Despite a Mixed 1st Quarter, Vail Resorts Has Favorable Trends Entering Peak Season

Will Americans make it a December to remember? All eyes are on the consumer following a very strong post-Thanksgiving shopping period and high travel volume trends throughout 2023. For winter ski enthusiasts, the focus shifts to what Mother Nature has in store. Forecasters predict a strong El Nino pattern across the continental U.S., which would mean warm and dry conditions for some of the country's most popular mountain range resorts, a key risk for ski operators.

I see shares of Vail Resorts Inc. (NYSE:MTN) as undervalued following its mixed first-quarter results. It is about to be prime time for the company as the bulk of its earnings come this time of year through the early spring.

Company description

According to Bank of America Global Research, Vail Resorts owns and operates mountain resorts and regional ski areas in the U.S. Some of its popular resorts include Vail, Breckenridge, Keystone, Heavenly, Kirkwood, Park City, Whistler and Stowe. It operates through three primary segments: Mountain, Lodging and Real Estate.

The company has expansion plans into the eastern third of the U.S. and in Europe, as well as owning some assets in the U.S. Midwest. It owns the RockResorts brand and the Grand Teton Lodge Company.

Key data

With an $8.3 billion market cap, the Colorado-based travel and leisure company within the consumer discretionary sector trades at an above-market 23.5 forward non-GAAP price-earnings ratio and pays a high 3.8% dividend yield. Following a soft first-quarter 2024 earnings report, shares trade with a moderate 34% implied volatility percentage. Short interest on the stock is material at 4.5% as of Dec. 7.

Earnings review

Earlier this month, Vail Resorts reported small misses on both its top and bottom lines. The earnings loss of $4.60 per share was worse than the -$4.56 consensus forecast during the off-season quarter. Revenue of $249 million was lower by 7.5% compared to year-ago levels, a $14.3 million miss. Shares were little changed in after-hours trading, though.

Despite the expected losing quarter, season pass metrics were better than expected, showing growth of 4% in volume and 11% in total dollars, indicating the company was able to pass through higher costs to its customers and a stabilizing in its product mix. (The company raised season pass prices by 8%, protecting a favorable spread between unit and dollar growth.)

As the ski season begins, there is now reason for optimism that lift ticket revenue could exceed its 6% to 7% growth forecast. In the report, Vail underscored robust growth in renewing pass holders and a geographic expansion into the Northeast and Eastern third of the contiguous U.S. The earnings miss was really due to timing issues with various expenses as the seasonal ramp-up began. On the earnings call, Vail announced the acquisition of a majority stake in Crans-Montana Mountain Resort in Switzerland, aiming to expand its resort network in Europe which would help to further diversify the company globally.

Risks

Key risks for the company include weaker-than-expected ski traffic and luxury travel that could come about amid a continued slowdown in payroll growth and softer consumer spending in 2024. Of course, weather risks are always apparent, so a light snow season would hurt near-term earnings. Investors should also consider the company's operating leverage a modest top-line downtick could significantly flow through to the bottom line. Additionally, the management team declared a $2.06 quarterly dividend, unchanged from previous quarters. They also reiterated their full-year Ebitda guidance of $912 million to $968 million.

Valuation and dividends

On valuation, analysts at Bank of America see earnings rising sharply this year after a tough 2023. Per-share profits are then expected to rise further in 2025 with moderating earnings per share growth by 2026. The current consensus forecast calls for a 37% year-over-year rise in operating earnings with 14% to 15% growth in the out years while revenue is seen rising at a mid-single-digit clip, underscoring the high operating leverage.

Dividends, meanwhile, are expected to rise at a steady pace over the coming quarters as shareholder-friendly activities may persist given solid free cash flow generation. Still, with mid-20s earnings multiples, this is by no means a pure value play, but rather a growth at a reasonalbe price candidate given the robust growth profile. Nevertheless, Vail's enterprise value/Ebitda ratio is actually below that of the broader market, though a 2.7 forward price-sales multiple is on the expensive side.

Given the high growth rate, if we apply a 1.5 PEG ratio (the sector median), then we can back into a fundamental valuation figure. With normalized forward earnings of $9.50 per share and a 20% growth rate, then an earnings multiple near 30 is appropriate in my view. That would put the stock near $285 today.

