Denny's (NASDAQ:DENN) Misses Q3 Sales Targets

Diner restaurant chain Denny’s (NASDAQ:DENN) fell short of analysts' expectations in Q3 FY2023, with revenue down 2.79% year on year to $114.2 million. Turning to EPS, Denny's made a non-GAAP profit of $0.17 per share, improving from its profit of $0.12 per share in the same quarter last year.

Is now the time to buy Denny's? Find out by accessing our full research report, it's free.

Denny's (DENN) Q3 FY2023 Highlights:

Revenue: $114.2 million vs analyst estimates of $116.9 million (2.29% miss)

EPS (non-GAAP): $0.17 vs analyst estimates of $0.15 (14.1% beat)

Free Cash Flow of $12 million, similar to the previous quarter

Gross Margin (GAAP): 33.7%, down from 36.5% in the same quarter last year

Same-Store Sales were up 1.8% year on year

Store Locations: 1,644 at quarter end, decreasing by 22 over the last 12 months

Kelli Valade, Chief Executive Officer, stated, "We were pleased to have generated a 1.8% increase in Denny’s domestic system-wide same-restaurant sales** and 15.5% growth in Adjusted EBITDA* during the third quarter. Despite a persistently challenging operating environment, we remain laser-focused on providing best-in-class breakfast, an unbeatable value proposition, and convenience through off-premises options”.

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Denny's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

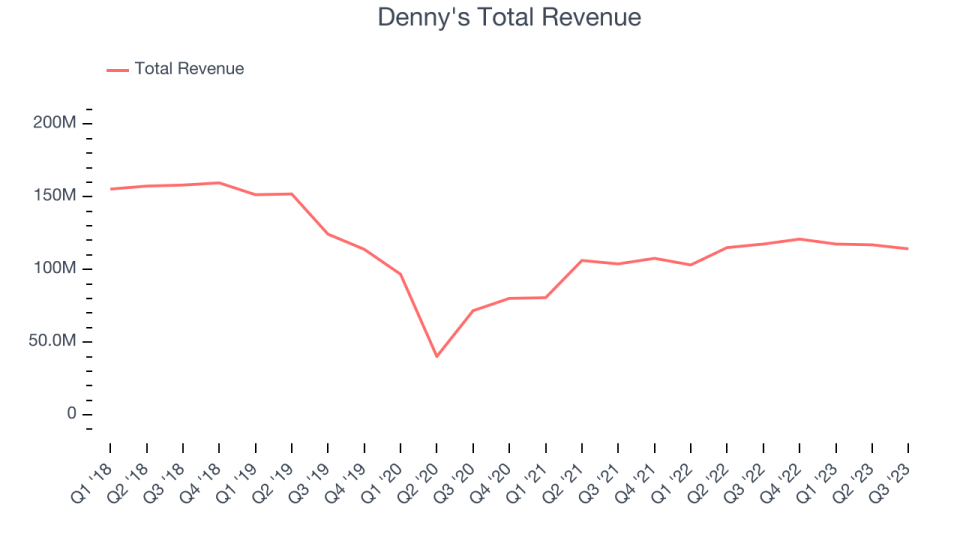

As you can see below, the company's revenue has declined over the last four years, dropping 5.44% annually as it didn't open many new restaurants.

This quarter, Denny's reported a rather uninspiring 2.79% year-on-year revenue decline, missing analysts' expectations. Looking ahead, the analysts covering the company expect sales to grow 3.17% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

