Department Store Stocks Q3 Highlights: Nordstrom (NYSE:JWN)

Looking back on department store stocks' Q3 earnings, we examine this quarter's best and worst performers, including Nordstrom (NYSE:JWN) and its peers.

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

The 4 department store stocks we track reported an impressive Q3; on average, revenues beat analyst consensus estimates by 0.8% Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but department store stocks held their ground better than others, with the share prices up 20.8% on average since the previous earnings results.

Weakest Q3: Nordstrom (NYSE:JWN)

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE:JWN) is a high-end department store chain.

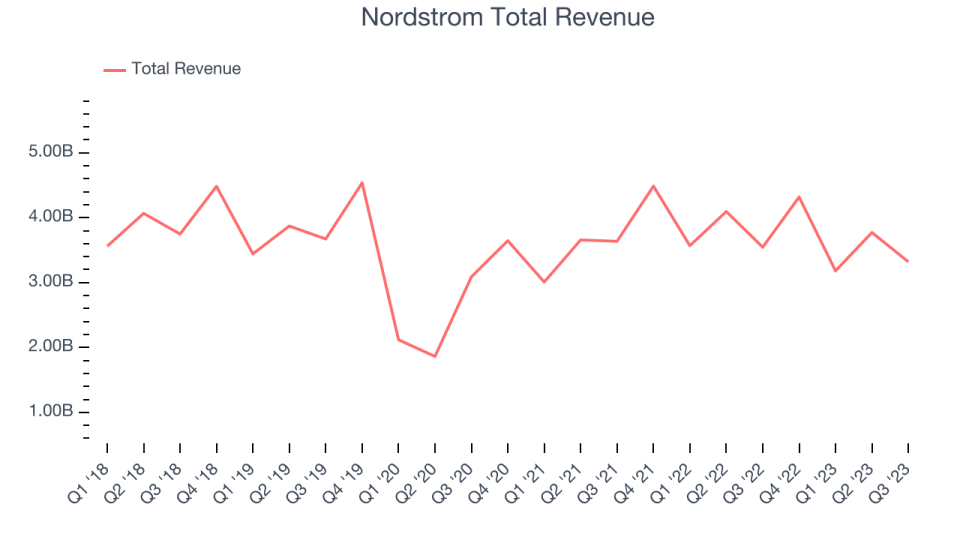

Nordstrom reported revenues of $3.32 billion, down 6.4% year on year, falling short of analyst expectations by 2.9%. It was a weak quarter for the company, with a miss beat of analysts' revenue estimates.

"In the third quarter we continued to make progress against our priorities, and we're especially pleased with the resulting improvements in gross margin and earnings," said Erik Nordstrom, chief executive officer of Nordstrom,

Nordstrom delivered the weakest performance against analyst estimates of the whole group. The stock is up 18.4% since the results and currently trades at $17.66.

Is now the time to buy Nordstrom? Access our full analysis of the earnings results here, it's free.

Best Q3: Macy's (NYSE:M)

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

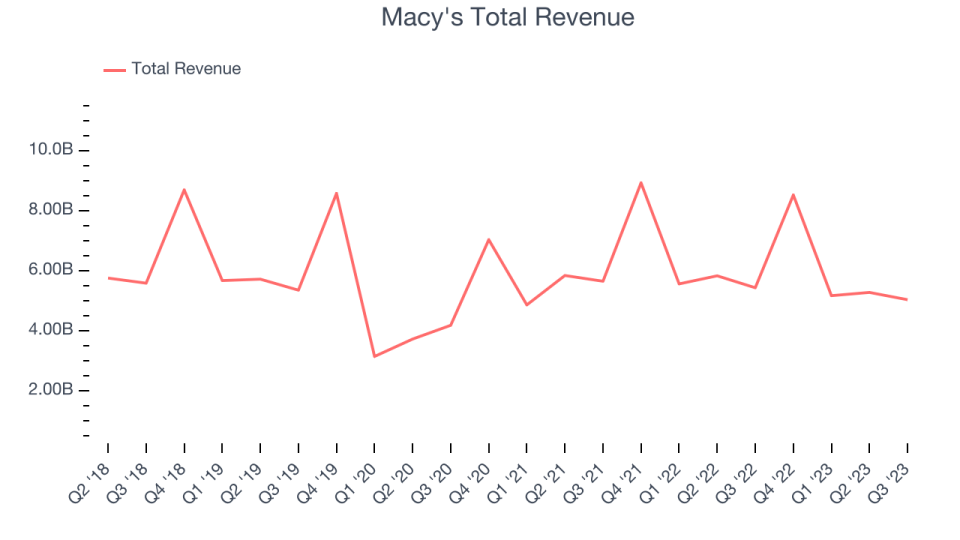

Macy's reported revenues of $5.04 billion, down 7.3% year on year, outperforming analyst expectations by 4.4%. It was an exceptional quarter for the company, with a solid beat of analysts' earnings and revenue estimates.

Macy's achieved the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 42% since the results and currently trades at $17.91.

Is now the time to buy Macy's? Access our full analysis of the earnings results here, it's free.

Dillard's (NYSE:DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $1.50 billion, down 4.4% year on year, falling short of analyst expectations by 1%. It was a mixed quarter for the company. Same store sales missed fairly meaningfully, leading to a revenue miss. On the other hand, gross margin was better than expectations and operating expenses were lower than expected though, allowing for operating profit and EPS to beat.

Dillard's pulled off the fastest revenue growth in the group. The stock is up 24.1% since the results and currently trades at $383.

Read our full analysis of Dillard's's results here.

Kohl's (NYSE:KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $4.05 billion, down 5.2% year on year, surpassing analyst expectations by 2.7%. It was a mixed quarter for the company. While same-store sales and net sales (excluding credit card operations revenue) missed expectations, gross margin and expense control was better, leading to a nice EPS beat vs. analysts' expectations. Guidance was also mixed, with the full year outlook lowered for same-store sales but raised for EPS.

The stock is down 1.4% since the results and currently trades at $24.5.

Read our full, actionable report on Kohl's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned