Designer Brands (NYSE:DBI) Misses Q3 Revenue Estimates, Stock Drops 22%

Footwear and accessories discount retailer Designer Brands (NYSE:DBI) missed analysts' expectations in Q3 FY2023, with revenue down 9.1% year on year to $786.3 million. It made a GAAP profit of $0.17 per share, down from its profit of $0.67 per share in the same quarter last year.

Is now the time to buy Designer Brands? Find out by accessing our full research report, it's free.

Designer Brands (DBI) Q3 FY2023 Highlights:

Revenue: $786.3 million vs analyst estimates of $822.8 million (4.4% miss)

EPS: $0.17 vs analyst estimates of $0.43 (-$0.26 miss)

Full year guidance lowered across the board, with huge EPS outlook cut (well below Consensus)

Gross Margin (GAAP): 32.6%, down from 33% in the same quarter last year

Same-Store Sales were down 9.3% year on year (big miss vs. expectations of down 3.6% year on year)

Store Locations: 643 at quarter end, increasing by 1 over the last 12 months

"This quarter, we were impacted by a footwear market that contracted for the first time since COVID coupled with unseasonably warm weather, which significantly reduced customer demand for shoes and pressured our heavily seasonal assortment," stated Doug Howe, Chief Executive Officer.

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

Designer Brands is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

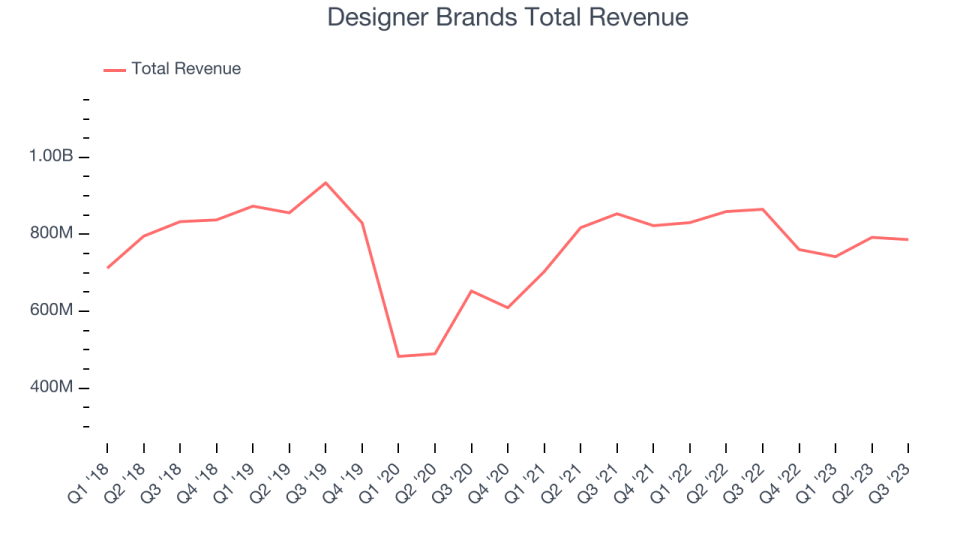

As you can see below, the company's revenue has declined over the last four years, dropping 3.1% annually as its store count shrunk.

This quarter, Designer Brands reported a rather uninspiring 9.1% year-on-year revenue decline, missing Wall Street's expectations. Looking ahead, analysts expect sales to grow 2.4% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

