An In-Depth Look at Pool Corp (POOL): A Modestly Undervalued Gem

On July 25, 2023, Pool Corp (NASDAQ:POOL) saw a gain of 3.14%, with its stock price rising to $376.61. With a market cap of $14.7 billion, the company's GF Value stands at $517.5, suggesting that the stock is modestly undervalued. Pool's Earnings Per Share (EPS) come in at $15.09, while its sales reach $5.8 billion.

Pool Corp is a leading distributor of swimming pool supplies and related products. Selling both national-brand and private-label items to approximately 120,000 customers, Pool's offerings range from non-discretionary pool-maintenance products like chemicals and replacement parts to pool equipment such as packaged pools, cleaners, filters, heaters, pumps, and lights. Its diverse customer base includes pool builders and remodelers, independent retail stores, and pool repair and service companies.

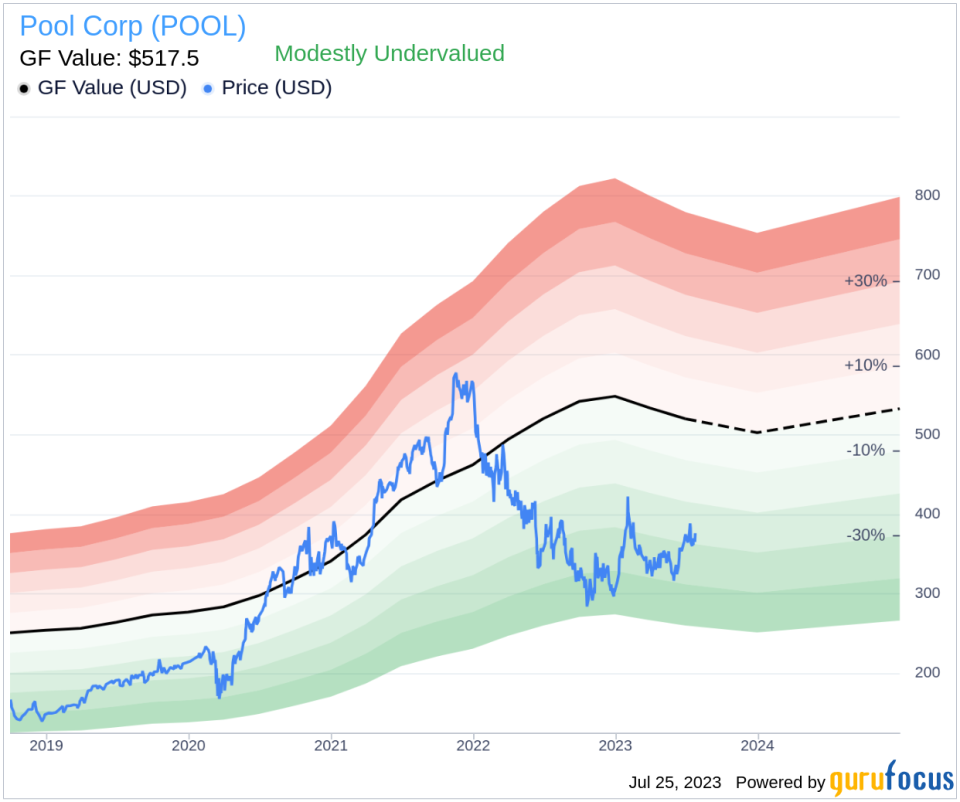

Understanding Pool Corp's GF Value

The GF Value of Pool Corp (NASDAQ:POOL) is a unique indicator of the company's intrinsic worth. This estimation is based on historical trading multiples, an adjustment factor from GuruFocus considering past performance and growth, and projections of future business performance. Pool's current price of $376.61 per share suggests that the stock is modestly undervalued. Given this, the long-term return of Pool's stock is likely to exceed its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength and Profitability

