Is DFS Furniture (LON:DFS) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that DFS Furniture plc (LON:DFS) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for DFS Furniture

How Much Debt Does DFS Furniture Carry?

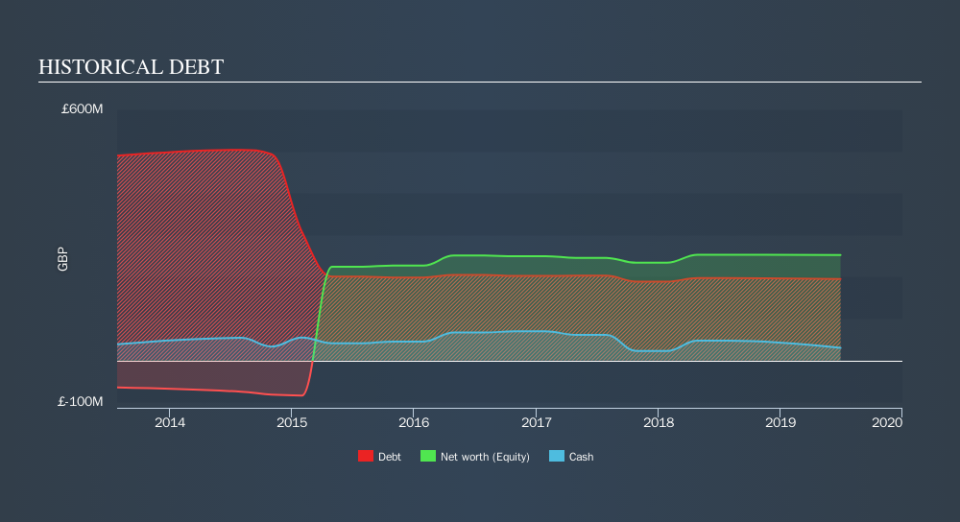

You can click the graphic below for the historical numbers, but it shows that DFS Furniture had UK£194.7m of debt in June 2019, down from UK£207.3m, one year before. However, because it has a cash reserve of UK£29.8m, its net debt is less, at about UK£164.9m.

How Strong Is DFS Furniture's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that DFS Furniture had liabilities of UK£230.9m due within 12 months and liabilities of UK£280.0m due beyond that. On the other hand, it had cash of UK£29.8m and UK£10.0m worth of receivables due within a year. So it has liabilities totalling UK£471.1m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of UK£480.6m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

DFS Furniture has net debt worth 2.5 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.2 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. The bad news is that DFS Furniture saw its EBIT decline by 18% over the last year. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if DFS Furniture can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, DFS Furniture produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Mulling over DFS Furniture's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that DFS Furniture's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.