Did You Manage To Avoid TEE International's (SGX:M1Z) Devastating 82% Share Price Drop?

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding TEE International Limited (SGX:M1Z) during the five years that saw its share price drop a whopping 82%. And it's not just long term holders hurting, because the stock is down 74% in the last year. Shareholders have had an even rougher run lately, with the share price down 42% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for TEE International

TEE International isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

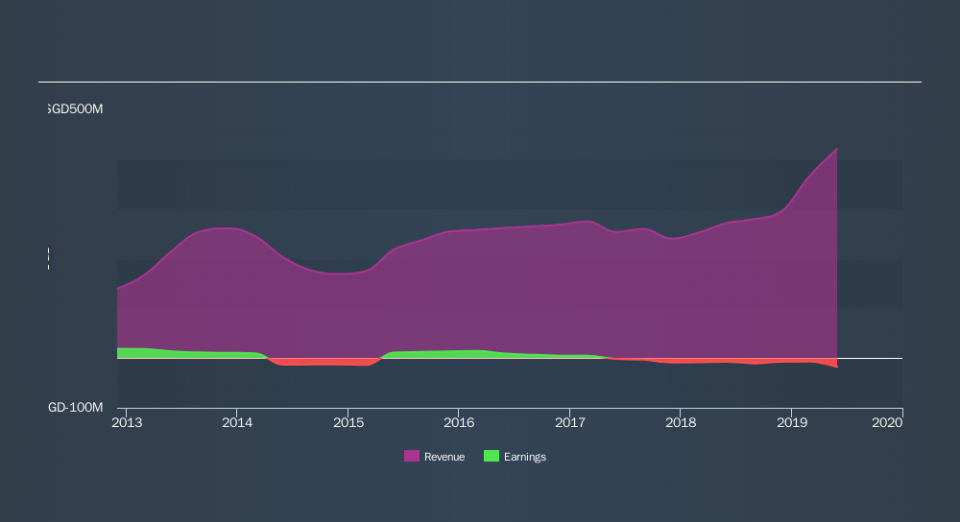

Over five years, TEE International grew its revenue at 12% per year. That's a pretty good rate for a long time period. So the stock price fall of 29% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on TEE International's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between TEE International's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that TEE International's TSR, which was a 78% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

TEE International shareholders are down 71% for the year, but the market itself is up 9.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 26% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

TEE International is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.