Diaceutics (LON:DXRX) shareholders have endured a 41% loss from investing in the stock three years ago

Diaceutics PLC (LON:DXRX) shareholders should be happy to see the share price up 21% in the last month. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 41% in the last three years, significantly under-performing the market.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Diaceutics

Given that Diaceutics only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Diaceutics saw its revenue grow by 9.9% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 12% per year, for three years. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

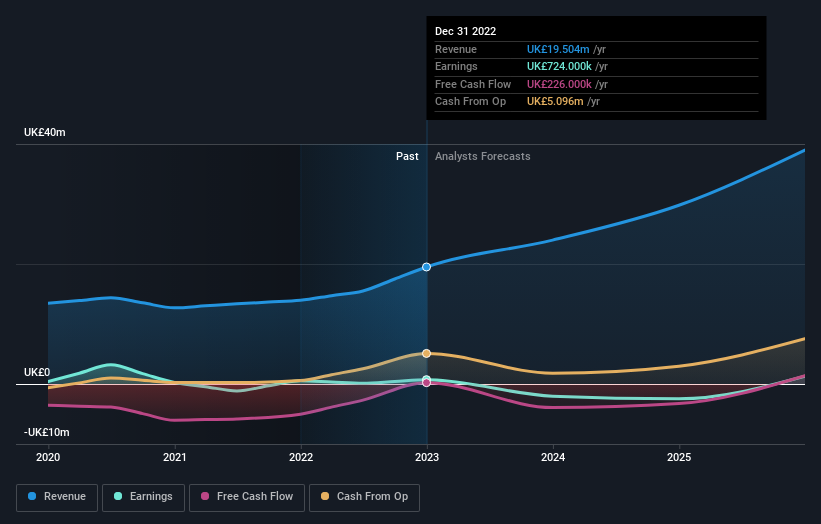

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Diaceutics has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Diaceutics in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Diaceutics rewarded shareholders with a total shareholder return of 11% over the last year. This recent result is much better than the 12% drop suffered by shareholders each year (on average) over the last three. It could well be that the business has turned around -- or else regained the confidence of investors. Before spending more time on Diaceutics it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.