Will Diamondback (FANG) Deliver a Surprise in Q4 Earnings?

Diamondback Energy FANG is set to release fourth-quarter results on Feb 21. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $5.20 per share on revenues of $2 billion.

Let’s delve into the factors that might have influenced the Permian-focused oil and gas producer’s performance in the December quarter. But it’s worth taking a look at FANG’s previous-quarter performance first.

Highlights of Q3 Earnings & Surprise History

In the last reported quarter, this Midland, TX-based upstream player missed the consensus mark due to a lower-than-expected oil price along with higher expenses. Diamondback had reported adjusted earnings per share of $6.48 for the third quarter, lagging the Zacks Consensus Estimate of $6.51. However, revenues of $2.4 billion outperformed the Zacks Consensus Estimate by 2.3%, backed by the positive effects of surging natural gas realizations.

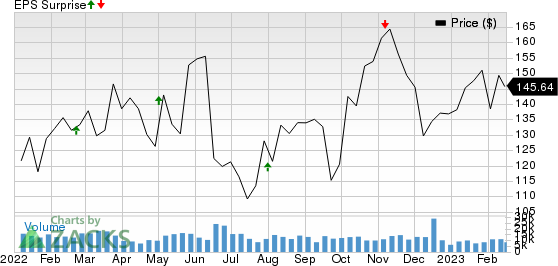

FANG beat the Zacks Consensus Estimate for earnings in three of the last four quarters, resulting in an earnings surprise of 5.7%, on average. This is depicted in the graph below:

Diamondback Energy, Inc. Price and EPS Surprise

Diamondback Energy, Inc. price-eps-surprise | Diamondback Energy, Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the fourth-quarter bottom line has remained the same in the past seven days. The estimated figure indicates a 43.3% improvement year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a marginal 0.5% increase from the year-ago period.

Factors to Consider

Diamondback Energy is expected to have benefited from the strength in oil realizations. As a reflection of this price boost, the Zacks Consensus Estimate for the fourth-quarter average sales price for crude is pegged at $83 per barrel, up from a year earlier when the company had fetched $74.50. With 57% oil-weighted production, the year-over-year improvement in crude realizations has most likely buoyed Diamondback Energy’s revenues and cash flows.

Diamondback Energy is also expected to have benefited from higher production during the quarter. The company continues to churn out impressive volumes from its wide inventory of drill-ready locations in the Permian Basin — America's hottest and lowest-cost shale region. Consequently, the consensus mark for FANG’s average Q4 volume is pegged at 389,984 barrels of oil equivalent per day (BOE/d), up from the prior-year quarter’s level of 387,065 BOE/d.

On a somewhat bearish note, the increase in Diamondback Energy’s costs might have dented the company’s to-be-reported bottom line. FANG’s cash operating cost was $11.97 per barrel of oil equivalent (BOE) in the third quarter, up 20.1% from the prior-year quarter. The upward cost trajectory is likely to have continued in the fourth quarter due to the prevailing inflationary environment.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Diamondback Energy is likely to beat estimates in the fourth quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -0.19%.

Zacks Rank: FANG currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for FANG, here are some firms from the energy space that you may want to consider on the basis of our model:

ProPetro Holding Corp. PUMP has an Earnings ESP of +21.30% and a Zacks Rank #1. The firm is scheduled to release earnings on Feb 21.

You can see the complete list of today’s Zacks #1 Rank stocks here.

For 2023, ProPetro Holding has a projected earnings growth rate of 596.1%. Valued at around $1.2 billion, PUMP has lost 19.9% in a year.

Par Pacific Holdings, Inc. PARR has an Earnings ESP of +6.79% and a Zacks Rank #1. The firm is scheduled to release earnings on Feb 22.

For 2022, Par Pacific Holdings has a projected earnings growth rate of 539%. Valued at around $1.7 billion, PARR has gained 87.6% in a year.

Cheniere Energy LNG has an Earnings ESP of +18.82% and a Zacks Rank #3. The firm is scheduled to release earnings on Feb 23.

For 2023, LNG has a projected earnings growth rate of 539.1%. Valued at around $37 billion, LNG has gained 30.4% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Par Pacific Holdings, Inc. (PARR) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report