Destination XL Group Inc (DXLG) Reports Mixed Fiscal 2023 Results Amid Retail Challenges

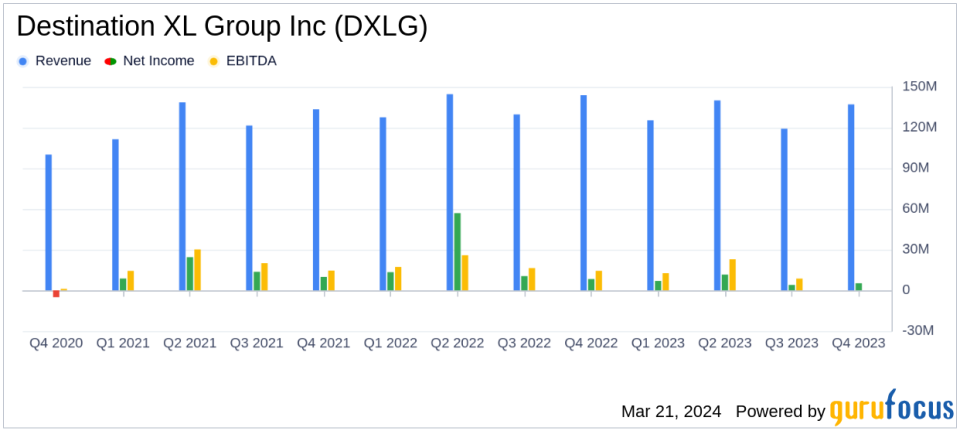

Net Income: Fiscal 2023 net income was $27.9 million, or $0.43 per diluted share.

Total Sales: Fiscal year sales decreased to $521.8 million from $545.8 million in the previous year.

Comparable Sales: Comparable sales for fiscal 2023 decreased by 4.6%.

Adjusted EBITDA: Adjusted EBITDA for fiscal 2023 was $55.9 million, down from $73.8 million in fiscal 2022.

Cash Flow: Cash flow from operations was $49.6 million, with free cash flow of $32.2 million.

Liquidity: As of February 3, 2024, DXLG had $60.0 million in cash and investments with no outstanding debt.

Store Footprint: DXLG ended the year with 283 total stores, having opened three new DXL stores and converted 11 Casual Male stores to DXL.

On March 21, 2024, Destination XL Group Inc (NASDAQ:DXLG) released its 8-K filing, detailing the financial results for the fourth quarter and the full fiscal year of 2023. As the leading specialty retailer of Big + Tall men's clothing and shoes, DXLG faced a challenging retail environment that reflected in its financial performance.

Financial Performance Overview

DXLG reported a decrease in total sales for the fiscal year 2023, amounting to $521.8 million compared to $545.8 million in the previous year. The company experienced a 4.6% decline in comparable sales, attributed to a challenging apparel retail market that impacted customer traffic both in-store and online. Despite these headwinds, DXLG managed to maintain a strong balance sheet, ending the year with $60.0 million in cash and investments and no outstanding debt.

Net income for the fiscal year was $27.9 million, or $0.43 per diluted share, which included a pre-tax charge of $5.7 million related to the termination of frozen retirement plans. This figure is notably lower than the $89.1 million, or $1.33 per diluted share, reported in fiscal 2022, which included a significant income tax benefit. Adjusted net income for fiscal 2023 was $0.50 per diluted share, down from $0.63 per diluted share in the prior year.

Adjusted EBITDA for fiscal 2023 was $55.9 million, a decrease from $73.8 million in fiscal 2022. The adjusted EBITDA margin for the full year was 10.7%, showcasing the company's operational discipline in a challenging market.

Strategic Initiatives and Management Commentary

President and CEO Harvey Kanter remarked on the resilience of DXLG's sales and adjusted EBITDA, which were the second and third highest in the company's history, respectively. He emphasized the company's operational discipline and strong balance sheet, which positions DXLG to pursue strategic goals and capture a share of the $23 billion total addressable market for big and tall men's apparel.

After two years of double-digit comp sales increases, a challenging apparel retail market in 2023 negatively impacted customer traffic to both our stores and website, contributing to our full-year comp sales decrease of 4.6%," said Harvey Kanter.

Kanter also outlined the company's future growth strategy, which includes marketing and brand building, store development, a new website platform, and alliances and collaborations. These initiatives are expected to drive sales growth and enhance the DXL brand's market presence.

Looking Ahead

For fiscal 2024, DXLG anticipates strategic investments in marketing, store expansion, and digital experience enhancements. The company expects to open eight new stores and convert five Casual Male stores to DXL. Despite a cautious outlook for consumer discretionary spending, DXLG is aiming for a minimum acceptable level of profitability with a 7.0% adjusted EBITDA margin.

DXLG's financial outlook for fiscal 2024 includes sales projections of $500.0 - $530.0 million, net income of approximately $17.0 million, and adjusted EBITDA of approximately $36.0 million, assuming sales at the midpoint of the forecast range.

Value investors may find DXLG's commitment to maintaining a strong balance sheet and strategic growth initiatives appealing, as the company navigates a challenging retail landscape and positions itself for future success.

For a more detailed analysis of Destination XL Group Inc's financial results and strategic plans, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Destination XL Group Inc for further details.

This article first appeared on GuruFocus.