Department of Justice Approves Cigna-Express Scripts Deal

- By Sydnee Gatewood

Clearing a major hurdle in the health care space's path to consolidation, Cigna Corp. (CI) announced on Monday its $52 billion acquisition of Express Scripts Holding Co. (ESRX) was approved by the U.S. Department of Justice, sending shares higher in after-hours trading.

Warning! GuruFocus has detected 3 Warning Signs with AVGO. Click here to check it out.

The intrinsic value of CI

By combining the Bloomfield, Connecticut-based health insurer and the St. Louis-based pharmacy benefits manager, Tim Wentworth, president and CEO of Express Scripts, said the companies hope to "transform" health care by reducing costs, expanding choice and improving patient outcomes.

Cigna President and CEO David Cordani echoed that sentiment, voicing his enthusiasm that the deal had been authorized.

"The value that we deliver together will help put our society on a far more sustainable path - one that helps health care professionals close gaps in care and supports our customers along their health journey," he said.

CNBC reported shareholders backed the deal last month despite opposition from activist investor Carl Icahn (Trades, Portfolio), who urged investors in an open letter to reject the proposed acquisition after it was announced in March. Now the deal only needs a seal of approval from state regulators. In a statement, the companies disclosed they have already been cleared by the departments of insurance in 16 states.

The transaction is expected to close by the end of the year.

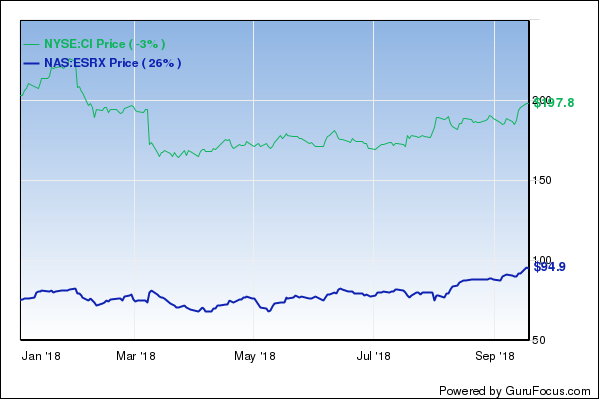

The stocks' rally carried over into Tuesday morning trading. Shares of Cigna were up 0.56% at $199 while Express Scripts shares rose 0.26% to $95.48. Year to date, GuruFocus estimates Cigna has fallen 3% while Express Scripts has climbed 26%.

Shares of CVS Health Corp. (CVS) and Aetna Inc. (AET), who also have a pending merger deal, traded higher on Tuesday morning as well. Approval of their deal has been delayed, but CNBC said it could receive a ruling later this month.

Disclosure: No positions.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with AVGO. Click here to check it out.

The intrinsic value of CI