Did Hedge Funds Drop The Ball On Agios Pharmaceuticals Inc (AGIO)?

The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Agios Pharmaceuticals Inc (NASDAQ:AGIO).

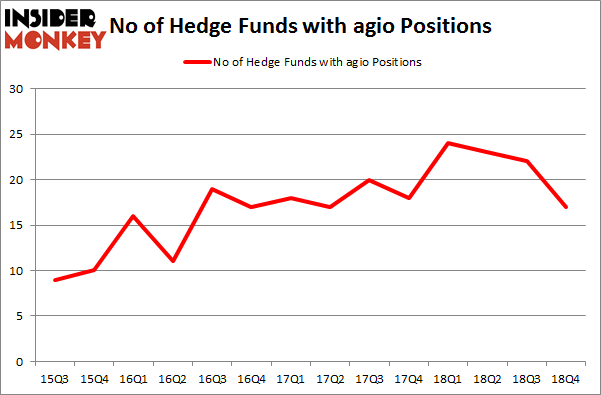

Is Agios Pharmaceuticals Inc (NASDAQ:AGIO) a healthy stock for your portfolio? Prominent investors are taking a bearish view. The number of bullish hedge fund positions fell by 5 recently. Our calculations also showed that agio isn't among the 30 most popular stocks among hedge funds. AGIO was in 17 hedge funds' portfolios at the end of December. There were 22 hedge funds in our database with AGIO positions at the end of the previous quarter.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We're going to go over the key hedge fund action surrounding Agios Pharmaceuticals Inc (NASDAQ:AGIO).

Hedge fund activity in Agios Pharmaceuticals Inc (NASDAQ:AGIO)

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from one quarter earlier. By comparison, 24 hedge funds held shares or bullish call options in AGIO a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Woodford Investment Management, managed by Neil Woodford, holds the largest position in Agios Pharmaceuticals Inc (NASDAQ:AGIO). Woodford Investment Management has a $91.2 million position in the stock, comprising 7.9% of its 13F portfolio. The second most bullish fund manager is Alkeon Capital Management, managed by Panayotis Takis Sparaggis, which holds a $20.7 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism include Eli Casdin's Casdin Capital, Brian Ashford-Russell and Tim Woolley's Polar Capital and D. E. Shaw's D E Shaw.

Seeing as Agios Pharmaceuticals Inc (NASDAQ:AGIO) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there exists a select few fund managers who sold off their positions entirely by the end of the third quarter. At the top of the heap, James E. Flynn's Deerfield Management sold off the biggest investment of the 700 funds monitored by Insider Monkey, comprising about $26.9 million in stock, and James A. Silverman's Opaleye Management was right behind this move, as the fund cut about $10 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 5 funds by the end of the third quarter.

Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Agios Pharmaceuticals Inc (NASDAQ:AGIO) but similarly valued. We will take a look at Inogen Inc (NASDAQ:INGN), Cedar Fair, L.P. (NYSE:FUN), Federated Investors Inc (NYSE:FII), and Delek US Holdings, Inc. (NYSE:DK). This group of stocks' market caps resemble AGIO's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position INGN,25,379083,4 FUN,10,39793,3 FII,15,146247,0 DK,27,233596,-4 Average,19.25,199680,0.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $200 million. That figure was $206 million in AGIO's case. Delek US Holdings, Inc. (NYSE:DK) is the most popular stock in this table. On the other hand Cedar Fair, L.P. (NYSE:FUN) is the least popular one with only 10 bullish hedge fund positions. Agios Pharmaceuticals Inc (NASDAQ:AGIO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on AGIO, though not to the same extent, as the stock returned 22.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index