Designer Brands (DBI) Q3 Earnings Lag Estimates, Comps Dip Y/Y

Designer Brands Inc. DBI released third-quarter fiscal 2023 results, wherein the top and bottom lines missed the Zacks Consensus Estimate. Also, both metrics declined year over year.

Designer Brands recently faced challenges due to a contracting footwear market, the first such decline since the pandemic, combined with unseasonably warm weather. This situation led to a significant reduction in customer demand for shoes, impacting the company's seasonal assortments.

Nonetheless, the company registered decent performances in casual and clearance categories. However, these improvements failed to mitigate the impacts of a broader decrease in demand. The company is actively working to overcome these challenges. It is refreshing product assortment with new specialty sizes and undertaking new marketing strategies.

Designer Brands Inc. Price, Consensus and EPS Surprise

Designer Brands Inc. price-consensus-eps-surprise-chart | Designer Brands Inc. Quote

Let’s Delve Deeper

Designer Brands reported fiscal third-quarter adjusted earnings of 24 cents per share, which missed the Zacks Consensus Estimate of 44 cents. The reported number declined sharply from earnings of 67 cents a share in the year-ago period.

Net sales were $786.3 million, down 9.1% year over year. The top line missed the Zacks Consensus Estimate of $822 million. Also, comparable sales (comps) decreased 9.3% year over year in the fiscal third quarter against an increase of 3% in the year-ago period. The Zacks Consensus Estimate for the metric was a decline of 4.4%.

Gross profit amounted to $256.4 million, down 10.3% from the $285.8 million reported in the year-ago quarter. The gross margin contracted 40 bps to 32.6% from the prior-year period.

Adjusted operating expenses increased 2.9% to $227.5 million. As a percentage of net revenues, adjusted operating expenses increased 340 bps to 28.9% in the third quarter of fiscal 2023.

Adjusted operating profit decreased 53.2% to $31.4 million. As a percentage of net revenues, adjusted operating profit decreased 380 bps to 4% in the third quarter of fiscal 2023.

Image Source: Zacks Investment Research

Segmental Details

U.S. Retail: Sales of $631.6 million decreased 10.6% year over year. The figure missed the Zacks Consensus Estimate of $668 million.

Canada Retail: This segment’s sales of $75.6 million declined 8.1% year over year. The figure missed the Zacks Consensus Estimate of $82 million.

Brand Portfolio: Sales of $94.1 million decreased 12.5% year over year. The figure lagged the Zacks Consensus Estimate of $118 million.

Other Financial Details

This Zacks Rank #4 (Sell) company ended the quarter with a debt of $375.5 million, and cash and cash equivalents of $54.6 million, with $213.3 million available for borrowings under its senior secured asset-based revolving credit facility and $85 million available for borrowings under its new senior secured term-loan credit agreement. Total stockholders' equity was $387.6 million at the end of the quarter under review.

Store Update

In the fiscal third quarter, the company opened one store in the United States and six stores in Canada, resulting in 499 U.S. stores and 144 Canada stores as of Oct 28, 2023.

FY23 Guidance

For fiscal 2023, Designer Brands anticipates net sales (excluding Keds) to be down in the high-single digits. Incremental net sales from the acquisition of Keds are expected to be $60-$70 million.

The company’s earnings per share, excluding Keds, are envisioned to be 40-70 cents per share.

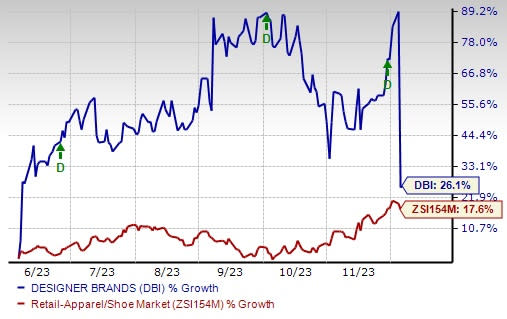

Shares of this company have risen 26.1% in the past six months compared with the industry's growth of 17.6%.

Stocks to Consider

A few better-ranked stocks are Abercrombie & Fitch Co. ANF, Deckers Outdoor Corporation DECK and Skechers U.S.A., Inc. SKX.

Abercrombie & Fitch operates as a specialty retailer of premium, high-quality casual apparel. It currently sports a Zacks Rank #1 (Strong Buy). The company reported an EPS surprise of 60.5% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales suggests growth of 12.8% from the year-ago reported numbers. ANF has a trailing four-quarter earnings surprise of 713%, on average.

Deckers is a leading designer, producer and brand manager of innovative, niche footwear and accessories developed for outdoor sports and other lifestyle-related activities. It has a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Deckers’s current fiscal-year sales and earnings suggests growth of 11.4% and 20.9%, respectively, from the year-ago reported numbers. DECK has a trailing four-quarter earnings surprise of 26.3%, on average.

Skechers U.S.A. designs, develops, markets and distributes footwear. It currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Skechers’ current financial-year earnings and sales indicates growth of 44.5% and 8.2%, respectively, from the previous year’s reported numbers. SKX has a trailing four-quarter average earnings surprise of 50.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report