Did Business Growth Power TIMIA Capital's (CVE:TCA) Share Price Gain of 242%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

TIMIA Capital Corp. (CVE:TCA) shareholders have seen the share price descend 11% over the month. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 242% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. The more important question is whether the stock is too cheap or too expensive today.

See our latest analysis for TIMIA Capital

Because TIMIA Capital is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, TIMIA Capital can boast revenue growth at a rate of 60% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 28% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes TIMIA Capital worth investigating - it may have its best days ahead.

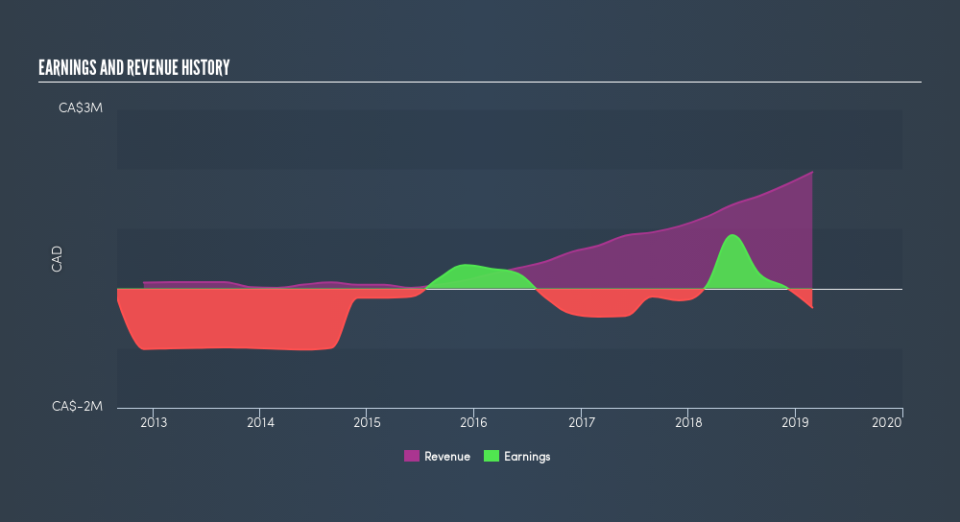

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of TIMIA Capital's earnings, revenue and cash flow.

A Different Perspective

It's good to see that TIMIA Capital has rewarded shareholders with a total shareholder return of 2.5% in the last twelve months. Having said that, the five-year TSR of 28% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.