Designer Brands Inc. Navigates Challenging Year with Strategic Focus on Growth

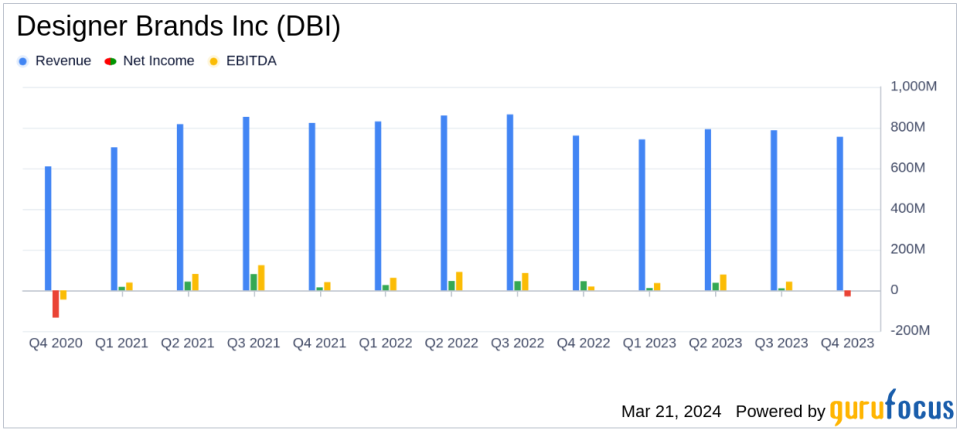

Net Sales: Q4 net sales slightly down by 0.8% to $754.3 million; FY net sales decreased by 7.3% to $3.1 billion.

Comparable Sales: Q4 total comparable sales fell by 7.3%; FY total comparable sales dropped by 9.0%.

Gross Margin: Q4 gross margin declined to 27.5%; FY gross margin decreased to 31.7%.

Net Income/Loss: Q4 reported a net loss of $29.7 million; FY net income stood at $29.1 million.

Diluted EPS: Q4 adjusted net loss per diluted share was $0.44; FY adjusted diluted EPS was $0.68.

Liquidity: Cash and cash equivalents totaled $49.2 million at the end of 2023.

Shareholder Returns: Repurchased 9.7 million shares and announced a dividend of $0.05 per share.

On March 21, 2024, Designer Brands Inc (NYSE:DBI) released its 8-K filing, detailing its financial performance for the fourth quarter and fiscal year 2023. The company, a prominent designer, producer, and retailer of footwear and accessories, operates through its U.S. and Canada Retail segments, as well as its Brand Portfolio segment, which includes the recently acquired Keds and launched Le Tigre brands.

Financial Performance and Challenges

DBI's fourth quarter saw a slight decrease in net sales and a more pronounced drop in comparable sales, reflecting a challenging retail environment marked by promotional pressures and unseasonably warm weather impacting seasonal footwear sales. Gross profit and margin also saw reductions, contributing to a net loss for the quarter. However, the full year results delivered an EPS at the high end of the guidance range, suggesting resilience amidst the challenges.

CEO Doug Howe emphasized the company's focus on returning to growth in 2024, with plans to refresh product assortments, enhance the shopping experience, and execute operational improvements. These initiatives, along with cost-saving measures, are expected to drive improved financial performance and strong cash flow generation.

Financial Achievements and Outlook

Despite the downturn in sales and profitability, DBI demonstrated financial discipline by ending the year with a solid cash position and available credit. The company also returned value to shareholders through share repurchases and dividends. Looking forward, DBI has issued guidance for low-single-digit net sales growth and a diluted EPS range of $0.70 to $0.80 for fiscal 2024, indicating a cautious but optimistic outlook for recovery.

Key Financial Metrics

DBI's balance sheet reflects a cautious liquidity position, with a slight decrease in cash and cash equivalents and an increase in debt compared to the previous year. Operating cash flow remained strong, although it saw a decrease from the prior year. Inventory levels were managed down from the end of 2022, which could be indicative of efforts to align stock levels with expected demand.

"We are laser focused on assembling a fresher and more trend-right assortment for our customers, providing an increasingly convenient shopping experience across our channels and executing on operational improvements in our brands business bolstered by our new hires," stated Doug Howe, CEO of Designer Brands.

Analysis of Company's Performance

DBI's performance in fiscal 2023 reflects the broader challenges faced by the retail sector, including a softening footwear market and competitive pressures. The company's strategic acquisitions and brand launches within its Brand Portfolio segment suggest a forward-looking approach to diversifying its offerings and strengthening its market position. The company's commitment to shareholder returns, even in a challenging year, underscores its confidence in long-term strategies and financial health.

As Designer Brands Inc (NYSE:DBI) looks to the future, investors and stakeholders will be watching closely to see if the company's strategic initiatives can overcome the headwinds faced in 2023 and lead to a return to growth in the coming year.

For more detailed insights and analysis, visit GuruFocus.com, where value investors can find comprehensive financial data and expert commentary on DBI and other companies in the Manufacturing - Apparel & Accessories industry.

Contact information for further inquiries and investor relations can be found on the company's website, ensuring stakeholders have access to timely updates and developments.

Explore the complete 8-K earnings release (here) from Designer Brands Inc for further details.

This article first appeared on GuruFocus.