Did You Manage To Avoid Merchants Bancorp’s (NASDAQ:MBIN) 11% Share Price Drop?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. For example, the Merchants Bancorp (NASDAQ:MBIN) share price is down 11% in the last year. That contrasts poorly with the market return of 0.9%. Merchants Bancorp may have better days ahead, of course; we’ve only looked at a one year period. There was little comfort for shareholders in the last week as the price declined a further 2.9%.

See our latest analysis for Merchants Bancorp

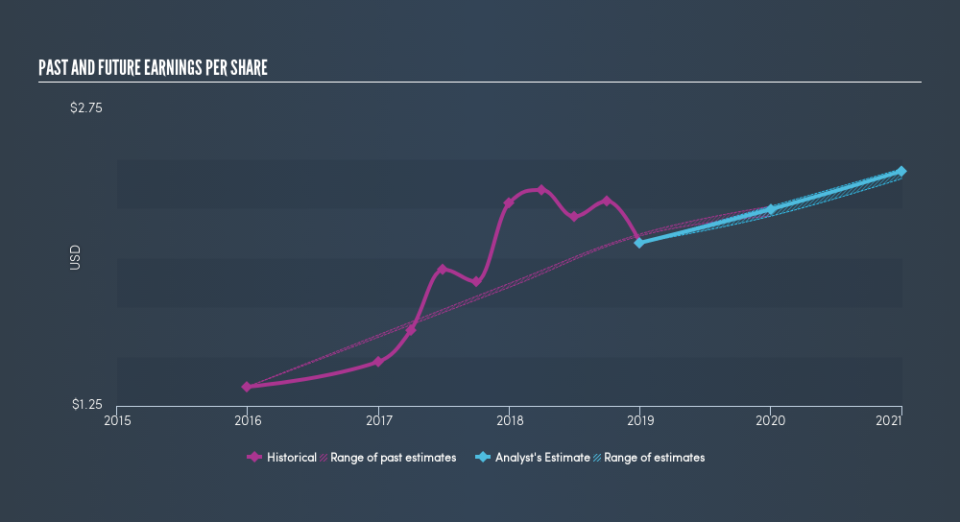

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Merchants Bancorp reported an EPS drop of 8.9% for the last year. The share price decline of 11% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The less favorable sentiment is reflected in its current P/E ratio of 9.61.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It’s probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Merchants Bancorp’s earnings, revenue and cash flow.

A Different Perspective

While Merchants Bancorp shareholders are down 10% for the year (even including dividends), the market itself is up 0.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 5.0%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we’d remain pretty wary until we see some strong business performance. Before forming an opinion on Merchants Bancorp you might want to consider these 3 valuation metrics.

But note: Merchants Bancorp may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.