Digimarc Corp (DMRC) Reports Significant Growth in Subscription Revenue and Margin Expansion ...

Annual Recurring Revenue (ARR): Increased by 71% year-over-year.

Subscription Revenue: Grew by 37% in Q4 and contributed to a total of $19.0 million for the fiscal year.

Subscription Gross Profit Margin: Expanded significantly to 87% in Q4, up from 77% in the same quarter last year.

Operating Expenses: Decreased to $16.8 million in Q4 and to $68.4 million for the fiscal year.

Net Loss: Improved to $10.6 million in Q4, a reduction from $12.4 million in the prior year's quarter.

Liquidity: Cash, cash equivalents, and marketable securities totaled $27.2 million as of December 31, 2023.

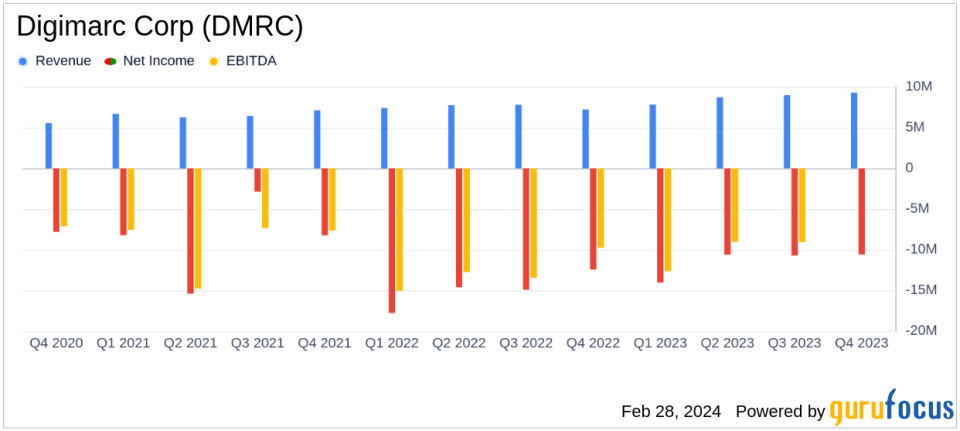

On February 28, 2024, Digimarc Corp (NASDAQ:DMRC) released its 8-K filing, detailing the company's financial performance for the fourth quarter and the fiscal year ended December 31, 2023. The company, known for its automatic identification solutions and digital watermarking technologies, reported a robust increase in its Annual Recurring Revenue (ARR) and an impressive expansion in subscription gross profit margins.

Financial Performance Highlights

Digimarc's subscription revenue for Q4 2023 rose to $5.6 million, a 37% increase compared to Q4 2022, driven by new and existing commercial contracts. Service revenue also saw an uptick to $3.7 million, primarily due to higher service revenue from a consortium of the world's central banks. Total revenue for Q4 2023 reached $9.3 million, marking a significant rise from $7.2 million in the same period last year.

The company's gross profit margin for Q4 2023 improved to 63%, up from 53% in Q4 2022. This growth is attributed to the expansion of the subscription gross profit margin, which soared to 87%, excluding amortization expense on acquired intangible assets. Operating expenses for the quarter decreased to $16.8 million, reflecting effective cost management.

For the fiscal year 2023, Digimarc reported a subscription revenue of $19.0 million, an increase from $15.2 million in the previous year. Total revenue for the year was $34.9 million, up from $30.2 million in fiscal year 2022. The company's net loss improved, with a reduction to $46.0 million for the fiscal year 2023 from a net loss of $59.8 million for fiscal year 2022.

Balance Sheet and Cash Flow

As of December 31, 2023, Digimarc's balance sheet showed cash, cash equivalents, and marketable securities totaling $27.2 million, a decrease from $52.5 million at the end of 2022. The net cash used in operating activities for the fiscal year 2023 was $21.9 million, and the company had a net decrease in cash, cash equivalents, and marketable securities of $25.4 million.

Management Commentary

"Q4 was another strong quarter for Digimarc. On a year-over-year basis, we accelerated our ARR growth to 71%, accelerated our subscription revenue growth to 37%, and expanded our subscription Gross Profit Margins more than 1,000 basis points to 87%," said Digimarc CEO Riley McCormack. "These results were made possible by the teams execution on multiple important initiatives we have been pursuing since we began our transformation in the second quarter of 2021, and with an ethos of never settling for the status quo and always planting the seeds for future growth, we remain excited for what is ahead."

Outlook and Strategic Focus

Digimarc's financial results reflect the company's ongoing commitment to innovation and growth in the digital watermarking space. The company's strategic focus on expanding its subscription services and maintaining high gross profit margins has yielded positive results, positioning Digimarc for continued success in the future.

Investors and stakeholders are encouraged to review the full 8-K filing for a more detailed understanding of Digimarc's financial position and operational strategies.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Digimarc Corp for further details.

This article first appeared on GuruFocus.