Despite delivering investors losses of 50% over the past 1 year, XP (NASDAQ:XP) has been growing its earnings

XP Inc. (NASDAQ:XP) shareholders should be happy to see the share price up 26% in the last week. But that doesn't change the fact that the returns over the last year have been disappointing. Like a receding glacier in a warming world, the share price has melted 50% in that period. It's not that amazing to see a bounce after a drop like that. Of course, it could be that the fall was overdone.

While the last year has been tough for XP shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for XP

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the XP share price fell, it actually saw its earnings per share (EPS) improve by 0.4%. It's quite possible that growth expectations may have been unreasonable in the past.

It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

XP managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

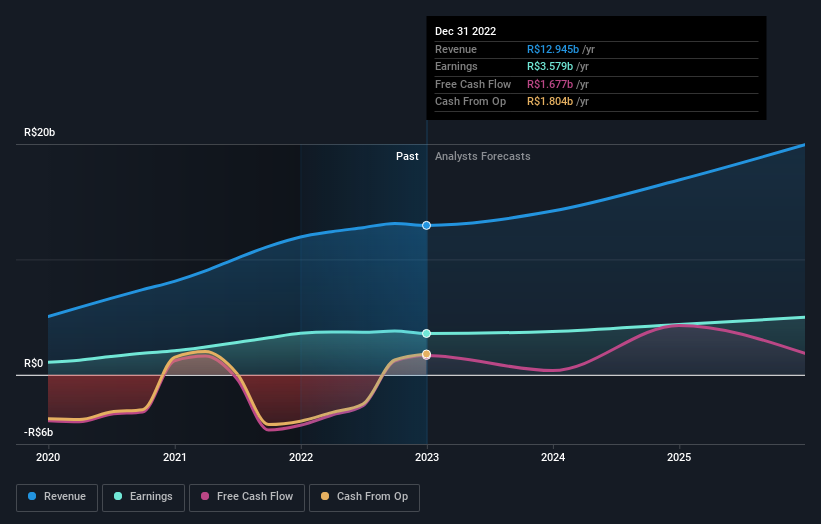

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that XP has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on XP's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for XP shares, which performed worse than the market, costing holders 50%. Meanwhile, the broader market slid about 6.1%, likely weighing on the stock. Shareholders have lost 14% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. Before forming an opinion on XP you might want to consider these 3 valuation metrics.

We will like XP better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here