surprise of 7.2%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LegalZoom.com, Inc. (LZ) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report