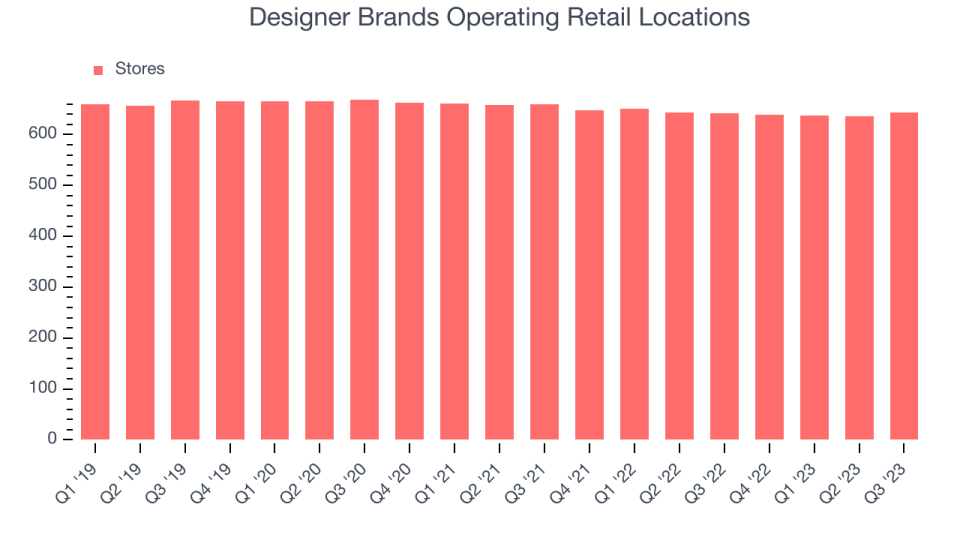

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like Designer Brands is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. At the end of this quarter, Designer Brands operated 643 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 1.6% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

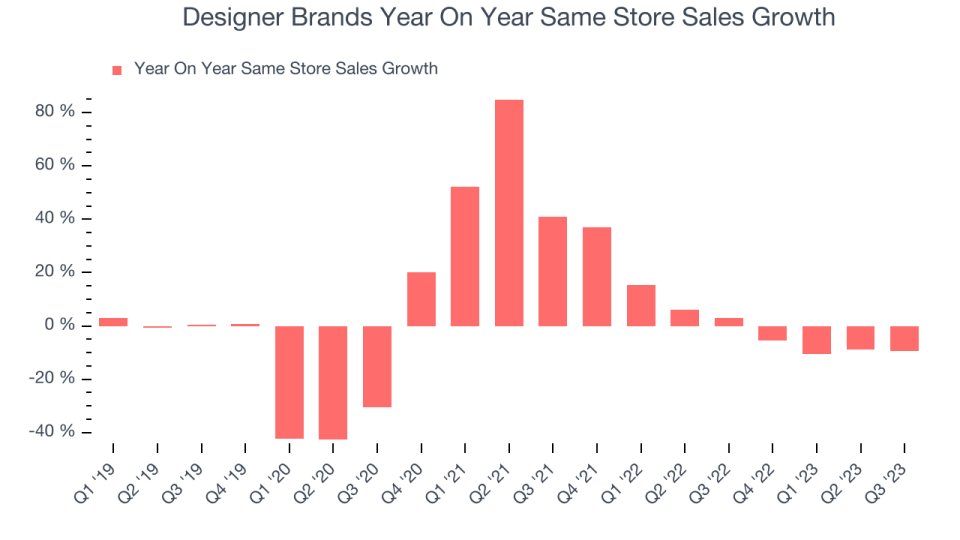

Designer Brands's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 3.4% year on year. Given its declining store count over the same period, this performance stems from higher e-commerce sales or increased foot traffic at existing stores, which is sometimes a side effect of reducing the total number of stores.

In the latest quarter, Designer Brands's same-store sales fell 9.3% year on year. This decline was a reversal from the 3% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Designer Brands's Q3 Results

With a market capitalization of $744.7 million and more than $54.64 million in cash on hand, Designer Brands can continue prioritizing growth.

We struggled to find many strong positives in these results. Its full-year earnings forecast underwhelmed and its revenue missed Wall Street's estimates, driven by a huge same-store sales decrease which greatly underperformed expectations. The commentary was just as bad as the results. Management said that "footwear market that contracted for the first time since COVID coupled with unseasonably warm weather, which significantly reduced customer demand for shoes and pressured our heavily seasonal assortment" and doesn't anticipate that these headwinds will ease. Overall, the results could have been better. The company is down 22% on the results and currently trades at $10 per share.

Designer Brands may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.