Denny's Corp (DENN) Reports Mixed Results for Q4 and Full Year 2023

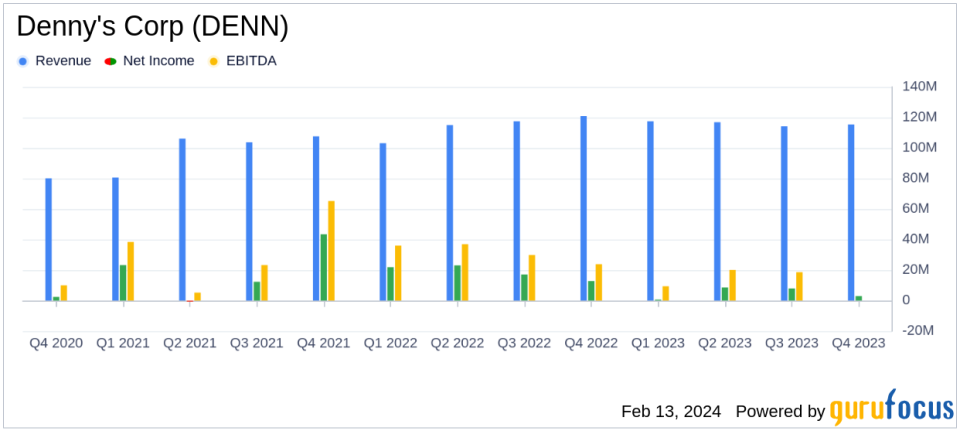

Revenue: Q4 operating revenue decreased to $115.4 million from $120.8 million in the prior year quarter.

Net Income: Full year net income dropped to $19.9 million from $74.7 million in the previous year.

Same-Restaurant Sales: Domestic system-wide same-restaurant sales increased by 1.3% in Q4 and 3.6% for the full year.

Operating Margins: Franchise Operating Margin improved to 51.4%, while Company Restaurant Operating Margin decreased to 10.0% in Q4.

Stock Repurchase: Denny's repurchased $16.2 million of common stock in Q4, totaling $52.1 million for the full year.

Adjusted EBITDA: Adjusted EBITDA for the full year was $81.5 million, compared to $77.5 million in the prior year.

Store Openings and Remodels: Opened 32 franchised restaurants and completed 22 remodels in 2023.

Denny's Corp (NASDAQ:DENN) released its 8-K filing on February 13, 2024, detailing its financial performance for the fourth quarter and full year ended December 27, 2023. As one of America's largest franchised full-service restaurant chains, Denny's Corp operates under the Denny's and Keke's brands, offering a variety of breakfast, appetizers, sandwiches, and other menu items. The company generates revenue through food and beverage sales and royalties and fees from its franchised restaurants.

In the fourth quarter, Denny's reported a slight increase in domestic system-wide same-restaurant sales, which CEO Kelli Valade attributed to strategic initiatives focused on breakfast offerings, value, and off-premises dining options. However, the company faced challenges, including a decrease in total operating revenue from $120.8 million in the prior year quarter to $115.4 million and a significant drop in net income to $2.9 million, or $0.05 per diluted share, compared to $12.8 million, or $0.22 per diluted share, in the prior year quarter.

The full year painted a similar picture, with total operating revenue increasing modestly from $456.4 million to $463.9 million, but net income falling to $19.9 million, or $0.35 per diluted share, from $74.7 million, or $1.23 per diluted share, in the previous year. The decline in net income was primarily due to a $6.7 million impairment loss and the absence of gains related to dedesignated interest rate swap valuation adjustments that were present in the prior year.

Financial Performance Analysis

Despite the challenges, Denny's achieved some financial successes. The Franchise Operating Margin improved to 51.4% of franchise and license revenue, up from 47.6% in the prior year quarter. This improvement was attributed to the completion of the kitchen modernization rollout during 2023. However, the Company Restaurant Operating Margin declined to 10.0% of company restaurant sales, down from 12.6% in the prior year quarter, primarily due to legal costs incurred in the current quarter.

Adjusted EBITDA for the full year was $81.5 million, a slight increase from $77.5 million in the prior year, indicating a measure of stability in the company's earnings before interest, taxes, depreciation, and amortization. Adjusted Free Cash Flow for the year was $44.7 million, demonstrating the company's ability to generate cash after accounting for capital expenditures.

Denny's aggressive share repurchase program saw the company buy back $16.2 million of its common stock in the fourth quarter, bringing the total for the year to $52.1 million. This reflects a commitment to returning value to shareholders and confidence in the company's financial position.

For the upcoming year, Denny's provided a business outlook that includes expectations of domestic system-wide same-restaurant sales between 0% and 3%, consolidated restaurant openings of 40 to 50, and a consolidated net decline of 10 to 20 locations. The company also anticipates commodity inflation between 0% and 2%, labor inflation between 4% and 5%, and total general and administrative expenses between $83 million and $86 million.

Value investors may find interest in Denny's Corp's solid franchise operating margins and ongoing share repurchases, despite the mixed performance in revenue and net income. The company's strategic focus on breakfast offerings and off-premises dining options, along with its remodeling initiatives, could position it for recovery and growth in the competitive restaurant industry.

For further details on Denny's Corp's financial performance, including the full earnings report and additional financial tables, please visit the SEC filing.

Explore the complete 8-K earnings release (here) from Denny's Corp for further details.

This article first appeared on GuruFocus.