Diageo (DEO) FY23 Results Gain From Productivity Efforts

Diageo plc DEO reported preliminary fiscal 2023 results, ending Jun 30, 2023, wherein pre-exceptional earnings per share rose 7.6% year over year to 163.5 pence (in local currency). This was mainly driven by strong top-line growth, organic operating margin expansion and productivity savings. Effective marketing and exceptional commercial execution further aided the results.

On a reported basis, net sales increased 10.7%, driven by strong organic growth and favorable currency impacts. Organic net sales were up 6.5% year over year, driven by a robust price mix, offset by a decline in volume. The company delivered a positive price mix of 7.3% in fiscal 2023. The price/mix benefited from a high-single-digit contribution from pricing and premiumization. The reported volume declined 7.4% in fiscal 2023, while the organic volume was down 0.8%. Sales improved in four of its five regions, with double-digit growth in Europe and the Asia Pacific.

Organic sales growth was driven by improvements across most categories, particularly its top three categories — scotch, tequila and beer, which delivered double-digit organic sales growth. The company’s premium-plus brands contributed 63% of the reported sales growth and 57% of the total organic sales growth for fiscal 2023.

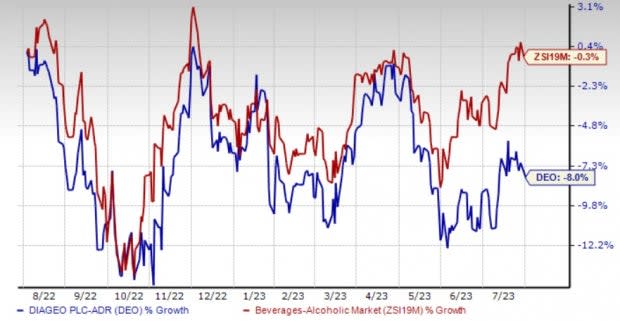

Shares of the Zacks Rank #4 (Sell) company have lost 8% in the past year compared with the industry’s decline of 0.3%.

Image Source: Zacks Investment Research

The company’s operating profit improved 5.1% in fiscal 2023, driven by robust organic operating profit growth, offset by the negative impacts of certain exceptional operating items and currency. Organic operating profit advanced 7%. The reported operating margin contracted 147 bps, while the organic operating margin increased 15 bps. The organic operating margin was aided by disciplined cost management. Gains from price increases more than offset the impacts of cost inflation on the gross margin.

On its fiscal 2023 earnings call, management noted that Diageo would change its reporting from sterling to the U.S. dollar starting fiscal 2024.

Financials

In fiscal 2023, Diageo delivered net cash from operating activities of £3 billion, marking a year-over-year decline of £0.9 billion. DEO reported a strong free cash flow of £1.8 million, down £1 billion from last year’s level due to higher working capital outflows, tax and interest payments, and capital investments. This was offset by gains from higher operating profit and favorable currency.

Diageo is committed to its disciplined approach to capital allocation primarily to enhance its shareholder value. In fiscal 2023, the company incurred a capital expenditure of £1.2 billion related to supply capacity, sustainability, digital capabilities and consumer experiences.

DEO increased the final dividend 5% to 49.17 pence per share. This reflects its strong liquidity position and confidence in the long-term health of its business.

Additionally, Diageo completed £1.4 billion of return of capital in fiscal 2023, including £0.9 billion linked to the completion of its £4.5-billion multi-year program. The company returned £0.5 billion in the second half of fiscal 2023. On its fiscal 2023 earnings call, the company approved a return of capital program of up to $1 billion.

FY24 & Long-Term View

Although the company expects the operating environment to be challenging in fiscal 2024, it predicts a gradual improvement in year-over-year comparisons in the second half. The company expects the operating margin in fiscal 2024 to benefit from a moderating inflationary environment and continued focus on revenue management initiatives, including improved pricing. Moreover, the organic operating margin is likely to benefit from premiumization trends and operating leverage with strong marketing investments.

The company anticipates the tax rate before exceptional items to be 24% for fiscal 2024. It expects the effective interest rate to be above 4% in the fiscal.

For fiscal 2024, the company expects a capital expenditure of $1.3-$1.5 billion (£1-£1.2 billion).

Moreover, it notes that it is on track to deliver on its medium-term guidance for fiscal 2023-2025, wherein it targets organic sales growth of 5-7% and organic operating profit growth of 6-9%.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Molson Coors TAP, The Duckhorn Portfolio NAPA and The Boston Beer Company SAM.

Molson Coors currently sports a Zacks Rank #1 (Strong Buy). TAP has a trailing four-quarter earnings surprise of 32.1%, on average. It has a long-term earnings growth rate of 7.1%. The company has rallied 22.8% in the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Molson Coors’ current financial-year sales and earnings suggests growth of 8.4% and 19.5%, respectively. The consensus mark for TAP’s earnings per share has moved up 3.6% in the past seven days.

Duckhorn currently has a Zacks Rank #2 (Buy) and an expected long-term earnings growth rate of 6.6%. NAPA has a trailing four-quarter earnings surprise of 14.2%, on average.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales suggests growth of 8.3% from the year-ago reported number. Shares of NAPA have declined 32.9% in the past year.

Boston Beer currently carries a Zacks Rank #2. SAM has a trailing four-quarter negative earnings surprise of 74.9%, on average. The company has declined 3% in the past year.

The Zacks Consensus Estimate for Boston Beer’s current financial year’s sales suggests a decline of 4.1% from the year-ago reported number, whereas the same for earnings per share indicates growth of 5.1%. The consensus mark for SAM’s earnings per share has moved up 5.9% in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Diageo plc (DEO) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report