Denison Mines (DNN)'s True Worth: A Complete Analysis of Its Market Value

Denison Mines Corp (DNN) has recently seen a daily gain of 3.06%, and a 3-month gain of 41.53%. Despite this positive trajectory, the company reported a Loss Per Share of $0.01. This raises a question: Is the stock significantly overvalued? This article aims to answer this question through a comprehensive valuation analysis of Denison Mines. Let's delve into the details.

Company Introduction

Denison Mines Corp is a uranium exploration and development company with interests primarily in the Athabasca Basin region of northern Saskatchewan, Canada. The company's flagship Wheeler River Uranium Project is the largest undeveloped uranium project in the infrastructure-rich eastern portion of the Athabasca Basin region. Denison Mines is also engaged in mine decommissioning and environmental services through its Closed Mines group, which manages its Elliot Lake reclamation projects and provides third-party post-closure mine care and maintenance services.

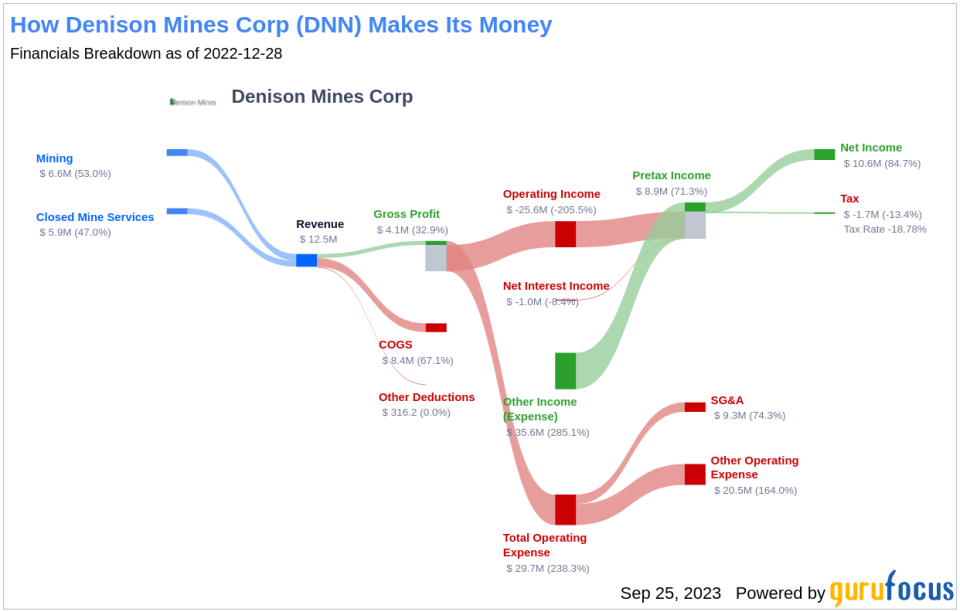

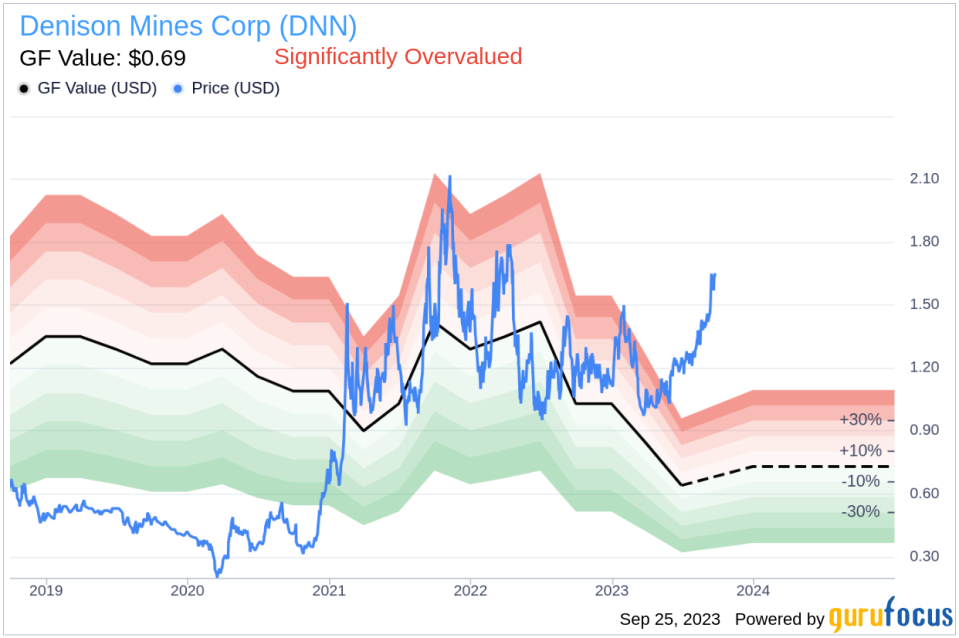

Currently, Denison Mines Corp (DNN) has a stock price of $1.68, contrasting with its GF Value of $0.69, suggesting that the stock could be significantly overvalued. To understand this further, let's take a look at the company's income breakdown:

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is considered overvalued, indicating potentially poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it is undervalued, suggesting potentially higher future returns.

For Denison Mines (DNN), the stock appears to be significantly overvalued according to the GF Value. With a market cap of $1.40 billion and a stock price of $1.68 per share, the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength Analysis

The financial strength of a company is a crucial factor to consider to avoid the risk of permanent capital loss. Denison Mines has a cash-to-debt ratio of 106.97, which ranks better than 72.73% of 176 companies in the Other Energy Sources industry. The overall financial strength of Denison Mines is 8 out of 10, indicating strong financial health.

Profitability and Growth

Denison Mines' profitability and growth are key factors in assessing its valuation. Despite being profitable in 2 out of the past 10 years, the company's operating margin of -369.9% ranks worse than 95.35% of its industry peers. Furthermore, Denison Mines' 3-year average revenue growth rate is worse than 90.83% of 120 companies in the Other Energy Sources industry.

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to assess its profitability. Over the past 12 months, Denison Mines' ROIC was -7.38, while its WACC came in at 16.11, suggesting that the company may not be creating value for shareholders.

Conclusion

In conclusion, Denison Mines (DNN) appears to be significantly overvalued. Despite the company's strong financial condition, its profitability and growth are poor, ranking worse than most companies in the Other Energy Sources industry. For more details about Denison Mines stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.