Denison Mines (DNN): A Closer Look at its Overvaluation

Denison Mines Corp (DNN) has experienced a daily gain of 3.8% and a 3-month gain of 32.26%. Despite these positive trends, the company reported a Loss Per Share of 0.01. This raises the question: is Denison Mines (DNN) significantly overvalued? In this article, we will delve into an in-depth valuation analysis of Denison Mines (DNN) to answer this question. We encourage readers to follow along for a comprehensive understanding of the company's intrinsic value.

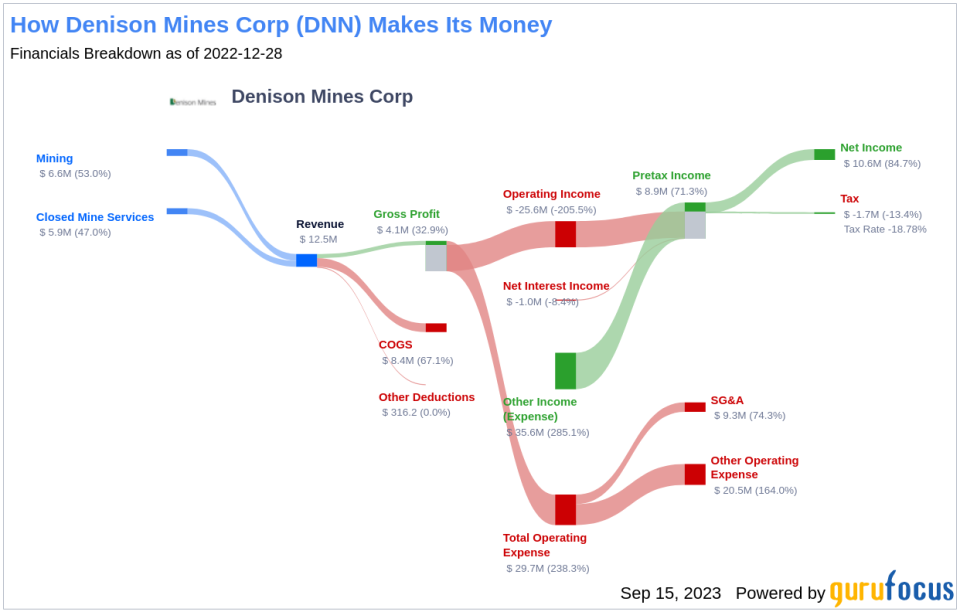

Company Overview

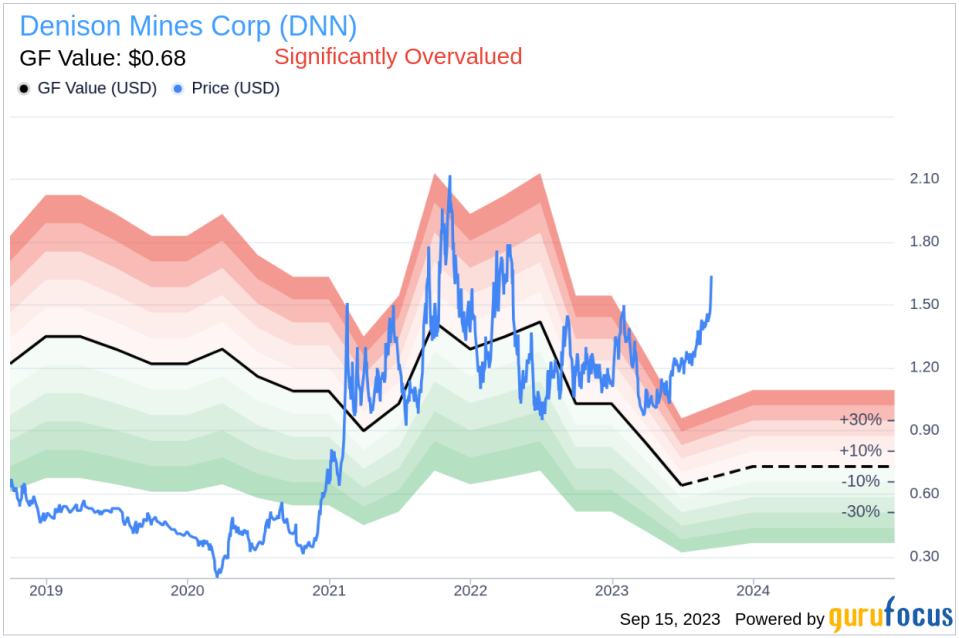

Denison Mines Corp is a uranium exploration and development company with a keen focus in the Athabasca Basin region of northern Saskatchewan, Canada. The company holds a 95% interest in the Wheeler River Uranium Project, the largest undeveloped uranium project in the infrastructure-rich eastern part of the Athabasca Basin region. In addition, Denison Mines is also involved in mine decommissioning and environmental services through its Closed Mines group. Currently, the company's stock price is $1.64, while its estimated fair value (GF Value) is $0.68, indicating a potential overvaluation.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, derived from historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. According to GuruFocus Value calculation, Denison Mines (DNN) is significantly overvalued. The company's current price of $1.64 per share and the market cap of $1.40 billion suggest a significant overvaluation. This overvaluation implies that the long-term return of Denison Mines stock is likely to be much lower than its future business growth.

