Despite shrinking by US$218m in the past week, ATI (NYSE:ATI) shareholders are still up 127% over 3 years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the ATI Inc. (NYSE:ATI) share price is 127% higher than it was three years ago. How nice for those who held the stock! On top of that, the share price is up 11% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 16% in 90 days).

Since the long term performance has been good but there's been a recent pullback of 4.0%, let's check if the fundamentals match the share price.

Check out our latest analysis for ATI

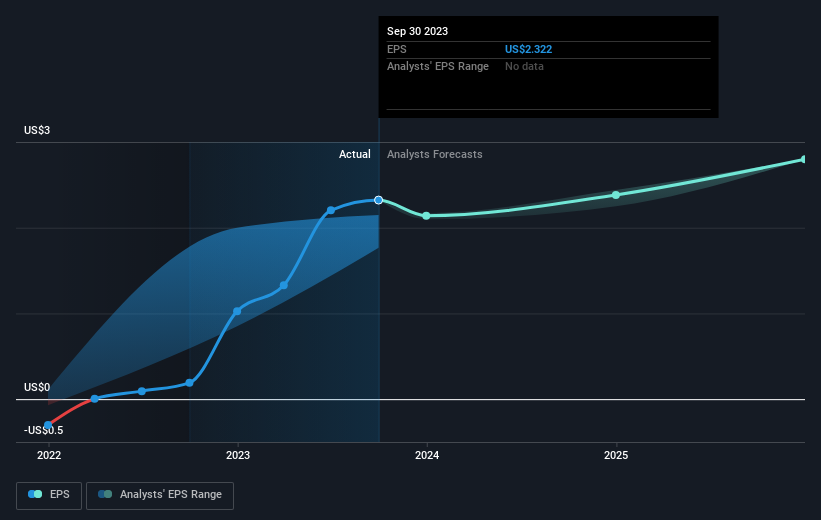

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, ATI moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how ATI has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

ATI shareholders gained a total return of 14% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 8% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for ATI you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.