Diamond Hill Capital's Q3 2023 13F Filing: A Deep Dive into Key Transactions

Significant Position Increases in Laboratory Corp of America Holdings

Diamond Hill Capital (Trades, Portfolio), a renowned investment advisory firm, recently disclosed its 13F report for the third quarter of 2023. The report provides valuable insights into the firm's investment activities during this period. Diamond Hill Capital (Trades, Portfolio), established in 2000 and based in Columbus, Ohio, is a publicly owned, independent investment adviser listed on the NASDAQ (ticker symbol: DHIL) and included in the Russell 2000 Index. The firm manages a diverse range of traditional and alternative equity strategies, serving a broad client base that includes institutions, financial intermediaries, and individuals. Diamond Hill's investment approach is primarily bottom-up, focusing on comprehensive fundamental analysis of a company's profitability, market position, financial and competitive standing, management quality, valuation, and growth components of valuation. The firm also conducts top-down analysis, focusing on industry dynamics, including sector economic factors, long-term capital flows, and the regulatory environment.

New Stock Additions

In the third quarter of 2023, Diamond Hill Capital (Trades, Portfolio) added a total of 7 stocks to its portfolio. The most significant addition was Extra Space Storage Inc (NYSE:EXR), with 1,428,043 shares, accounting for 0.84% of the portfolio and a total value of $173.62 million. The second-largest addition was Diamondback Energy Inc (NASDAQ:FANG), with 831,092 shares, representing approximately 0.62% of the portfolio, with a total value of $128.72 million. The third-largest addition was Mid-America Apartment Communities Inc (NYSE:MAA), with 148,761 shares, accounting for 0.09% of the portfolio and a total value of $19.14 million.

Key Position Increases

Diamond Hill Capital (Trades, Portfolio) also increased stakes in a total of 61 stocks. The most notable increase was in Laboratory Corp of America Holdings (NYSE:LH), with an additional 1,108,776 shares, bringing the total to 1,280,884 shares. This adjustment represents a significant 644.23% increase in share count, a 1.08% impact on the current portfolio, and a total value of $257.52 million. The second-largest increase was in Target Corp (NYSE:TGT), with an additional 1,022,437 shares, bringing the total to 2,839,156 shares. This adjustment represents a significant 56.28% increase in share count, with a total value of $313.93 million.

Complete Exits

Diamond Hill Capital (Trades, Portfolio) completely exited 8 holdings in the third quarter of 2023. The firm sold all 779,777 shares of Sherwin-Williams Co (NYSE:SHW), resulting in a -0.93% impact on the portfolio. Additionally, the firm liquidated all 1,059,496 shares of Phinia Inc (NYSE:PHIN), causing a -0.15% impact on the portfolio.

Key Position Reductions

Diamond Hill Capital (Trades, Portfolio) also reduced positions in 89 stocks. The most significant changes include a reduction in Verizon Communications Inc (NYSE:VZ) by 6,019,899 shares, resulting in a -89.69% decrease in shares and a -1% impact on the portfolio. The stock traded at an average price of $33.79 during the quarter and has returned 9.72% over the past 3 months and -2.48% year-to-date. The firm also reduced The Walt Disney Co (NYSE:DIS) by 2,476,369 shares, resulting in a -88.14% reduction in shares and a -1% impact on the portfolio. The stock traded at an average price of $85.41 during the quarter and has returned -3.89% over the past 3 months and -4.53% year-to-date.

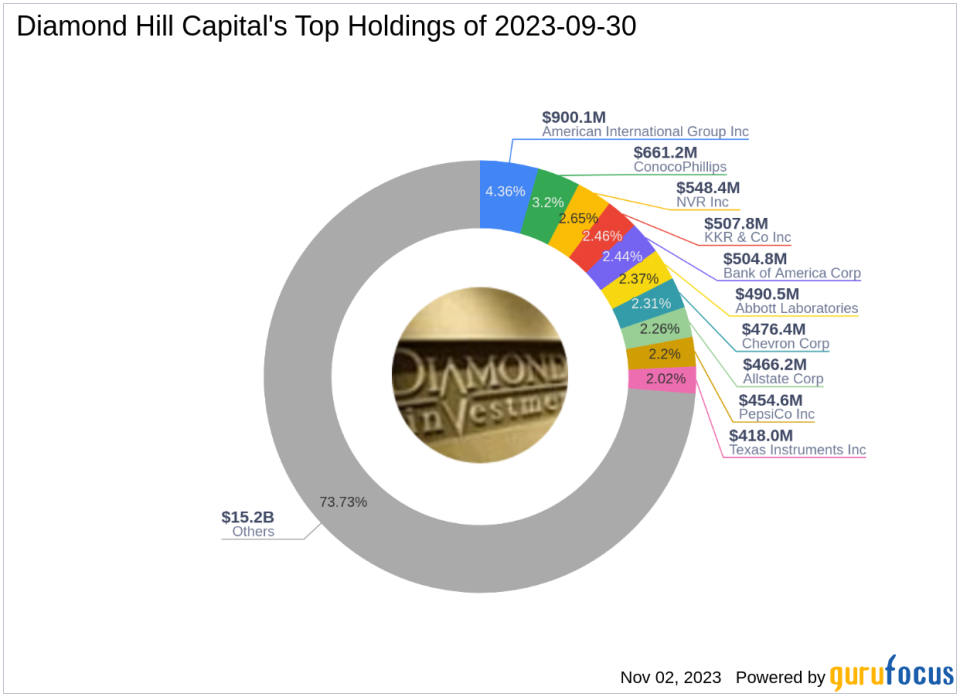

Portfolio Overview

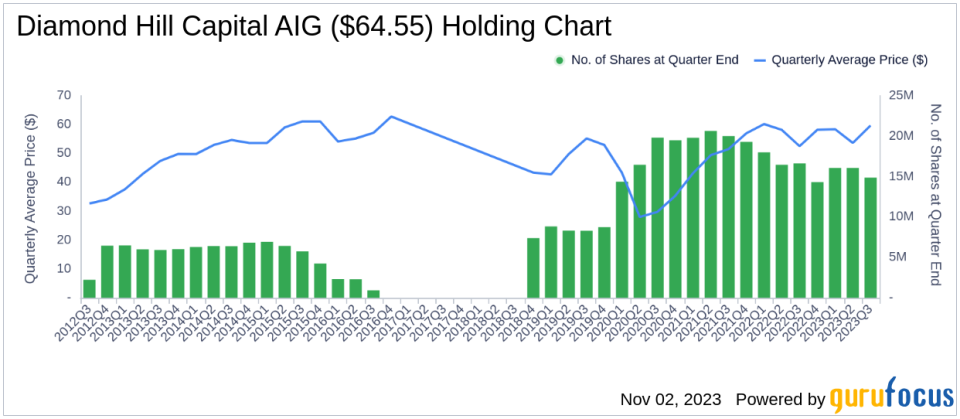

As of the third quarter of 2023, Diamond Hill Capital (Trades, Portfolio)'s portfolio included 167 stocks. The top holdings included 4.36% in American International Group Inc (NYSE:AIG), 3.2% in ConocoPhillips (NYSE:COP), 2.65% in NVR Inc (NYSE:NVR), 2.46% in KKR & Co Inc (NYSE:KKR), and 2.44% in Bank of America Corp (NYSE:BAC). The holdings are mainly concentrated in 11 industries: Financial Services, Industrials, Healthcare, Consumer Cyclical, Technology, Energy, Consumer Defensive, Real Estate, Basic Materials, Communication Services, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.