Link: These companies may deliever higher future returns at reduced risk.

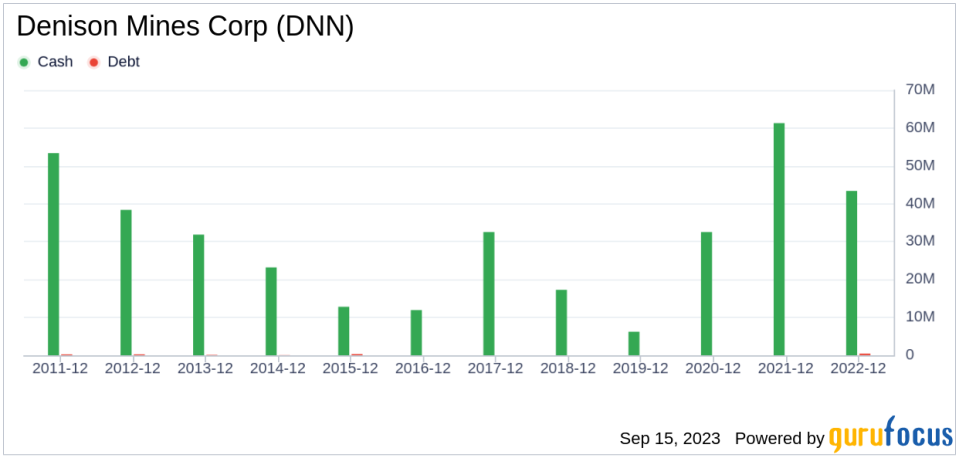

Financial Strength

Before investing, it is crucial to assess the financial strength of a company. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage offer valuable insights into a company's financial strength. Denison Mines boasts a cash-to-debt ratio of 106.97, outperforming 73.41% of 173 companies in the Other Energy Sources industry. This implies a strong financial position for Denison Mines.

Profitability and Growth

Investing in profitable companies, particularly those with consistent long-term profitability, is generally less risky. Denison Mines has been profitable 2 times over the past 10 years. However, its operating margin is -369.9%, ranking worse than 95.35% of companies in the Other Energy Sources industry. This indicates poor profitability.

Growth is a crucial factor in a company's valuation. A company's growth is closely correlated with the long-term performance of its stock. Unfortunately, Denison Mines's 3-year average revenue growth rate is worse than 90.83% of 120 companies in the Other Energy Sources industry, indicating poor growth.

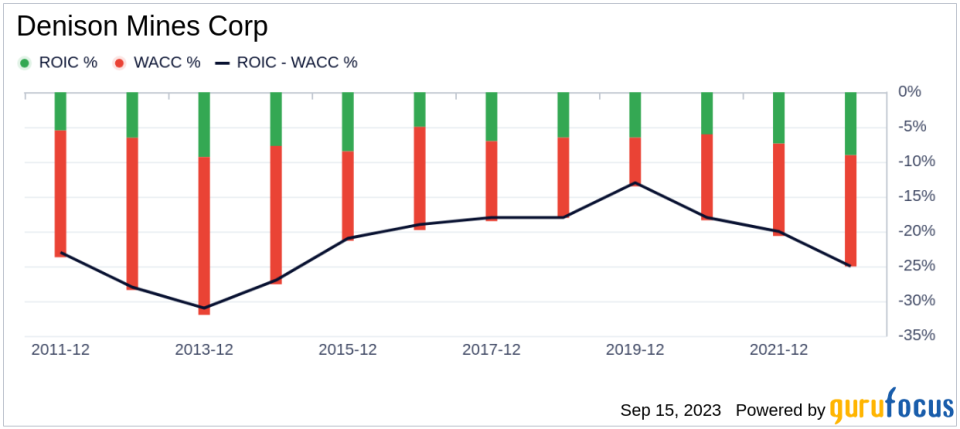

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Over the past 12 months, Denison Mines's ROIC was -7.38, while its WACC came in at 16.11, suggesting that the company is not creating value for shareholders.

Conclusion

In conclusion, Denison Mines (DNN) is significantly overvalued. Despite its strong financial condition, its profitability is poor, and its growth ranks worse than 0% of 138 companies in the Other Energy Sources industry. To learn more about Denison Mines stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.