Vail Resorts: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

Source: BofA Global Research

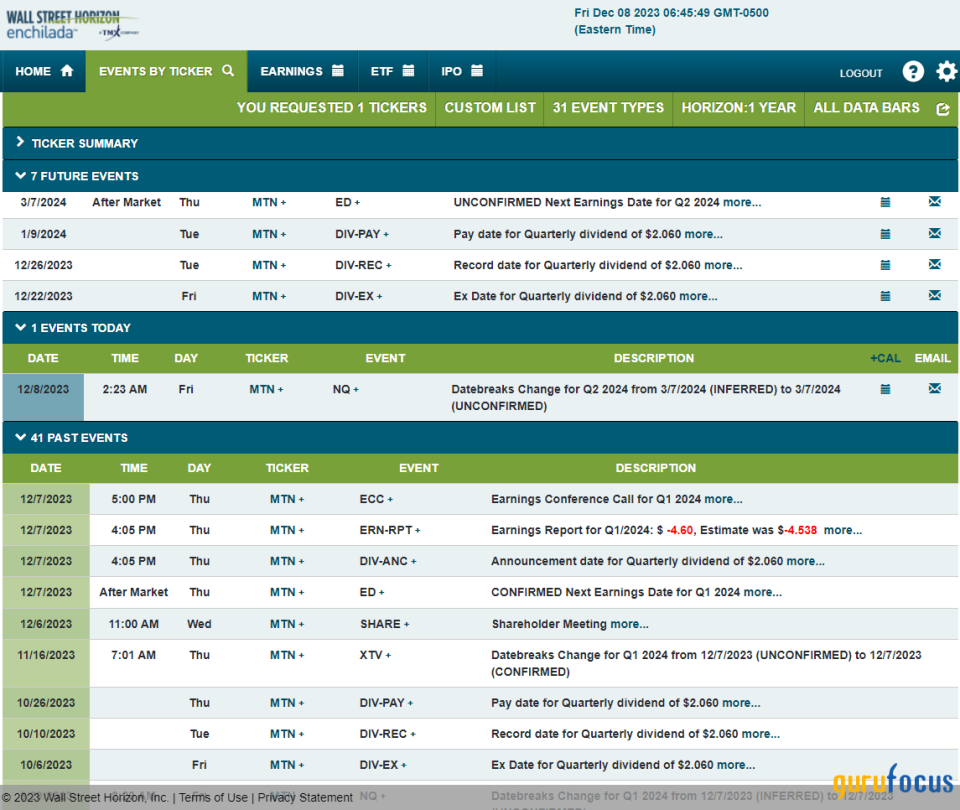

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed second-quarter 2024 earnings date of Thursday, March 7. Before that, there is an expected distribution of a $2.06 dividend on Friday, Dec. 22.

Corporate Event Risk Calendar

Source: Wall Street Horizon

The technical take

Vail performed well in the months after the worst of the pandemic. Notice in the chart below that shares hit a March 2020 low near $125 and then went on to more than triple to $376 at the November 2021 peak. It has been tough sledding for the travel-dependent company in recent months, though, as the stock has consolidated between $202 and $273 for nearly two years. An important consolidation pattern is now in play a rally above $255 would support the notion of a bullish upside measured move price objective to near $300, while a bearish breakdown under $202 could lead to further losses, targeting about $155.

Also take a look at the long-term 200-day moving average it is back to being negatively sloped, indicating the bears are in control. I also see a high amount of volume by price in the $210 to $245 zone, marking an important battleground between the bulls and bears. Moreover, rally attempts toward resistance at $250 could be difficult. Finally, I noticed that Vail tends to perform poorly in December and January when analyzing historical performance trends, so patience may be important when timing an entry (waiting to buy until late January could be the play based on these trends).

Overall, it is a neutral consolidation pattern, but being long today with a stop under $190 could work from a risk-reward point of view given my undervalued opinion on the stock.

MTN: Consolidation Phase, Eyeing Key Support Near $202

The bottom line

I see Vail Resorts as a solid value today. While it missed estimates in its off-season quarter, all eyes are now on the upcoming ski travel season with the stock undervalued, in my view.

This article first appeared on GuruFocus.