DHI Group Inc (DHX) Reports Mixed 2023 Financial Results Amid Economic Challenges

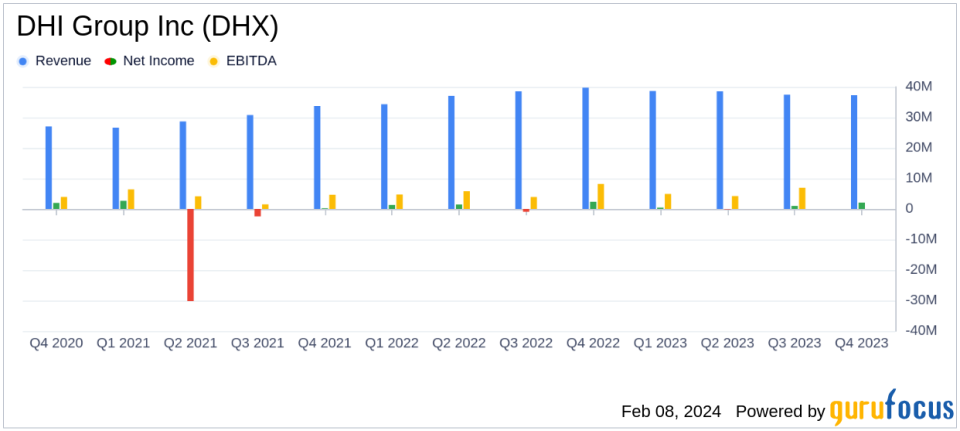

Annual Revenue: Slight increase to $151.9 million, up 1% year over year.

Quarterly Revenue: Decreased to $37.3 million, down 6% year over year.

Net Income: Annual net income at $3.5 million, down from $4.2 million year over year.

Adjusted EBITDA: Grew to $36.3 million for the year, a 17% increase.

Bookings: Total annual bookings declined by 4% year over year.

Cash Flow: Operating cash flow decreased to $21.3 million from $36.0 million the previous year.

On February 7, 2024, DHI Group Inc (NYSE:DHX) released its 8-K filing, detailing the financial outcomes for both the fourth quarter and the full year ended December 31, 2023. The company, known for its AI-powered career marketplaces focusing on technology roles, including its brands Dice and ClearanceJobs, faced a challenging macro-economic environment throughout the year.

Annual and Quarterly Performance

For the full year, DHI Group reported a marginal revenue increase to $151.9 million, up from $149.7 million in the previous year. This growth was attributed to a 9% increase in total recurring revenue. However, the company experienced a 4% decline in total bookings, which could signal a potential slowdown in future revenue growth.

The fourth quarter saw a decrease in revenue to $37.3 million, a 6% drop compared to the same period last year. Despite this, the company managed to increase its Adjusted EBITDA significantly by 24% to $10.1 million, with an Adjusted EBITDA Margin improvement from 20% to 27% year over year.

Financial Challenges and Achievements

Net income for the year stood at $3.5 million, or $0.08 per diluted share, down from $4.2 million, or $0.09 per diluted share, in the previous year. The Adjusted Diluted Earnings Per Share, however, doubled from $0.05 to $0.10, reflecting the company's efforts to improve profitability amidst economic headwinds.

Operating cash flow decreased to $21.3 million from $36.0 million in the prior year, which could impact the company's ability to invest in growth initiatives or reduce debt. The company ended the quarter with $4.2 million in cash and a total debt of $38.0 million, compared to $40 million at the end of the previous quarter.

"We continue to operate effectively and efficiently in this challenging macro-economic environment as we finished the full year with total revenue growth and a significantly improved Adjusted EBITDA margin," said Art Zeile, President and CEO of DHI Group.

"While we saw signs of an improved bookings environment across all of our new business teams in the fourth quarter, we do not expect total bookings growth to return until the second half of the year, which we expect to result in a low single-digit percentage decline in our total revenue for the full year," stated Raime Leeby, CFO of DHI Group.

Looking Ahead

The company's leadership remains focused on driving long-term, sustainable revenue growth and is well-positioned to return to more accelerated growth when the economy begins its recovery and tech hiring returns. The guidance for 2024 anticipates an Adjusted EBITDA margin of 24% for the full year, despite expecting a low single-digit percentage decline in total revenue.

DHI Group Inc's performance in 2023 reflects resilience in a tough economic climate, with significant improvements in profitability metrics like Adjusted EBITDA margin. However, the decline in bookings and operating cash flow suggests caution as the company navigates the uncertain market conditions ahead.

Investors and stakeholders will be watching closely to see if the company's strategic initiatives and market position can translate into stronger financial performance as the economy recovers.

Explore the complete 8-K earnings release (here) from DHI Group Inc for further details.

This article first appeared on GuruFocus.