Diamond Offshore Drilling Inc (DO) Reports Q4 2023 Results Amidst Industry Challenges

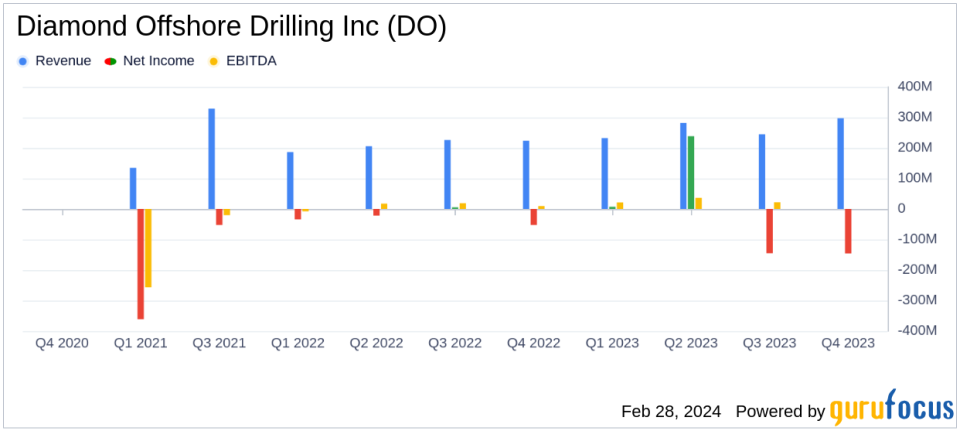

Revenue: Increased to $297.6 million in Q4 from $244.9 million in Q3.

Operating Income: Rose to $44.9 million in Q4 from $0.9 million in Q3.

Net Loss: Reported a net loss of $145.7 million in Q4, consistent with Q3.

Adjusted EBITDA: Improved to $72.3 million in Q4 from $27.7 million in Q3.

Income Tax Expense: Increased to $174.3 million in Q4 from $125.4 million in Q3.

Dayrate and Utilization: Average dayrate increased to $316, with a fleet utilization of 69% and revenue efficiency of 94.9%.

On February 27, 2024, Diamond Offshore Drilling Inc (NYSE:DO) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a global leader in offshore drilling with a fleet of 12 rigs, reported a significant increase in revenue to $297.6 million, up from $244.9 million in the previous quarter. This increase was primarily attributed to new contract commencements and operational improvements.

Despite the revenue growth, Diamond Offshore faced a net loss of $145.7 million, which remained consistent with the previous quarter's figures. The loss per diluted share stood at $1.42. The company also reported an operating income of $44.9 million, a substantial improvement from just $0.9 million in the third quarter. Adjusted EBITDA also saw a notable increase to $72.3 million, up from $27.7 million in the prior quarter.

However, the company encountered challenges, including a significant income tax expense of $174.3 million, reflecting the normalization of the company's tax expense and the reversal of a tax benefit recorded earlier in the year. The company's President and CEO, Bernie Wolford, Jr., highlighted the transformational year for Diamond Offshore, with $485 million in new contract awards and notable average dayrate improvements as the company transitions to new contracts.

Operationally, Diamond Offshore achieved a revenue efficiency of approximately 95% across its fleet for the second consecutive quarter, despite significant shipyard activity and the start-up of new contracts. The company also earned a bonus for efficient, injury-free operations in Senegal.

The balance sheet shows an increase in total assets to $1.71 billion, up from $1.52 billion at the end of the previous year. The company's cash and cash equivalents also grew to $124.5 million from $63 million. Long-term debt increased to $533.5 million, up from $360.6 million at the end of 2022.

Looking ahead, Diamond Offshore will provide guidance for the first quarter and full year of 2024, along with updates on recovery operations for certain equipment from the Ocean GreatWhite during their earnings conference call.

Diamond Offshore's performance in the fourth quarter demonstrates the company's resilience in a challenging offshore drilling market. The increase in revenue and operational efficiency, coupled with strategic contract awards, positions the company to potentially capitalize on market improvements, despite the net loss and increased tax expenses faced in the quarter.

For more detailed information, investors and interested parties are encouraged to review the full earnings report and listen to the earnings conference call scheduled for 8:00 a.m. CDT on February 28, 2024.

Explore the complete 8-K earnings release (here) from Diamond Offshore Drilling Inc for further details.

This article first appeared on GuruFocus.