Did You Manage To Avoid Cogelec's (EPA:COGEC) 31% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Cogelec SA (EPA:COGEC) shareholders will doubtless be very grateful to see the share price up 36% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 31% in the last year, well below the market return.

Check out our latest analysis for Cogelec

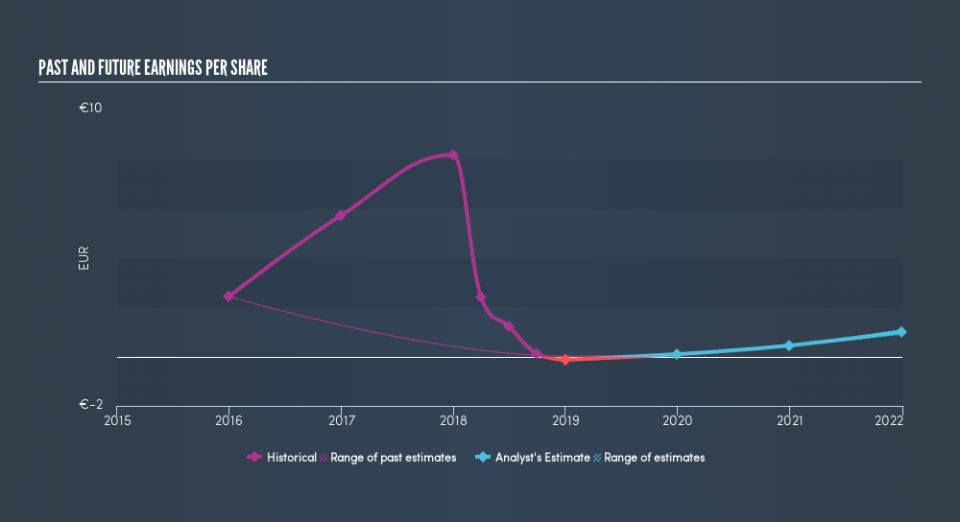

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Cogelec fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. We hope for shareholders' sake that the company becomes profitable again soon.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Cogelec's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Cogelec shareholders are down 31% for the year (even including dividends), the market itself is up 5.2%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 36% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Importantly, we haven't analysed Cogelec's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.