Did Boston Beer Company’s Share Price Deserve to Gain 85%?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the The Boston Beer Company, Inc. (NYSE:SAM) share price is 85% higher than it was a year ago, much better than the market return of around 3.3% (not including dividends) in the same period. So that should have shareholders smiling. And shareholders have also done well over the long term, with an increase of 53% in the last three years.

View our latest analysis for Boston Beer Company

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Boston Beer Company actually saw its earnings per share drop 3.4%. The mild decline in EPS may be a result of the fact that the company is more focused on other aspects of the business, right now. Since the change in EPS doesn’t seem to correlate with the change in share price, it’s worth taking a look at other metrics.

However the year on year revenue growth of 15% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

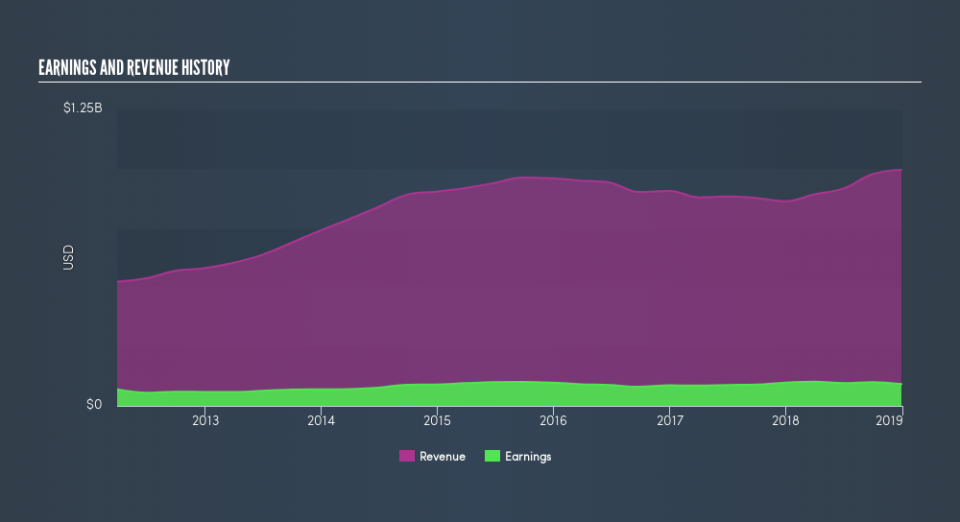

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We’re pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Boston Beer Company stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It’s nice to see that Boston Beer Company shareholders have received a total shareholder return of 85% over the last year. That’s better than the annualised return of 4.8% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Boston Beer Company may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.