Did You Manage To Avoid IDT's (NYSE:IDT) Painful 53% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is doubtless a positive to see that the IDT Corporation (NYSE:IDT) share price has gained some 31% in the last three months. But if you look at the last five years the returns have not been good. After all, the share price is down 53% in that time, significantly under-performing the market.

See our latest analysis for IDT

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

IDT became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

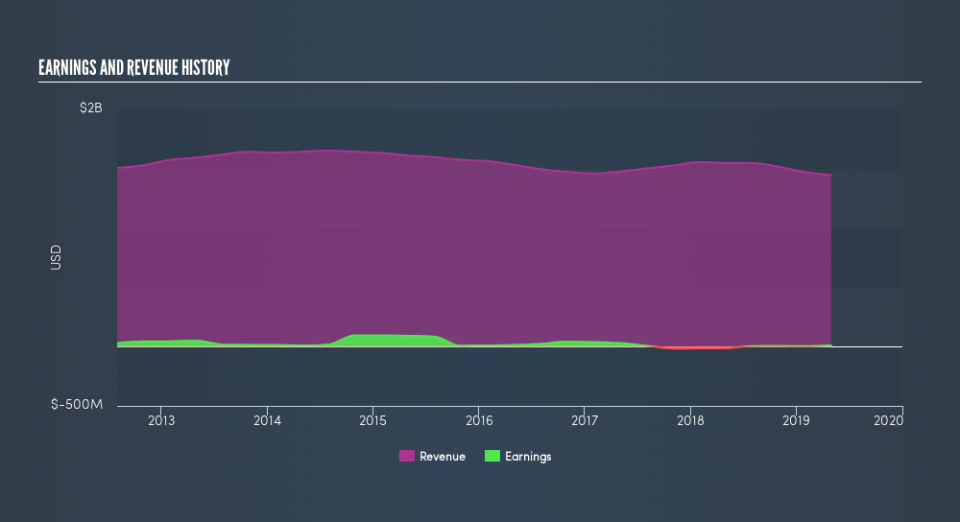

The revenue decline of 2.1% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of IDT's earnings, revenue and cash flow.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 5 years, IDT generated a TSR of -13%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

It's good to see that IDT has rewarded shareholders with a total shareholder return of 21% in the last twelve months. Notably the five-year annualised TSR loss of 2.7% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

IDT is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.