Descartes sees ‘no end in sight’ for elevated supply chain investments

Supply chain software provider Descartes again reported record quarterly results, noting it is “picking up a bunch of business from competitors.”

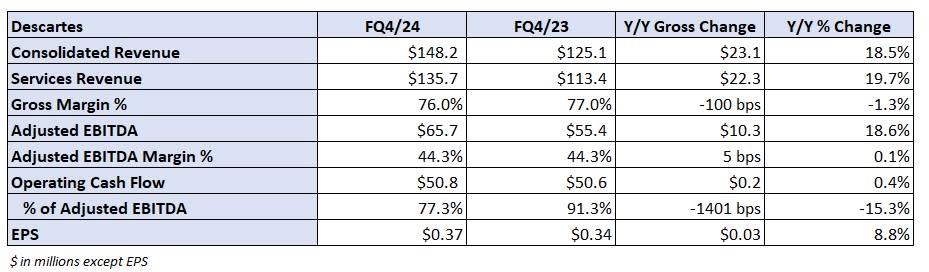

Descartes (NASDAQ: DSGX) reported consolidated revenue of $148.2 million, a 19% year-over-year (y/y) increase, for its 2024 fiscal fourth quarter ended Jan. 31. Services revenue was up 20% to $135.7 million. The period benefitted from prior acquisitions of final-mile solutions providers GroundCloud and Localz. Excluding the impact of those deals as well as changes in foreign exchanges rates, revenue was 10% higher on a same-store basis.

Earnings per share increased 3 cents y/y to 37 cents in the quarter.

“Complexity and change is a big growth driver for us in our business and I think that’s why you’ve seen us outperform the logistics transportation market over the last year,” CEO Ed Ryan told analysts on a Wednesday evening call.

He said multiple conflicts across the globe have put more companies on sanctioned parties’ lists. There have also been numerous changes in tariffs and duties, providing additional growth opportunities as operators seek best-in-class platforms to ensure trade compliance.

“During tough times I think people tend to flock to a safe and reliable source,” Ryan said.

The Canada-based company reported adjusted earnings before interest, taxes, depreciation and amortization of $65.7 million, a 19% y/y increase. For fiscal full year 2024 adjusted EBITDA was $247.5 million, 15% higher y/y.

Looking forward, the company forecast revenue of $130.5 million and adjusted EBITDA of $49.5 million for its fiscal first quarter ending Apr. 30.

“The whole world has realized that supply chain and logistics is more important … the first place they [make] investments is into technology because it gives them the fastest return on investment and it’s the most visible for their customers,” Ryan continued. “I see no end in sight to that.”

The company generated $50.8 million in cash flow from operations in the quarter. The result included a $12.6 million negative impact from higher-than-expected earnout payments on past acquisitions.

Descartes ended the quarter with $321 million in cash and an untapped $350 million line of credit.

More FreightWaves articles by Todd Maiden

The post Descartes sees ‘no end in sight’ for elevated supply chain investments appeared first on FreightWaves.