Diamondback (FANG) Q2 Earnings Miss Estimates on Lower Prices

U.S. energy operator Diamondback Energy FANG reported second-quarter 2023 adjusted earnings per share of $3.68, missing the Zacks Consensus Estimate of $3.92 and deteriorating from the year-ago bottom line of $7.07. The underperformance reflects lower overall realization.

Meanwhile, revenues of $1.9 billion fell 30.7% from the year-ago quarter’s sales but marginally outperformed the Zacks Consensus Estimate (by $8 million) due to higher-than-expected production.

In good news for investors, the company is using the excess cash to reward them with dividends and buybacks. As part of that, FANG’s board of directors declared a quarterly cash dividend of 84 cents per share to its common shareholders of record on Aug 10. The payout will be made on Aug 17.

The company also executed $321 million of share repurchases during the second quarter of 2023 at $132.21 apiece.

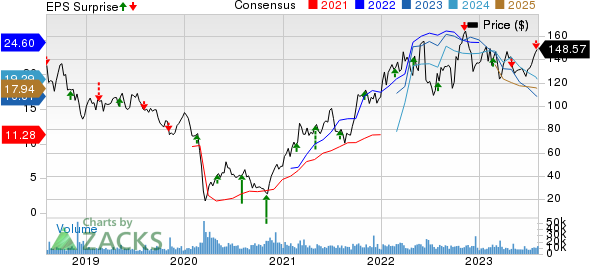

Diamondback Energy, Inc. Price, Consensus and EPS Surprise

Diamondback Energy, Inc. price-consensus-eps-surprise-chart | Diamondback Energy, Inc. Quote

Production & Realized Prices

FANG’s production of oil and natural gas averaged 449,912 barrels of oil equivalent per day (BOE/d), comprising 58% oil. The figure was up 18.3% from the year-ago quarter and surpassed our estimate of 432,895 BOE/d. While crude and natural gas output increased 19% and 18.4% year over year, respectively, natural gas liquids volumes rose 16% from the first quarter of 2022.

The average realized oil price during the most recent quarter was $71.33 per barrel, 34.4% lower than the year-ago realization of $108.80 but outperformed our projection of $66.32. Meanwhile, the average realized natural gas price plunged to 94 cents per thousand cubic feet (Mcf) from $6.15 in the year-ago period and missed our estimate of $1.92. Overall, the company fetched $45.94 per barrel compared with $70.65 a year ago.

Costs & Financial Position

Diamondback’s second-quarter cash operating cost was $10.66 per barrel of oil equivalent (BOE) compared to $12.24 in the prior-year quarter and our projection of $10.86. The cutback in costs came even though lease operating expenses rose to $4.88 per BOE from $4.59 in the second quarter of 2022.

FANG’s production taxes decreased 29.8% year over year to $3.61 per BOE, while gathering and transportation expenses moved down in the second quarter of 2023 to $1.66 per BOE from $1.76 during the corresponding period of 2022.

Diamondback spent $711 million in capital expenditure — $635 million on drilling and completion, $46 million on infrastructure, environment and $30 million on midstream. The company booked $547 million in free cash flows in the second quarter.

As of Jun 30, the Permian-focused operator had approximately $18 million in cash and cash equivalents, and $6.5 billion in long-term debt, representing a debt-to-capitalization of 28.8%.

Guidance

In 2023, FANG said it still looks to pump 435,000-445,000 BOE/d of hydrocarbon, up from the prior outlook of 430,000-440,000 BOE/d. Of this, oil volumes are likely to be 260,000-262,000 barrels per day. The company forecast a capital spending budget between $2.6 billion and $2.675 billion.

Zacks Rank & Stock Picks

Diamondback — a Permian Basin-focused upstream oil and gas company — carries a Zacks Rank #3 (Hold) at present.

Meanwhile, investors interested in the energy sector might look at operators like Solaris Oilfield Infrastructure SOI, Murphy USA MUSA and CVR Energy CVI. Each of these companies has a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Solaris Oilfield Infrastructure: SOI beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters. Solaris Oilfield Infrastructure has a trailing four-quarter earnings surprise of 18.8%, on average.

SOI is valued at around $485.2 million. Solaris Oilfield Infrastructure has seen its shares inch up 8.9% in a year.

Murphy USA: Murphy USA beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed in the other two. MUSA has a trailing four-quarter earnings surprise of roughly 5.1%, on average.

Murphy USA is valued at around $6.6 billion. MUSA has seen its shares gain 5.6% in a year.

CVR Energy: CVI beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters. Over the past 30 days, CVR Energy saw the Zacks Consensus Estimate for 2023 move up 22.9%.

CVR Energy is valued at around $3.7 billion. CVI has seen its shares gain 14.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Solaris Oilfield Infrastructure, Inc. (SOI) : Free Stock Analysis Report