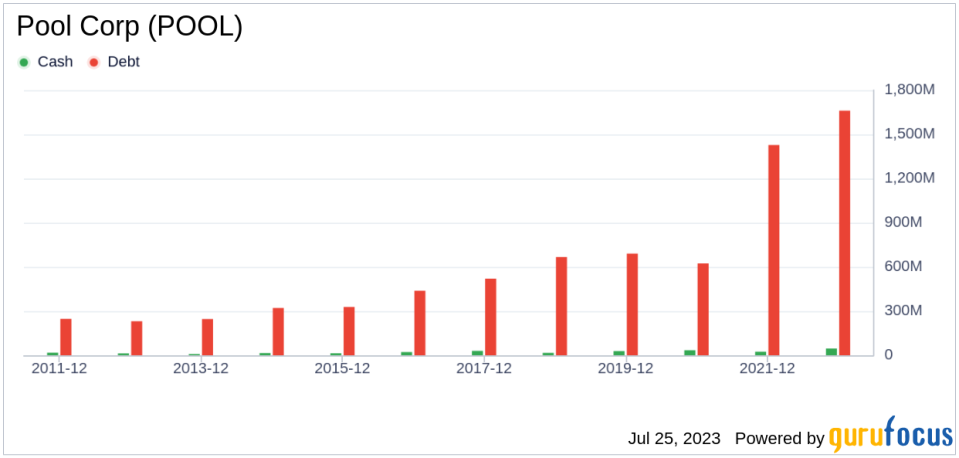

Investing in companies with robust financial strength can mitigate the risk of capital loss. Pool's cash-to-debt ratio stands at 0.04, ranking lower than 91.16% of companies in the Industrial Distribution industry. Despite this, GuruFocus rates Pool's financial strength as 6 out of 10, indicating a fairly strong balanced sheet.

Pool has maintained profitability for ten years, with an operating margin of 14.62% that surpasses 91.39% of companies in the Industrial Distribution industry. The company's 3-year average annual revenue growth rate is 25.6%, better than 88.97% of companies in the industry. The 3-year average EBITDA growth rate is 43.4%, outperforming 84.5% of industrial distribution companies.

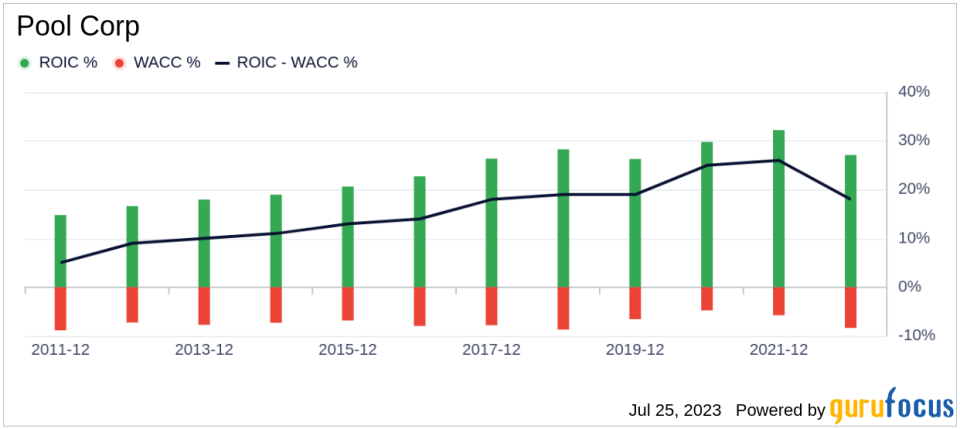

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) can provide insight into its profitability. Pool's ROIC was 21.28 over the past 12 months, while its WACC came in at 9.6. This indicates that Pool is creating value for shareholders.

Conclusion

In conclusion, Pool Corp (NASDAQ:POOL) appears to be a modestly undervalued investment opportunity. The company boasts a fair financial condition and strong profitability, with growth rates that outstrip 84.5% of companies in the Industrial Distribution industry. For more information about Pool stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.