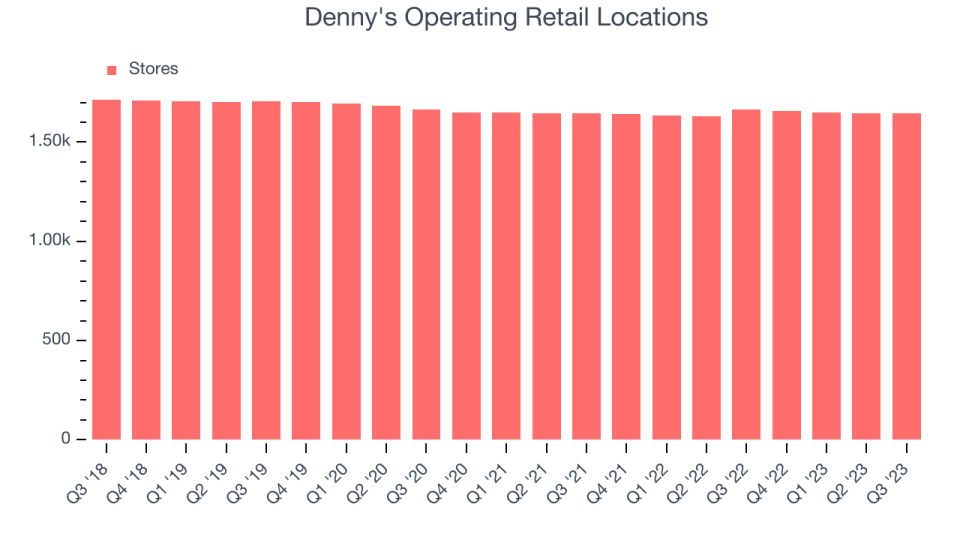

When a chain like Denny's doesn't open many new restaurants, it usually means there's stable demand for its meals and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Denny's operated 1,644 total locations, in line with its restaurant count 12 months ago.

Taking a step back, Denny's has kept its locations more or less flat over the last two years compared to other restaurant businesses. A flat restaurant base means Denny's needs to boost foot traffic and turn tables faster at existing restaurants or raise prices to generate revenue growth.

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

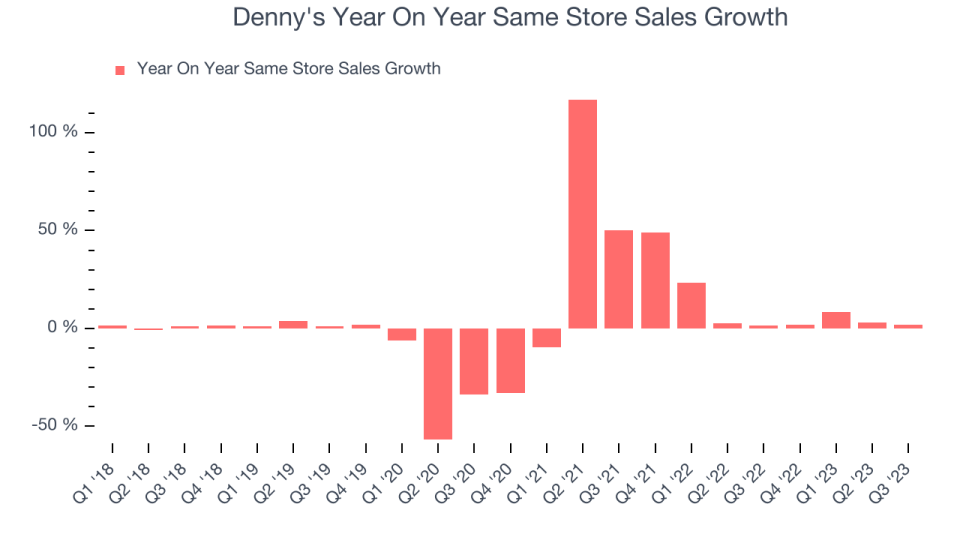

Denny's demand has outpaced the broader restaurant sector over the last eight quarters. On average, the company has grown its same-store sales by a robust 11.4% year on year. Given its flat restaurant base over the same period, this performance stems from increased foot traffic or larger order sizes per customer at existing locations.

In the latest quarter, Denny's same-store sales rose 1.8% year on year. This growth was an acceleration from the 1.5% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Denny's Q3 Results

Sporting a market capitalization of $472.6 million, Denny's is among smaller companies, but its more than $2.28 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was good to see Denny's beat analysts' EPS expectations this quarter. That really stood out as a positive in these results. On the other hand, its gross margin sadly missed analysts' expectations and its revenue missed Wall Street's estimates, driven by lower-than-expected same-store sales growth. Overall, the results could have been better. The stock is up 1.16% after reporting and currently trades at $8.75 per share.

Denny's may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.