Desktop Metal Inc Reports Record Recurring Revenue Despite Market Challenges

Recurring Revenue: Achieved a record $65 million, a 29% increase year-over-year.

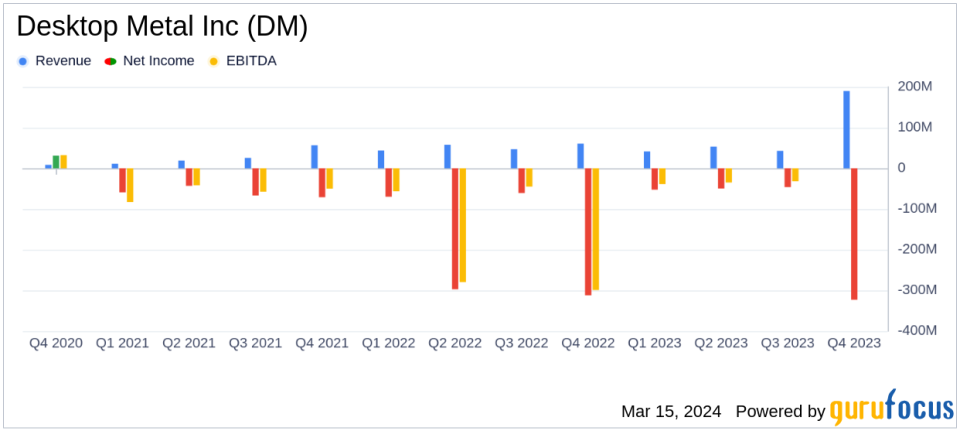

Net Loss: Reduced net loss to $323.3 million for the year ended December 31, 2023.

Adjusted EBITDA: Recorded a record performance, despite not meeting the A-EBITDA positive target.

Cost Structure: Implemented a lower cost structure to enhance long-term resilience.

Balance Sheet: Ended the year with $83.8 million in cash and cash equivalents.

Operational Challenges: Faced a challenging capital investment environment with elevated interest rates and slower sales cycles.

On March 15, 2024, Desktop Metal Inc (NYSE:DM), a leader in additive manufacturing technologies, released its fourth quarter and full year 2023 financial results through an 8-K filing. Despite the challenging economic environment, the company reported significant strides in its operating performance, including a reduction in net loss and a record adjusted EBITDA.

Company Overview

Desktop Metal Inc is at the forefront of the 3D printing industry, focusing on making metal and carbon fiber 3D printing widely accessible. The company's innovative solutions cater to a variety of industries, including automotive, consumer goods, and industrial equipment manufacturing. With a global footprint, Desktop Metal serves markets across the Americas, EMEA, and APAC regions.

Financial Performance and Challenges

For the full year, Desktop Metal reported a net loss of $323.3 million, an improvement from the previous year's loss of $740.3 million. The company's focus on operational efficiency is evident in its reduced net loss and record adjusted EBITDA performance. However, the company did not achieve its internal target of A-EBITDA positivity by year-end, attributing the shortfall to customer projects rolling into 2024. CEO Ric Fulop expressed confidence in reaching profitability, citing strong demand for production binder jet systems and the increasing value of Additive Manufacturing 2.0 systems.

Despite the progress, Desktop Metal faced a challenging capital investment environment characterized by elevated interest rates and slower sales cycles. These challenges underscore the importance of the company's strategic initiatives to lower its cost structure and enhance resilience in the face of market headwinds.

Financial Achievements

The company's record recurring revenue of $65 million, representing a 29% increase over the prior year, is a testament to the successful adoption and value of its technologies by customers. This recurring revenue now accounts for 34% of the company's total revenue, up from 24% in 2022. Such achievements are crucial for a hardware company like Desktop Metal, as they indicate a stable and growing customer base that is actively using and benefiting from its products and services.

Key Financial Metrics

Desktop Metal's financial health can be further assessed through its balance sheet and income statement. The company ended the year with $83.8 million in cash and cash equivalents, a slight increase from $76.3 million in the previous year. Total assets stood at $458 million, while total liabilities were $216.3 million, resulting in total stockholders' equity of $241.7 million.

Revenue for the year was $189.7 million, a decrease from $209 million in the previous year. The cost of sales outpaced revenue, leading to a gross loss of $10.1 million. Operating expenses, while still significant at $313.1 million, were reduced from the previous year's $746.8 million, reflecting the company's cost-saving measures and operational efficiencies.

"Our all-time high recurring revenue levels prove that customers who have adopted our technology are using it successfully and getting great value from our technologies," said Ric Fulop, Founder and CEO of Desktop Metal.

Analysis of Performance

Desktop Metal's efforts to streamline operations and focus on recurring revenue streams have begun to pay off, as evidenced by the improved financial metrics. The company's strategic pivot towards a more sustainable cost structure positions it well to navigate the uncertain economic landscape. However, the ongoing challenges in the capital investment environment and the need to achieve profitability remain critical areas for the company to address in the coming year.

For investors and stakeholders, the emphasis on recurring revenue and the reduction in net loss are positive indicators of Desktop Metal's potential for long-term growth and stability. The company's commitment to driving profitability, despite tough market conditions, will be a key factor to watch in 2024.

For more detailed information and analysis on Desktop Metal Inc's financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Desktop Metal Inc for further details.

This article first appeared on GuruFocus.